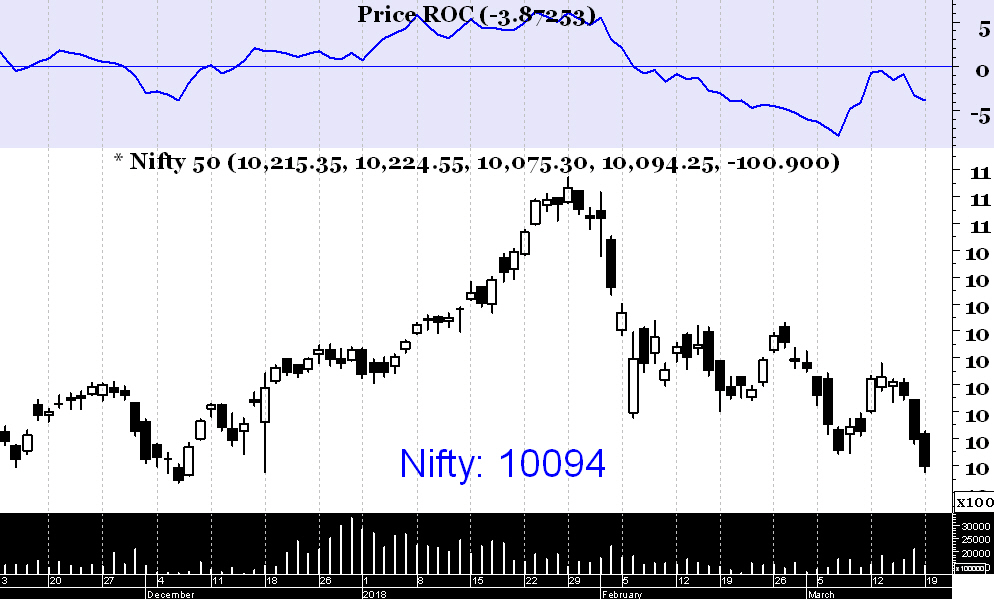

Nifty (CMP: 10094)

Nifty on Monday dipped below its 200 Day Moving Average at 10160 regions after a good long year, which officially ended the bull market. Although after a strong primary uptrend of nearly 2 years, this kind of corrections are perfectly natural, yet the negative market breadth & across the market selling by institutions made the correction look worse. We notice the pending FED meet later this week where interest rates are likely to be raised & how market negotiates the resulting volatility will set the course for its future direction. Technically, it remains weak below 10400 regions and pulls backs are likely to be capped.

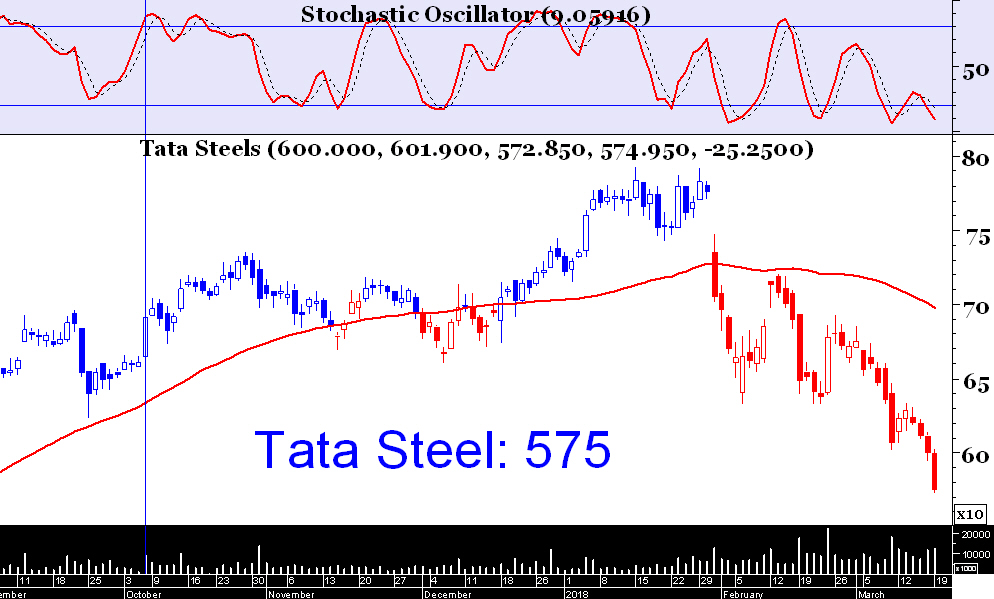

(Sell) Tata Steel (CMP: 575)

Metal stocks have been exceptionally week and remained a favorite hunting sector for the bears. Tata Steel has already seen an erosion of 200 points from its January high & the carnage does not appear to fizzle out anytime soon. Sell on pull back to 590 regions with stop loss at 610 & target 555.

(Buy) HEG (CMP: 3365)

The graphite electrode manufacturer HEG is showing off strength in an overall weak market and deserves to be traded from the long side. Buy on pull back to 3300 regions with stop loss at 2980 & target 3700.

(Sell) Reliance Capital (CMP: 419)

Non Banking Finance Stocks are another favorite hunting ground for the bears in recent times and Reliance Capital has particularly seen tremendous selling pressure. Its primary trend has turned down since September 2007 and at present it is loitering at its 52-week low. A break below 410 will unleash fresh selling for this stock.

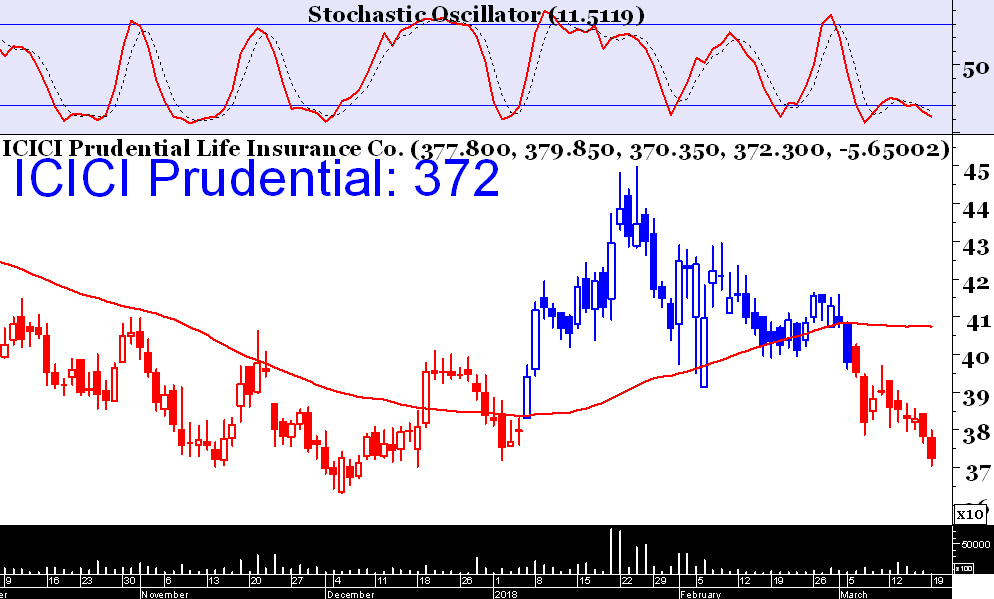

(Sell) ICICI Prudential (CMP: 372)

Sell ICICI Prudential on rise to 380 regions with stop loss at 397 & target 357.