Nifty on weekly basis closed 0.36% higher, thanks to the late-afternoon buying on Friday. However, the possibility of intermediate term weakness to return still looms large & the market is not out of the woods as yet. However, in the short term, it is oversold & hence a dead cat bounce might be seen above 10540 regions which might face resistance at 10630 levels. On the other hand if it slips below 10340 levels sometimes next week, odds are high that intermediate downtrend shall resume.

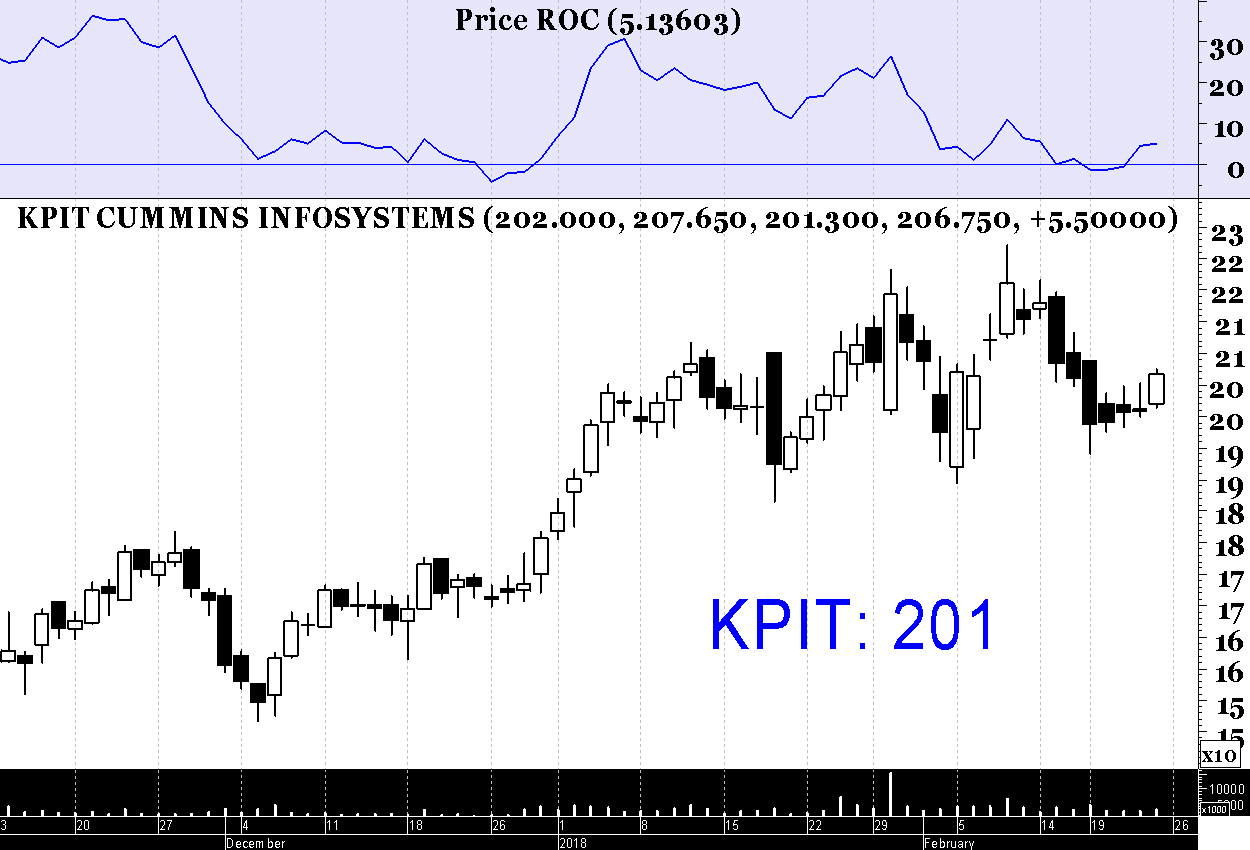

As Rupee have been tumbling against dollar, the IT stocks have been outperforming lately & we continue to assert bullish opinion in KPIT in intermediate to longer term timeframe.

Buy at CMP with stop loss at 194 & target 224.

Metal Sector have been outperforming in recent past & Tata Steel took a technical support at 630 regions. One may, therefore buy this stock on pull back to 665 levels with stop loss at 625 & target 725.

Biocon have been trading in a short trem choppy range for the past 6 weeks, although the primary uptrend continues to remain healthy. The break out will occur above 644, which if taken, could be held with stop 620 & target 680.

As the overall market recovers, Can Fin Homes is very likely to outperform in the upside. The bullish gap on 14th Feb 2018 suggest that there could be more steam left in the present bull run. We therefore recommend buying Can Fin Homes at CMP with stop loss at 502 & target 554.