Nifty (CMP: 10817)

Last week saw a volatile phase in Nifty where previous week’s high was taken out but it closed off its high. However in spite of that we got a closing 40 points higher and combined with the fact that Nifty is still trading above all major moving averages like 50, 100 & 200 day denominations put the odd in favor of the bulls. This view will gain further confirmation if 10840 is conquered by the index sometimes early next week.

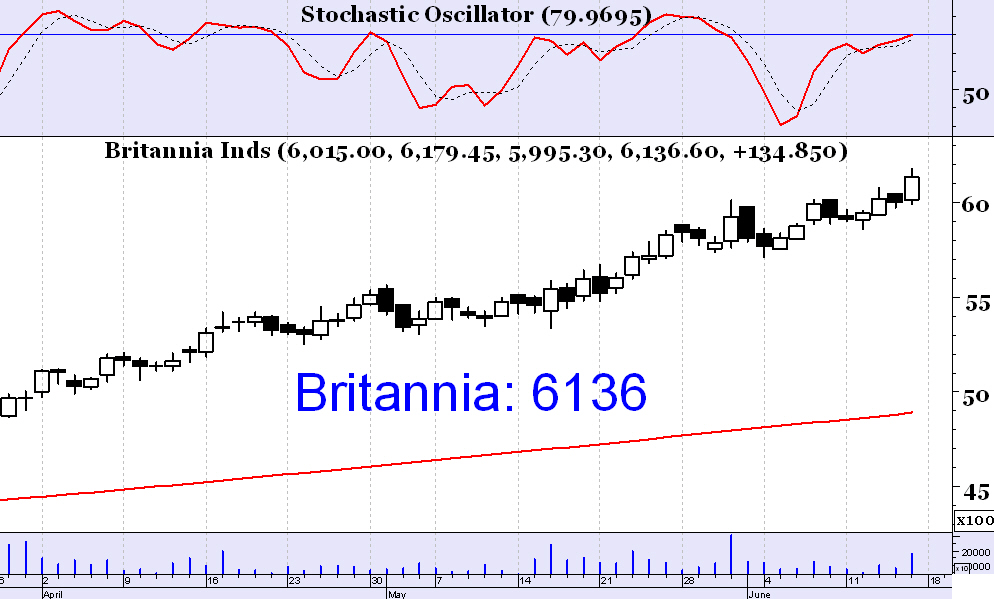

Britannia (CMP: 1227)

Riding on the strong fundamentals, Britannia is surging ahead. The nature of the long term trend is steady & hence reliable. Short term support exists at 5900 regions and any pullback might be a good opportunity to go long in this FMCG stock.

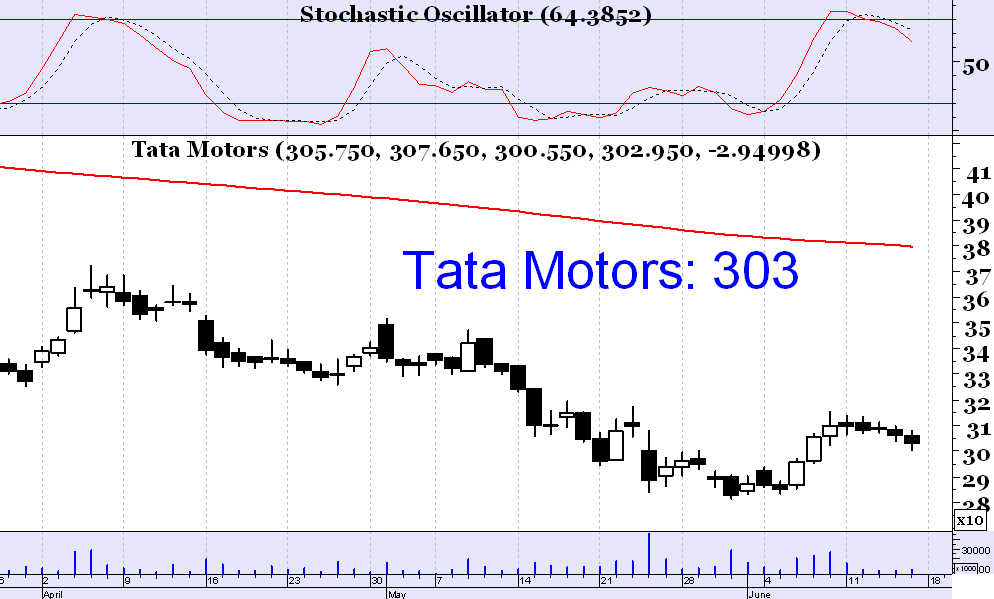

(Sell) Tata Motors (CMP: 303)

Although there is a recent strength, yet this auto stock is a relative under-performer in the longer term & the primary downtrend trend is pretty strong. Keep short term stoploss at 315 & sell Tata Motors on rise to 306 for target 285.

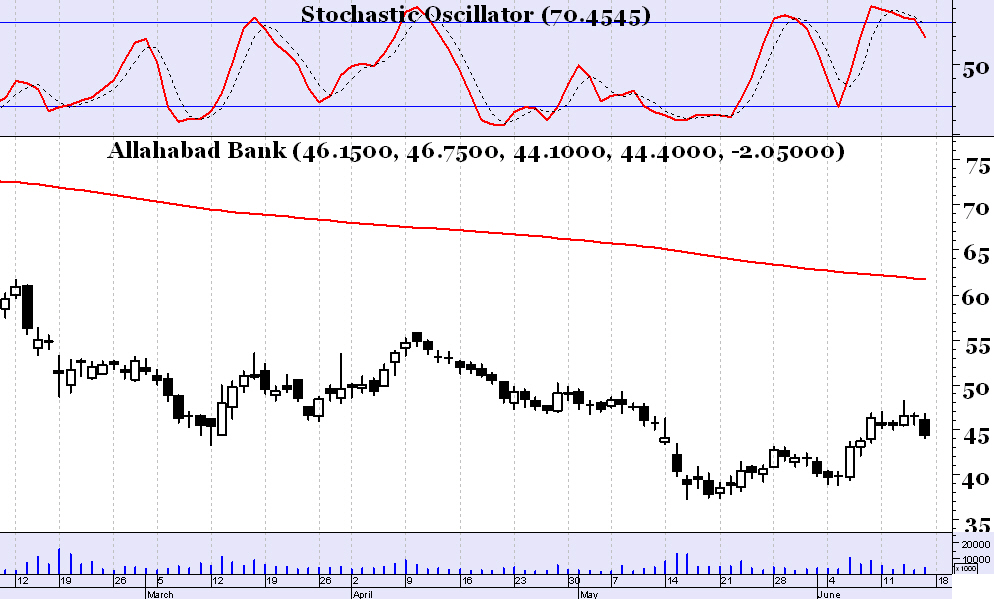

(Sell) Allahabad Bank (CMP: 44.40)

We note this stock for its strong long-term primary downtrend. Past week saw a routine pull back o which was in fact a selling opportunity. Sell at CMP with stop loss at 46.50 (on closing basis) & target 40.

Infy (CMP: 1281)

Large-cap IT sector is seeing a strong demand & Infosys is continuing in its primary uptrend. We recommend buying at CMP with stoploss at 1239 & target 1333.