Nifty (CMP: 10727)

Previous week saw continuation of increased volatility in Nifty where it continued with the sequence of closing above & below 200 day moving averages alternately. Market breadth, in the meanwhile has improved and it signifies some sort of recoveries in Mid-cap stocks which puts the odd in favor of continuation of the bullish trend, albeit with some intermittent phase of correction. The outlook for next week remains positive as long as it keeps above 10628 regions as the previous resistance is now expected to serve as support.

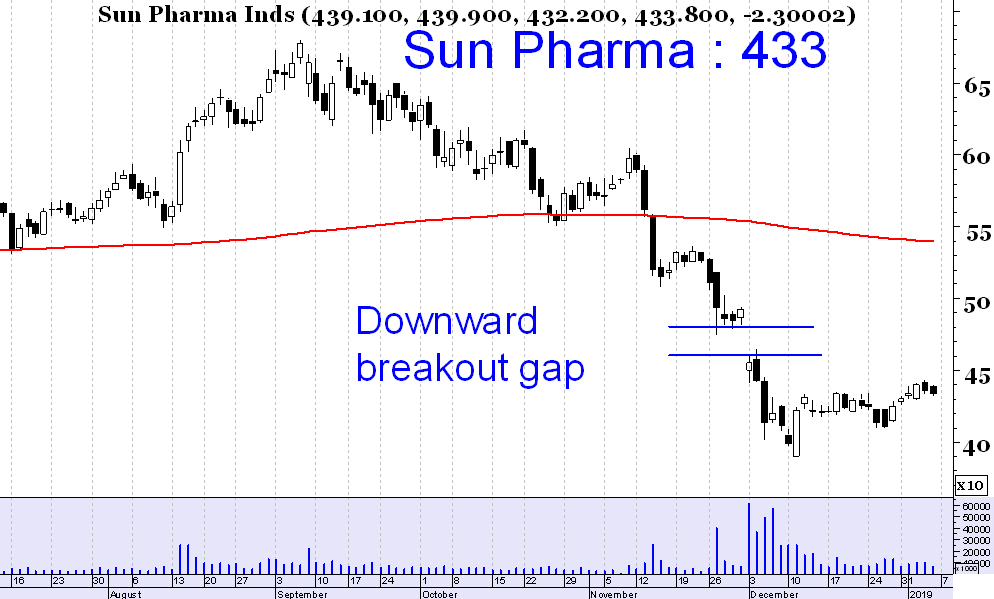

(Sell) Sun Pharma (CMP: 433.80)

Sun Pharma has been one of the laggards in recent periods. We note the occurrence of a downward breakout gap on the daily chart of this Parma major (shown in the adjoined diagram), which is a sort of bearish continuation pattern & likely to provide resistance in the present scenario. The fact that that Sun Pharma continues to trade below major moving averages adds further weightage. Short term resistance exists at 444 & 452 regions and any pullback might be a good opportunity to go short in Sun.

Dabur (CMP: 419)

In the daily chart of Dabur as shown here, we notice two consecutive higher bottom formations, which add credibility to the uptrend. One may buy this FMCG stock either on pull back to 415 regions with stop loss at 406 and target 432 or buy above 425 with stop loss at 415 and target 441.

(Sell) Grasim (CMP: 806)

We note this stock for its weakness as when Nifty & most other stocks are trading close their respective 50-, 100- & 200- day averages & displaying strength, Grasim is witnessing significant selling pressure & staying below most important moving averages. Past few sessions saw continued selling pressure that pushed it below the support of 810 odd levels. Sell Grasim on pull back to 812 with stop loss at 828 & target 788.

HDFC Bank (CMP: 2122)

HDFC Bank continues to showed resilience last week in the face of across-the-board sell off previous week. Last Friday, it tested its support zone at 2100 regions, and bounced back. Buy above 2124 with stop loss at around 2100 levels and target at 2170.