Nifty (CMP: 10692)

After 4 weeks of consecutive fall, Nifty gained for 5 weeks & continues to maintain above all the major moving averages, which is a significant sign of strength.

However, for the new found strength to survive, Nifty now must not close below 10520 regions which happen to be the low of previous week. Another strong argument for the bulls’ camp is that the index for the first time in 2018, has registered a higher top formation on daily chart only last week.

Going forward, we expect the volatility is likely to continue & the Midcap stocks are poised to outperform their large cap peers.

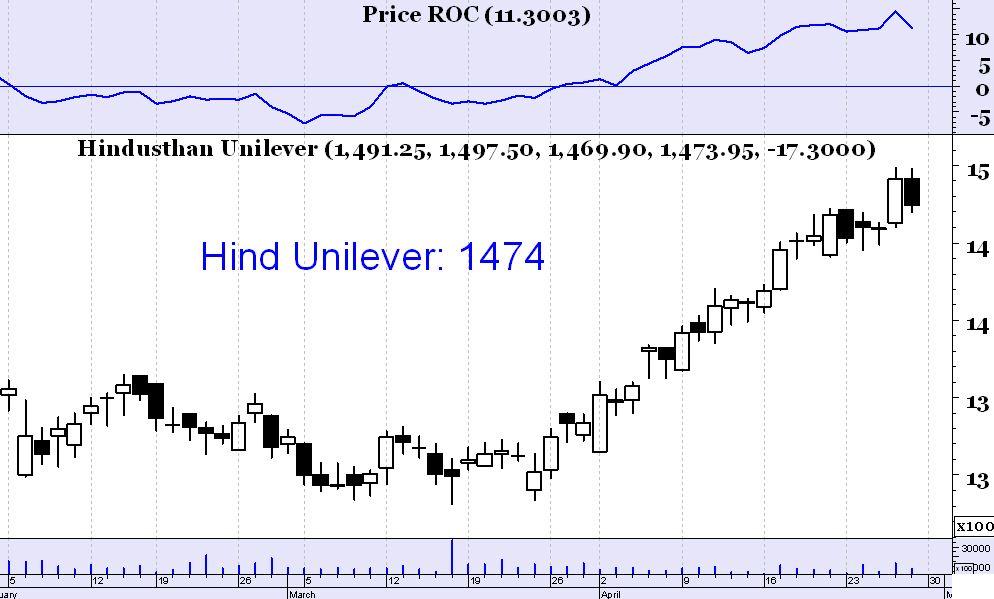

Hind Unilever (CMP: 1474)

Riding on the strong fundamentals, Hind Unilever is surging ahead & making a new life high almost on regular intervals. The nature of the trend is steady & hence reliable. Short term support exists at 1440 regions and any pullback might be a good opportunity to go long in this FMCG major.

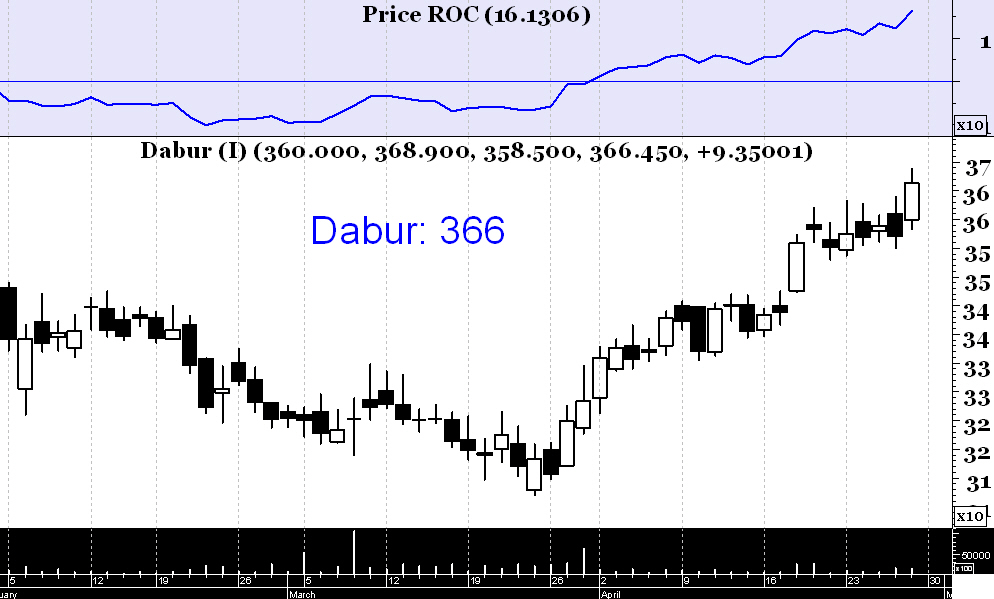

Dabur (CMP: 366)

With FMCG index making new life high much ahead of the broader market, the signal is pretty clear that this is one of the most outperforming sectors & not to miss. Just like Hindustan Unilever, Dabur is also a strong buying candidate in this sector. Keep short term stop at 355.

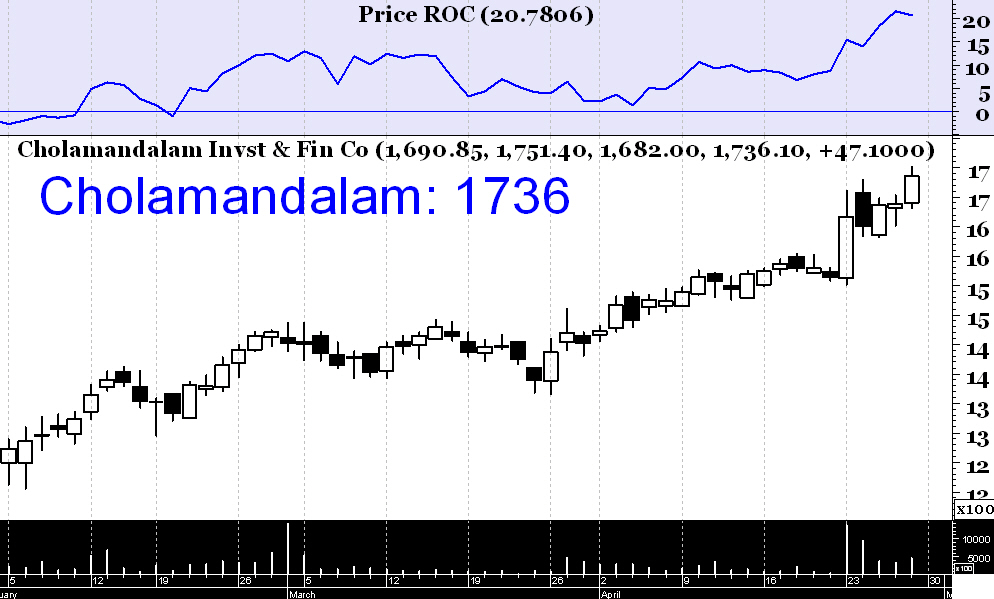

Cholamandalam (CMP: 1736)

The stock is making life high almost at regular intervals and the resulting primary uptrend is extremely strong. We recommend buying Chola on pullback to 1710 regions with stoploss at 1632 & target 1840.

KPIT Technologies (CMP: 243.10)

IT sector is seeing a strong demand & KPIT Technologies is continuing in its primary uptrend. We recommend buy at CMP with stoploss at 234 & target 258.