Incorporated in 1999, Mumbai based HDFC Asset Management Company (HDFC AMC) Limited is well-known fund house engaged in providing savings and investment products. It is a joint venture between Housing Development Finance Corporation Limited (HDFC) and Standard Life Investments Limited (SLI). SLI is part of Standard Life Aberdeen plc., one of the world’s largest investment company.

According to CRISIL, as of December 31, 2017, HDFC AMC has been the most profitable AMC of the country in terms of net profits since Fiscal 2013 with a total AUM (Assets Under Management) of ₹2,932.54 billion. Its profits has grown every year since 2002.

It has been the largest AMC in equity-oriented AUM since the last quarter of Fiscal 2011 and has consistently been among the top two asset management companies in India in terms of total average AUM since the month of August 2008..

HDFC AMC offers a wide range of savings and investment products across asset classes. As of December 31, 2017, it offered 127 schemes categorized into-

- 28 equity-oriented schemes

- 91 debt schemes

- 3 liquid schemes

- 5 other schemes (including exchange-traded schemes and funds of fund schemes).

- The company also provides portfolio management and segregated account services to HNIs, family offices, trusts, domestic corporates and provident funds etc. As of December 31, 2017, it managed a total AUM of ₹75.78 billion as part of its portfolio management and segregated account services’ business.

- Strengths-

- 1. Brand reputation of HDFC and SLI helps in earning the trust of customers.

2. Consistent investment performance over the years has helped it established itself as one of the leading AMC in the country

3. Diversified product mix with a multi-channel distribution network helps it expand its reach.

4. Strong profitable growth, over the years, provides it with resources to fund future growth. - Company Promoters:

- The Promoters of the Company are HDFC and Standard Life Investments. HDFC holds 120,772,800 Equity Shares and Standard Life Investments, holds 80,515,200 Equity Shares, which constitutes 57.36% and 38.24%, respectively, of the Company’s pre-Offer, issued, subscribed and paid-up Equity Share capital.

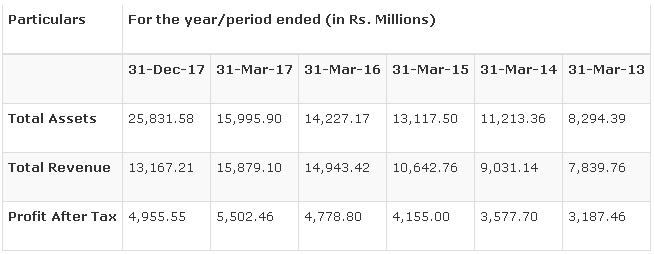

Company Financials:

| Summary of financial Information (Restated) |

Objects of the Issue:

The objects of the Offer-

1. To carry out the sale of Equity Shares offered for sale by the Selling Shareholders.

2. Enhance the company’s visibility and brand image,

3. Provide a public market for Equity Shares in India.

The Company will not receive any proceeds from the Offer and all the proceeds from the Offer will be received by the Selling Shareholders.

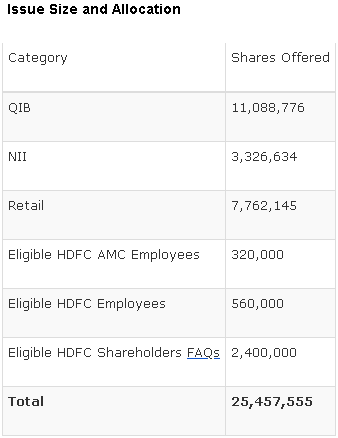

Issue Detail:

»» Issue Open: Jul 25, 2018 – Jul 27, 2018

»» Issue Type: Book Built Issue IPO

»» Issue Size: 25,457,555 Equity Shares of Rs 5 aggregating up to Rs 2,800.33 Cr

› Offer for Sale of 25,457,555 Equity Shares of Rs 5 aggregating up to Rs [.] Cr

»» Face Value: Rs 5 Per Equity Share

»» Issue Price: Rs 1095 – Rs 1100 Per Equity Share

»» Market Lot: 13 Shares

»» Minimum Order Quantity: 13 Shares

»» Listing At: BSE, NSE