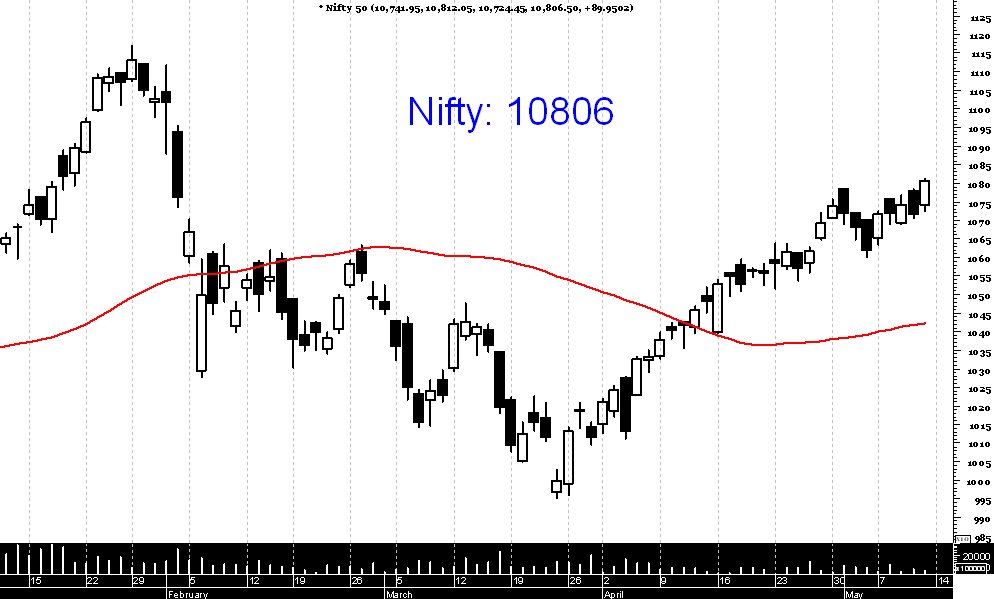

Nifty (CMP: 10806)

After a brief pull back, Nifty resumed its intermediate uptrend previous week & closed at nearly 3 month high.

However, for the intermediate uptrend to survive, Nifty now must not close below 10618 regions which happen to be the low of the past two weeks. Another strong argument for the bulls’ camp is that the index for the first time in 2018, has registered a higher top formation on daily chart only last week.

Going forward, we expect the volatility is likely to continue & the Midcap stocks are poised to outperform their large cap peers.

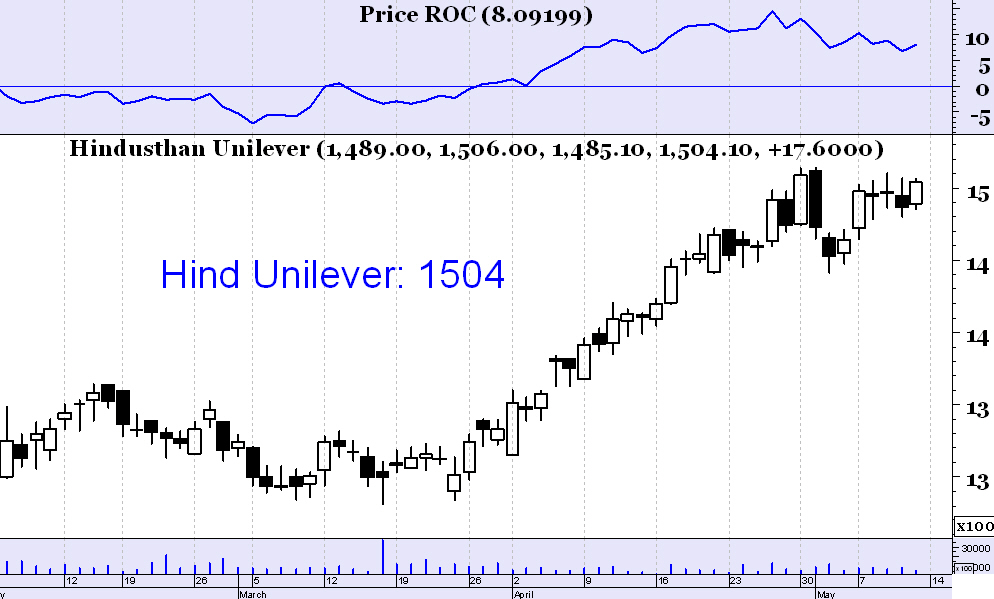

Hind Unilever (CMP: 1504)

Riding on the strong fundamentals, Hindustan Unilever is surging ahead & making a new life high almost on regular intervals. The nature of the trend is steady & hence reliable. Short term support exists at 1480 & 1440 regions and any pullback might be a good opportunity to go long in this FMCG stock.

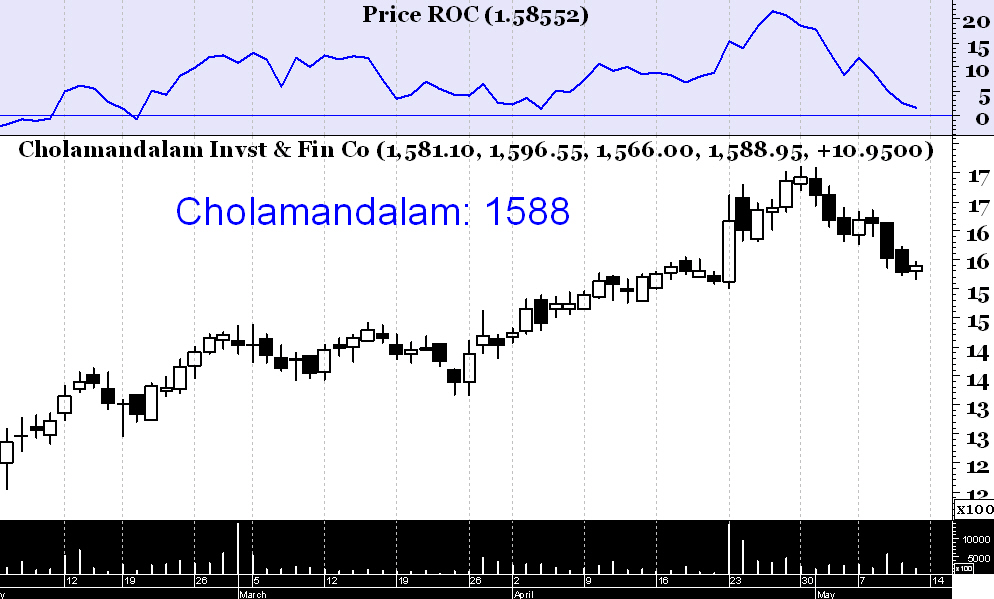

Cholamandalam Finance (CMP: 1588)

Although there is a recent weakness, yet this NBFC stock is a relative outperformer in the longer term & the primary uptrend is pretty strong. Keep short term stoploss at 1550 & buy Cholamandalam above 1600.

Ashok Leyland (CMP: 161.85)

This evergreen auto-stock is exhibiting an extremely strong primary uptrend. We recommend buying Ashok Leyland above 162 with stoploss at 160 & target 168.

HDFC Bank (CMP: 2011)

Private Banking sector is seeing a strong demand & HDFC Bank is continuing in its primary uptrend. We recommend buying at CMP with stoploss at 1967 & target 2100.