Nifty (CMP: 10821)

Last week saw a volatile phase in Nifty where previous week’s low was taken out but it closed off its low and almost unchanged on weekly basis. However in spite of that Nifty is still trading above all major moving averages like 50, 100 & 200 day denominations & it puts the odd in favor of the bulls. This view will gain further confirmation if 10840 is conquered by the index sometimes early next week.

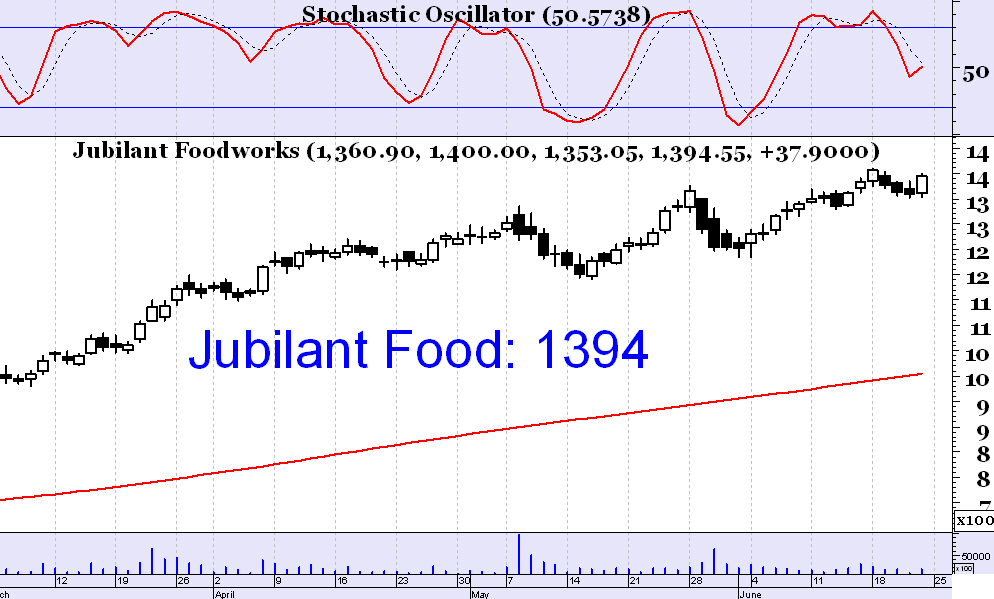

Jubilant Food (CMP: 1394)

Riding on the strong fundamentals, Jubilant is surging ahead. The nature of the long term trend is steady & hence reliable. Short term support exists at 1350 regions and any pullback might be a good opportunity to go long in this FMCG stock.

(Sell) Cadila HealthCare (CMP: 409)

Although there is a recent strength, yet this pharma stock is a relative under-performer in the longer term & the primary downtrend trend is pretty strong. Keep short term stoploss at 417 & sell Cadila HealthCare on rise to 412 for target 390.

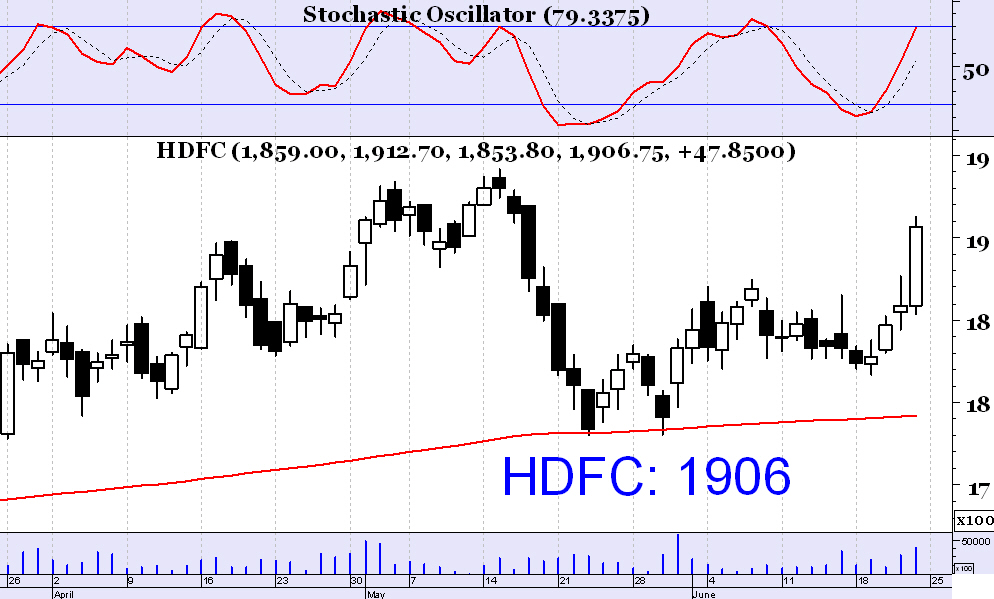

HDFC Ltd (CMP: 1906)

We note this stock for its strong long-term primary uptrend. Past several weeks saw a routine pull back which was in fact a buying opportunity. Buy on pullback to 1880 levels with stop loss at 1800 (on closing basis) & target 2000.

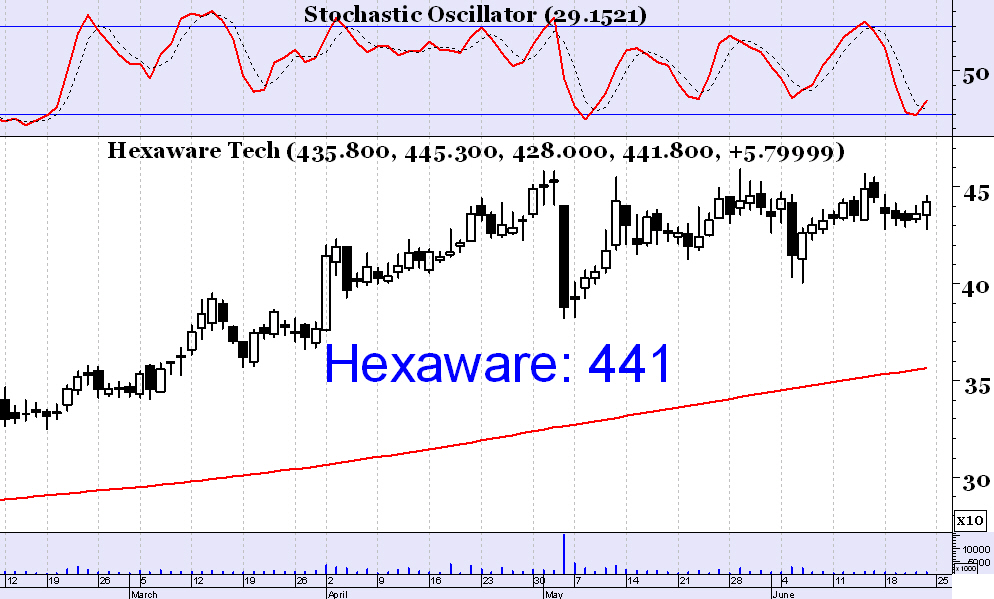

Hexaware (CMP: 441)

Large-cap IT sector is seeing a strong demand & Hexaware is continuing in its primary uptrend. We recommend buying at CMP with stoploss at 430 & target 460.