We all have our preferences and risk-taking capabilities when it comes to investment choices. According to the Times of India, a survey held across 47,000 households and over 391 districts all over India showed that 31% of Indians preferred investing in mutual funds in 2022. So what makes mutual funds a great option for investing and what are the benefits of mutual funds?

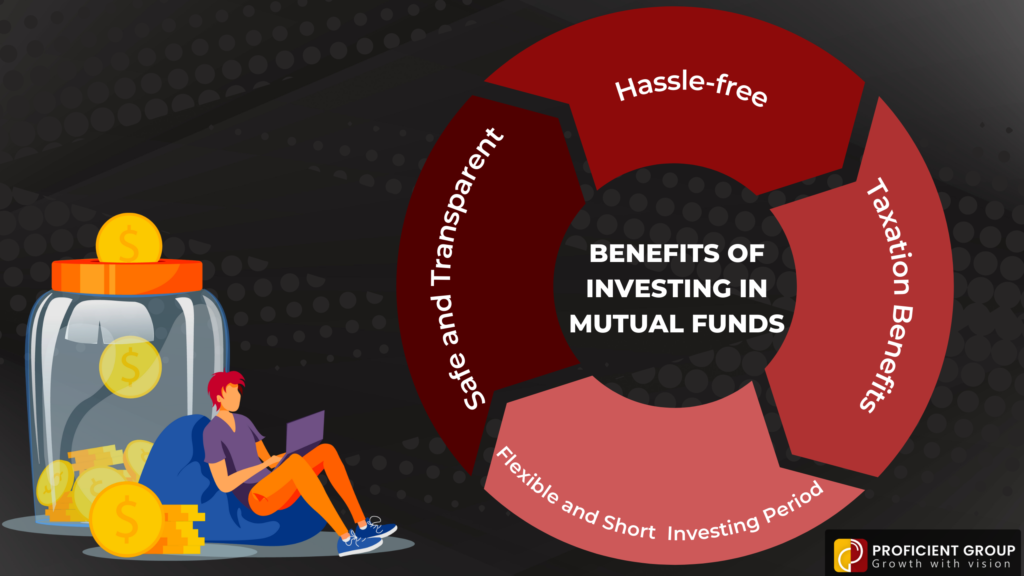

- Hassle-free

One can start investing in mutual funds by contacting a financial institution or simply from one’s home by creating a mutual fund account. All you need to do is verify your KYC (Know Your Customer) documents and start investing in websites or mobile applications. Brokerage firms like Proficient Group, AMC’s (Asset Management Companies), online mutual funds investment platforms and other agents are available both online and offline. Your account is managed by expert fund managers so you have little to no work to do post-investing.

- Taxation Benefits

ELSS (Equity Linked Saving Scheme) Mutual Funds have a tax exemption of Rs. 1.5 lakh a year under section 80C of the Income Tax Act.

ELSS Tax Saving Mutual Funds have the potential to deliver higher returns than other tax-saving investments like PPF, NPS, and Tax Saving FDs.

- Safe & transparent

Mutual funds have a net worth of INR 50 Crs in India. All schemes and products are approved by SEBI and are color coded for indicating their level of risk. Mutual fund agents cannot close business and run as SEBI has strict rules for exiting. Even if AMC goes bankrupt your money is safe in a trust that AMC has no access to. Investors can also verify the credentials of their fund managers like their qualifications, AUM (Assets Under Management), years of experience and solvency of the fund house.

- Flexible & shortest Investing Period

One does not have to invest a large amount to start investing. If you have a monthly salary you can opt for SIP (Systematic Investment Plan). The minimum amount of investment can be Rs.500 and the maximum amount is whatever the investor wishes for. Moreover, investors can withdraw their funds at any time. Everyone gets a plan according to their expenses, investing goals and risk-taking capabilities.

Investors can opt for a 3 years maturity period being the lowest and can stay invested even after the lock-in period.

DISCLAIMER : All mutual funds are subject to market risks. Read all the related documents carefully before investing. This is for educational purposes only. We do not provide any investing suggestions nor are we responsible for any profits and losses.