Nifty (CMP: 10331)

After 4 weeks of consecutive fall, Nifty rose for 2 weeks & maintained above the critical mark of 200 DMA Friday.

However, for the new found strength to survive, Nifty now must not close below 10120 regions next week. The confirmation of strength will come once the index manages to close above the 50 DMA of 10460 regions.

Going forward, we expect the volatility is likely to continue & the Midcap stocks are poised to outperform their large cap peers.

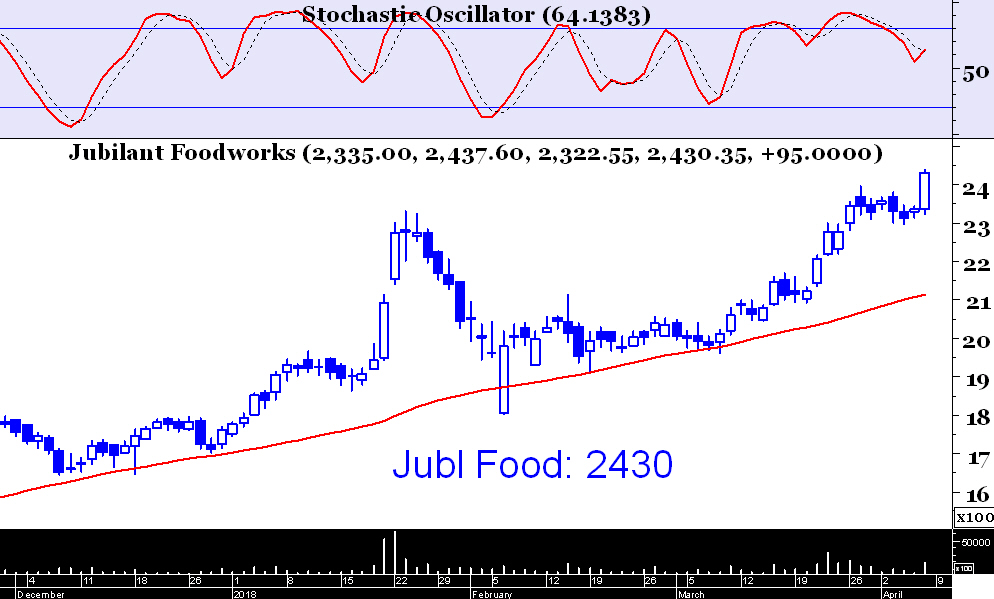

Jubilant Food (CMP: 2430)

This is an exceptionally strong upward trending stock, made new life high Friday. The nature of the trend is very steady & hence reliable. Buy on decline with stoploss at 2300.

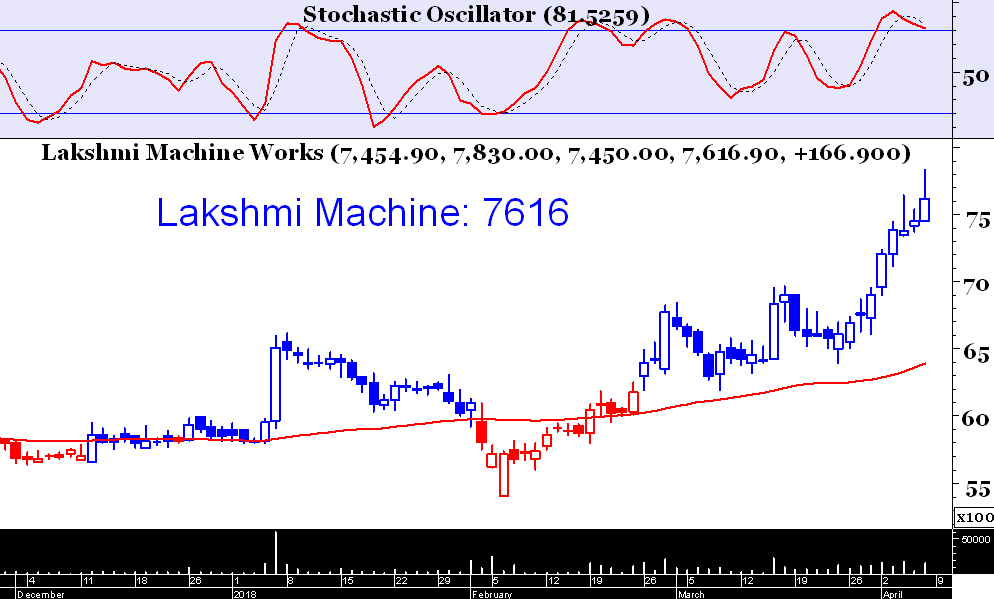

Lakashmi Machine (CMP: 7616)

The chart of Lakshmi Machine is very similar to in terms of steadiness. This stock, in fact was kept in a sidewise choppy mode for the 6 month’s period from September 2017 till February 2018. The subsequent breakout above 7000 odd level hence adds credibility to the primary uptrend. We advise to buy Lakshmi Machine on pull back with stoploss at 6500.

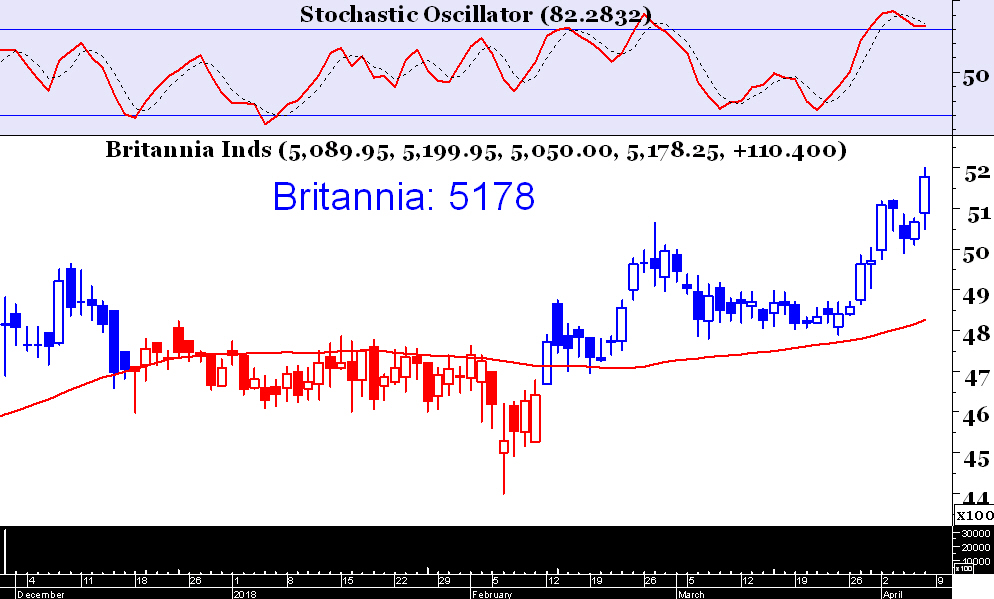

Britannia (CMP: 5178)

FMCG sector, barring a few stocks, are in general relatively insulated from large scale supply & Britannia in fact is a super achiever in this sector. The stock keeps making new life high almost in regular interval & the primary uptrend is pretty obvious from the chart itself. Buy on decline with stop loss at 5000 levels, however, the primary uptrend will continue as long as it keeps above 4800 odd levels.

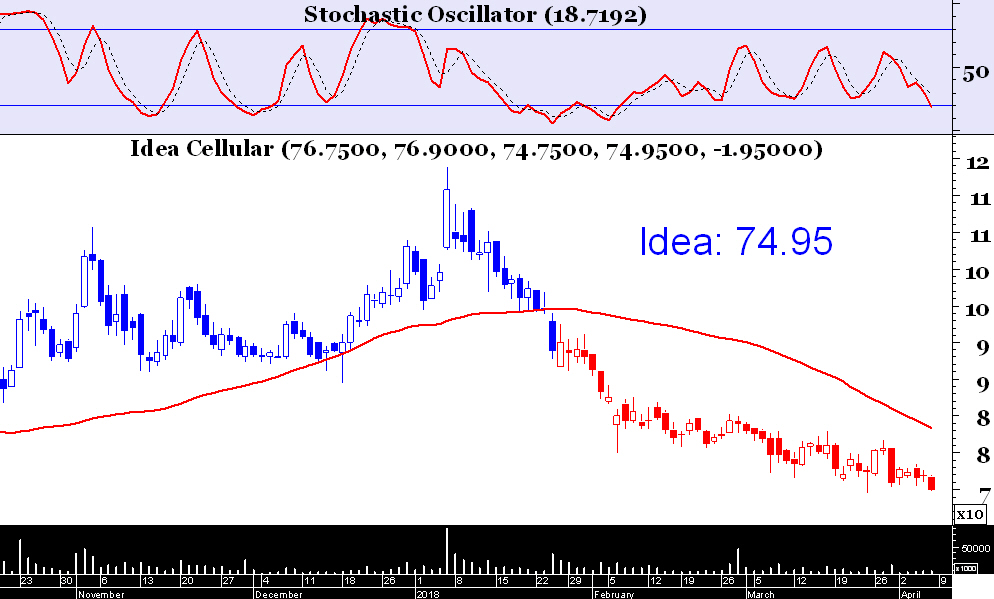

(Sell) Idea Cellular (CMP: 74.95)

Telecom sector is facing the brunt of the bears & Bharti Airtel, Idea is exceptionally weak. We recommend selling Idea on rise to 78 regions with stop loss at 81 & target 71.