Nifty (CMP: 10908)

Previous few sessions, especially the post election period, saw a phase of increased volatility in Nifty where it successfully closed above 200 day moving average with good conviction. Market breadth has returned to positive and that puts the odd in favor of continuation of the bullish trend, albeit with some intermittent phase of correction. The outlook for next week remains positive as long as it keeps above 10740 regions as the previous resistance is now expected to serve as support.

Reliance Inds (CMP: 1136)

Riding on the strong fundamentals, Reliance Inds is surging ahead with great momentum. We find the occurrence of a Doji Star formation on the weekly chart of Reliance, which is a sort of bullish reversal pattern in the present scenario. The nature of the long term trend is steady & hence reliable. The recent weakness in October represented a good opportunity to create a core position during weakness in this Energy major. Short term support exists at 1090 & 1055 regions and any pullback might be a good opportunity to go long in Reliance Inds.

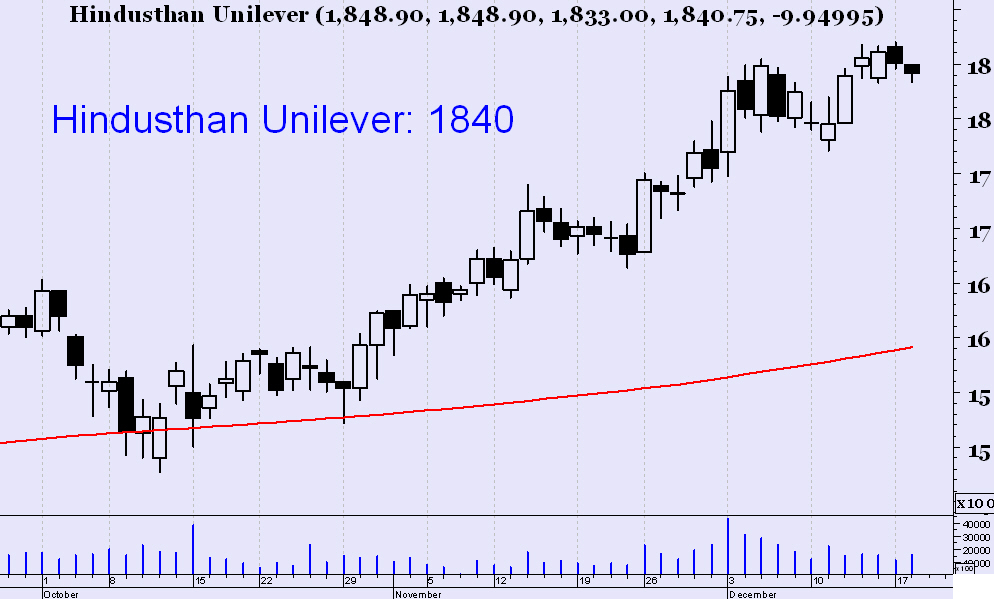

Hindusthan Unilever (CMP: 1840)

In the daily chart of Infosys, as shown here, we notice a series of higher bottom formation & that too happens after a significant testing of 200 bar average on daily chart, which adds credibility to the uptrend. Buy either on pull back to 1795 regions with stop loss at 1760 and target 1850 or buy above 1853 with stop loss at 1815 and target 1890.

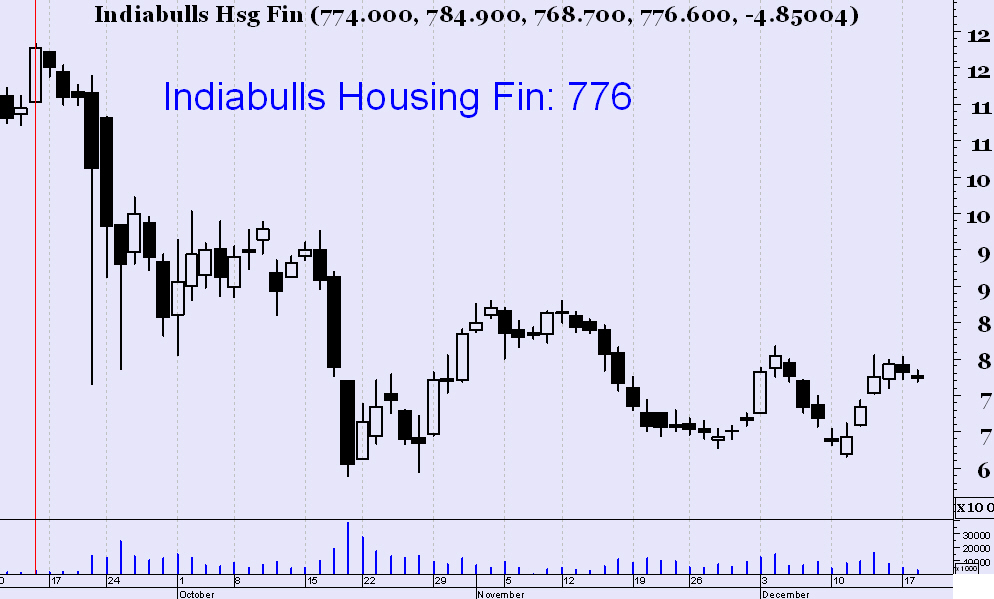

(Sell) Indiabulls Housing Finance (CMP: 776)

We note this stock for its weakness as when Nifty & most other stocks are trading above their respective 50-, 100- & 200- day averages & displaying strength, Ibul Housing Finance is witnessing significant selling pressure & staying below most important moving averages. Past few sessions saw a routine pull back which is in fact a selling opportunity. Sell Indiabull Housing below 768 with stop loss at 804 & target 710.

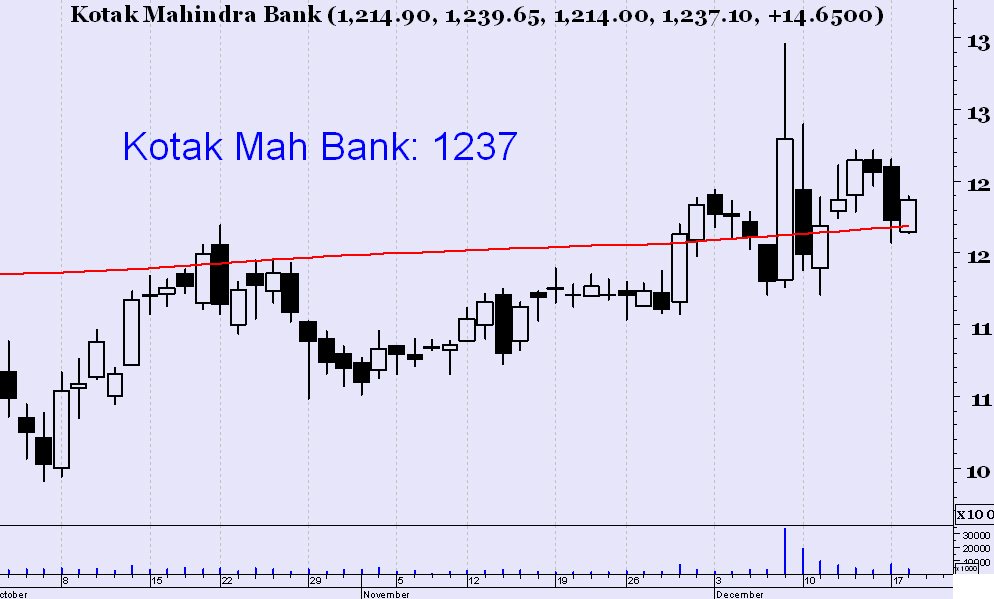

Kotak Mah Bank (CMP: 1237)

After a hiatus, this private sector bank is coming back to life! Last Friday, it put up significant strength & closed above 200 day Moving Average, implying strength ahead. Buy at CMP with stop loss at around 1200 levels and target at 1290.