Incorporated in 2014, Bandhan Bank Limited is Kolkata, West Bengal based commercial bank focused on micro banking and general banking services. Bandhan Bank has a license to provide banking services pan-India across customer segments. Bank offer a variety of asset and liability products and services designed for micro banking and general banking, as well as other banking products and services to generate non-interest income.

With the a network of 2,546 doorstep service centres (DSCs) and 9.47 million micro loan customers, the bank has strong very hold in microfinance. Bandhan bank has 864 bank branches and 386 ATMs serving over 1.87 million general banking customers. Banks distribution network is strong in East and Northeast India, with West Bengal, Assam and Bihar.

Bandhan Bank Products:

1. Retail loans including micro loans, SME loans and small enterprise loans

2. Savings accounts, current accounts and a variety of fixed deposit accounts

3. Other banking products and services including debit cards, internet banking, mobile banking, EDC-POS terminals, online bill payment services and the distribution of third-party general insurance products and mutual fund products.

Bandhan Bank Strengths:

1. Operating Model Focused on Serving Underbanked and Underpenetrated Markets (microfinance)

2. Consistent Track Record of Growing a Quality Asset and Liability Franchise

3. Extensive, Low Cost Distribution Network

4. Provide accessible, simple, cost-effective and innovative financial solutions

5. Robust Capital Base

6. Maintaining focus on micro lending while expanding further into other retail and SME lending

Company Promoters:

The Promoters of the Bank are BFHL, BFSL, FIT and NEFIT.

1. Bandhan Financial Services Private Limited (BFSL) is a non-banking financial institution for purposes

of carrying out non-banking financial activities without accepting public deposits.

2. BFSL was accorded in-principle approval by the RBI on April 9, 2014 for setting up a bank in the private sector. The promoter of BFHL is BFSL.

3. FIT is an irrevocable charitable trust with objectives including inter alia eliminating functional illiteracy in India by making education economically relevant.

4. NEFIT is an an irrevocable charitable trust with objectives including inter alia eliminating illiteracy in India by making education available to the underprivileged.

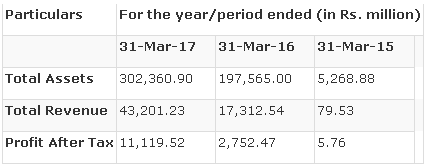

Company Financials:

Summary of financial Information (Restated)

Objects of the Issue:

The Issue comprises of a Fresh Issue and an Offer for Sale.

Fresh Issue

The object of the fresh issue is to augment Bank’s Tier-I capital base to meet Bank’s future capital requirements.

Offer for Sale

The Selling Shareholders will be entitled to the respective portion of the proceeds of the Offer for Sale.

Issue Detail:

»» Issue Open: Mar 15, 2018 – Mar 19, 2018

»» Issue Type: Book Built Issue IPO

»» Issue Size: 119,280,494 Equity Shares of Rs 10 aggregating up to Rs 4,473.02 Cr

› Fresh Issue of 97,663,910 Equity Shares of Rs 10 aggregating up to Rs [.] Cr

› Offer for Sale of 21,616,584 Equity Shares of Rs 10 aggregating up to Rs [.] Cr

»» Face Value: Rs 10 Per Equity Share

»» Issue Price: Rs 370 – Rs 375 Per Equity Share

»» Market Lot: 40 Shares

»» Minimum Order Quantity: 40 Shares

»» Listing At: BSE, NSE

Tentative Date / Timelines of Bandhan Bank IPO:

Bid/Offer Opens On: Mar 15, 2018

Bid/Offer Closes On: Mar 19, 2018

Finalisation of Basis of Allotment: On or about Mar 22, 2018

Initiation of refunds: On or about Mar 23, 2018

Credit of Equity Shares to demat accounts: On or about Mar 26, 2018

Commencement of trading of the Equity Shares on the Stock Exchanges: On or about Mar 27, 2018

Please contact us today for application at 033 40266300