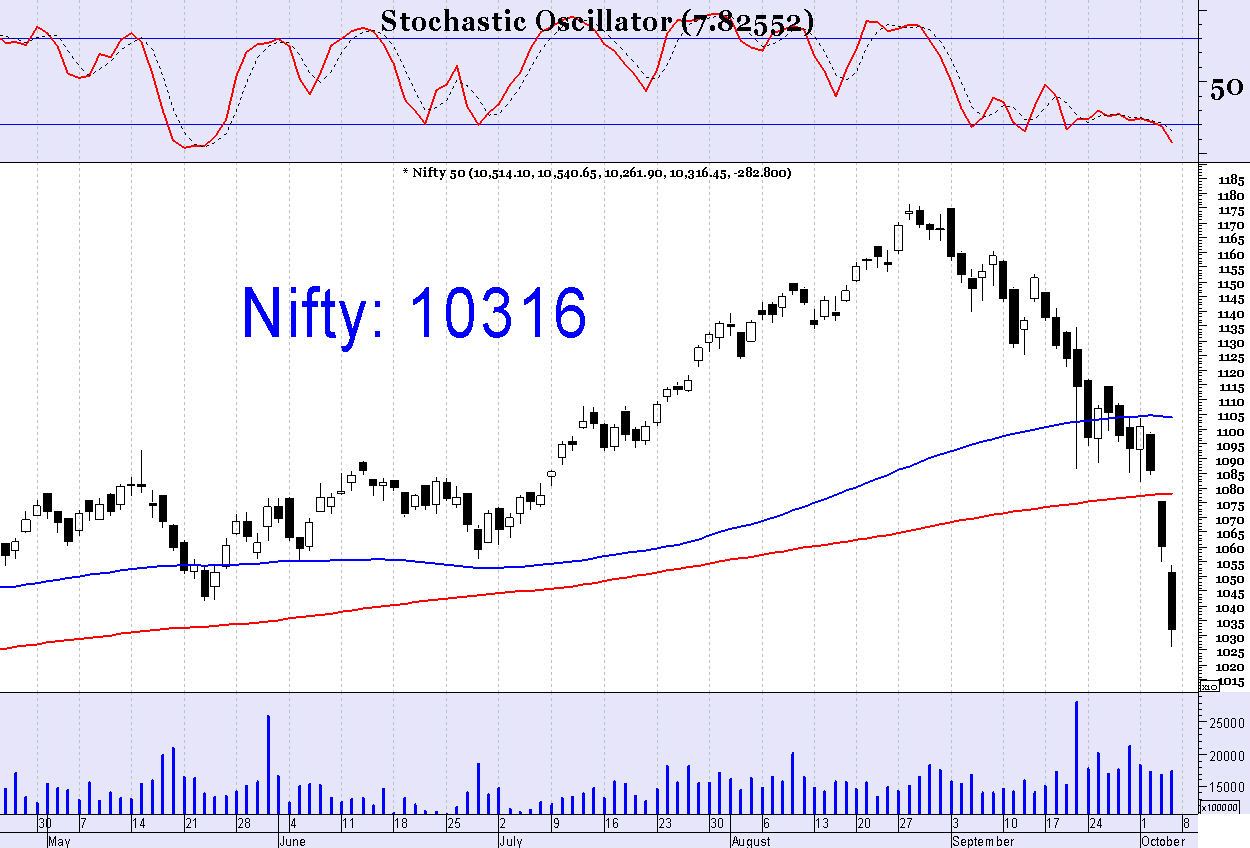

Nifty (CMP: 10316)

Last week continued to witness extreme volatility where Nifty convincingly breached the 200 day Moving Average mark at 10775 zones & ended the week almost at the lowest point. This confirms the official bear market & we should now approach the market as one to be sold on upside surges. The outlook for next week therefore remains negative as long as it stays below 10550 regions as the previous support is expected to serve as resistance.

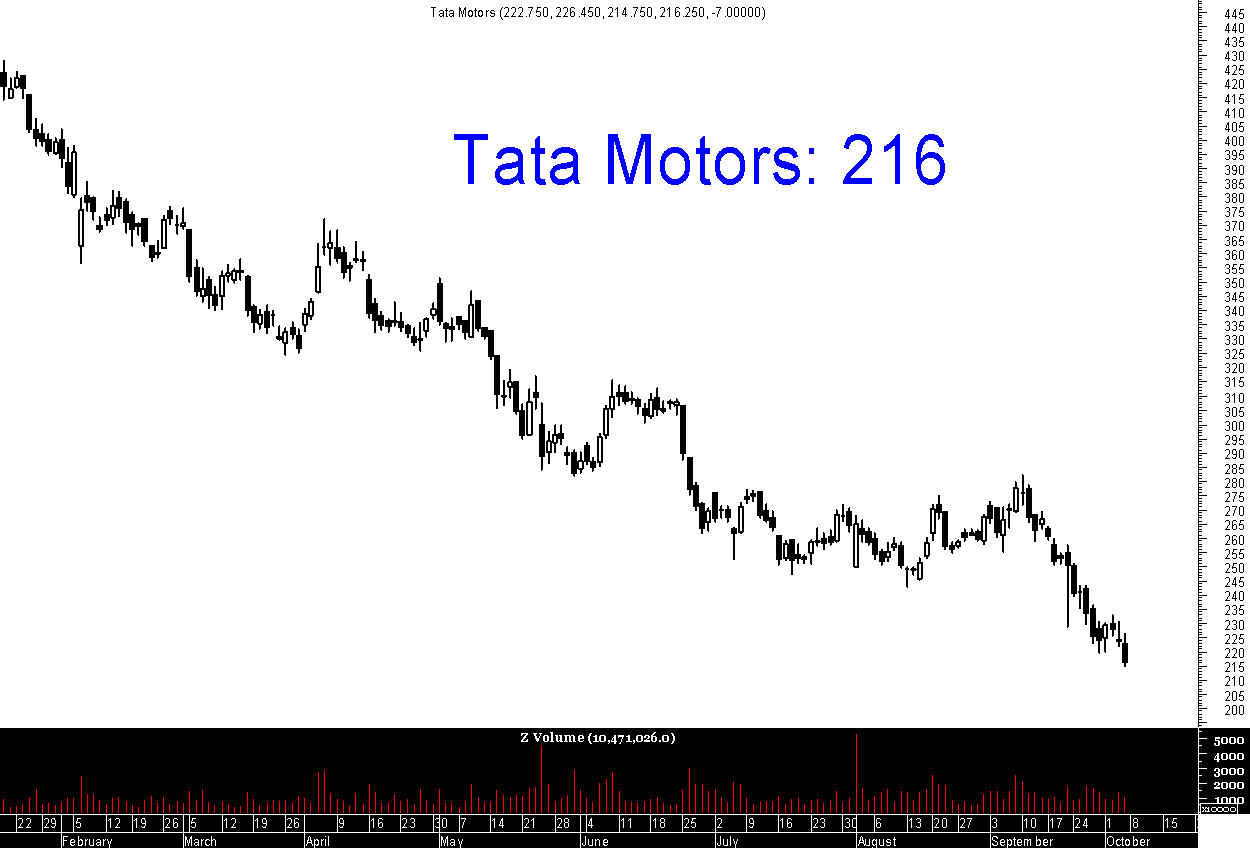

(Sell) Tata Motors (CMP: 216)

Tata Motors has recently seen some serious sell off & it has resumed the primary downtrend. Last week saw continued sell-off in this scrip where it failed to put up any strength. Short term resistance exists at 221 & 226 regions and any pullback might be a good opportunity to go short in this auto stock.

TCS (CMP: 2102)

Although there is a minor consolidation phase in this stock, yet this IT major is showing promise in terms of resumption of the longer term uptrend. One may therefore initiate a long position in TCS on pull back to 2060 regions with stop loss at 2030 & target 2100.

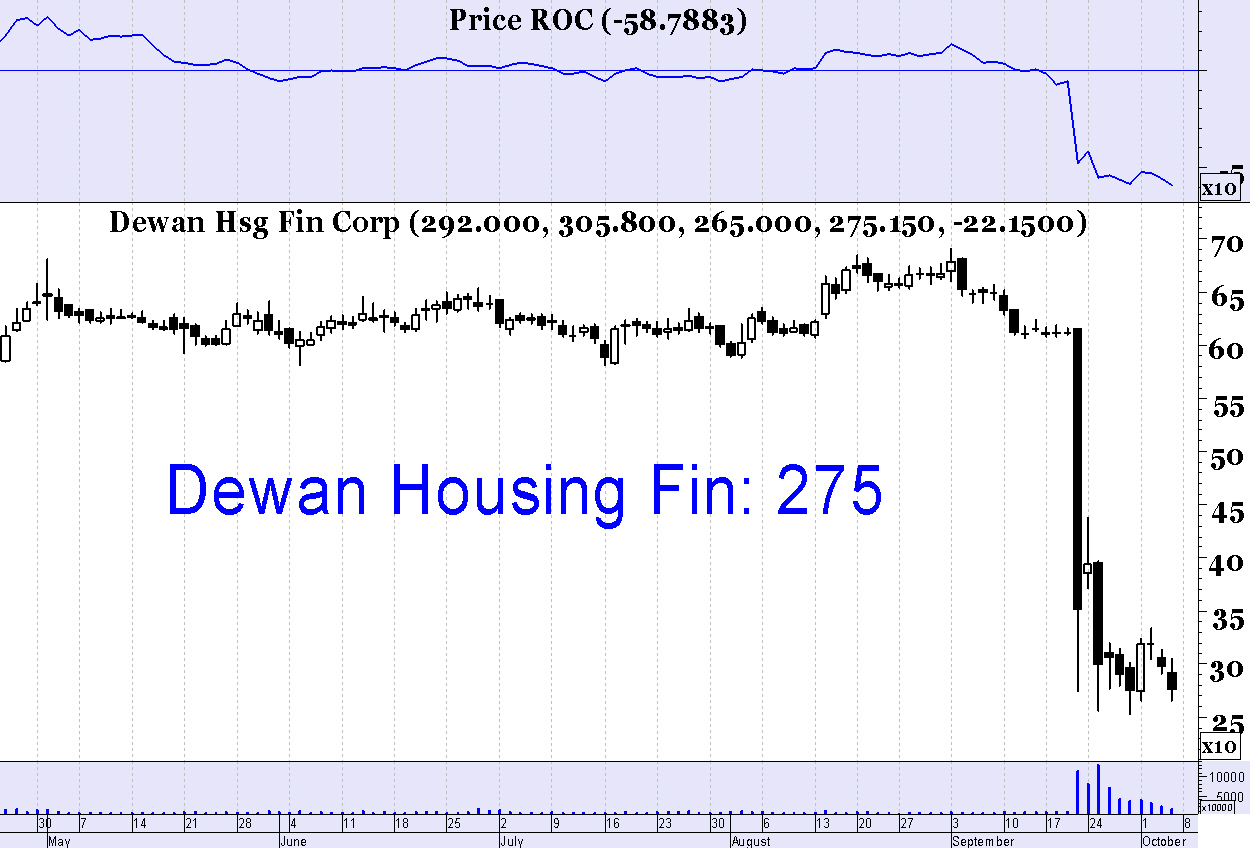

(Sell) Dewan Housing Finance (CMP: 275)

With a primary downtrend, and volatility subsidizing Dewan Housing presents a good shorting opportunity in near future. The stock closed at 275 & one may sell it on rise to 280 regions with stop at 288 & target 267.

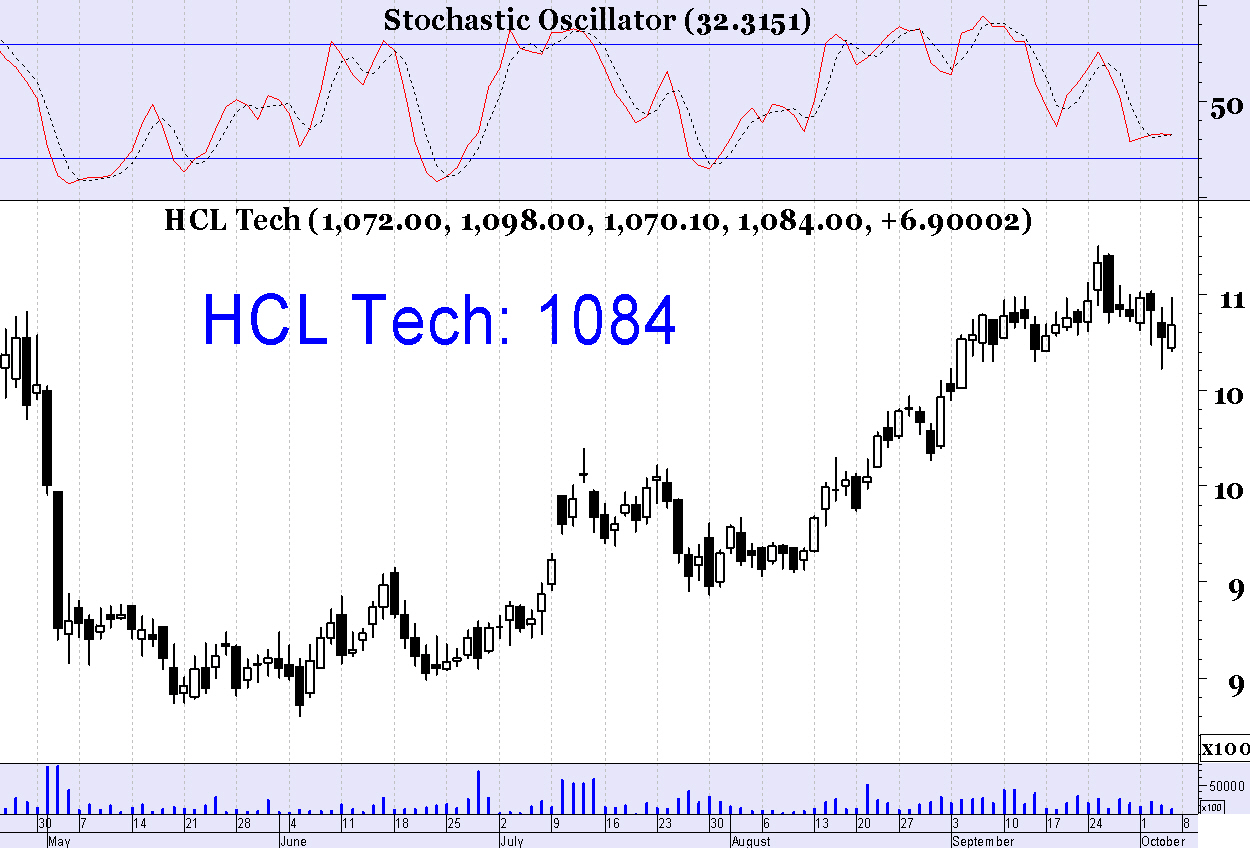

HCL Tech (CMP: 1084)

Thanks to weakening Rupee, large-cap IT sector is still looking resilient as compared to the broader market & HCL Tech is one of the most outperforming scrip in this sector, which is still doing good. We recommend buying at CMP with stop loss at1055 on closing basis & target 1140.