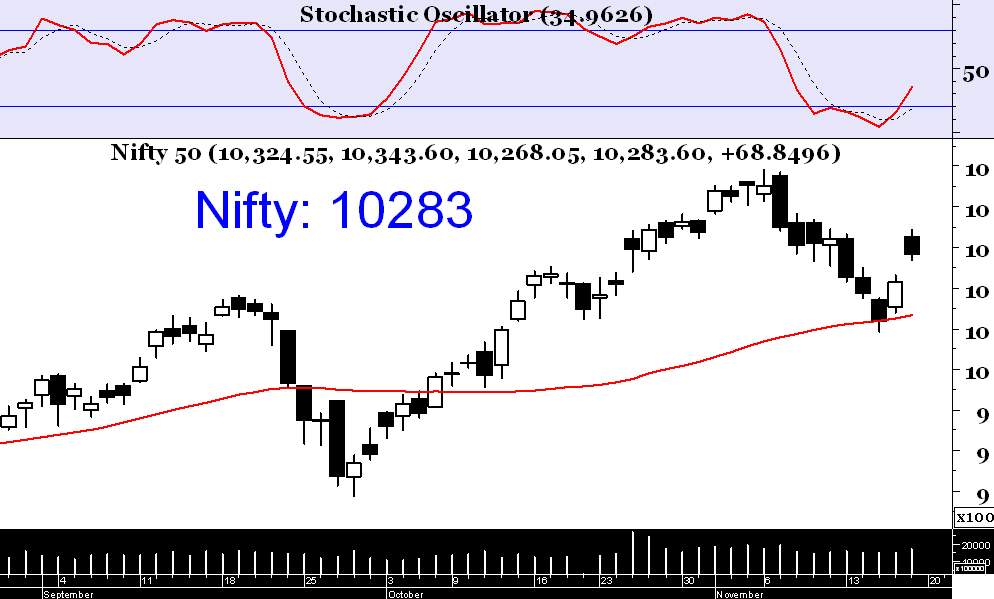

Nifty this week took support from its 50 Day Moving Average and formed a Hammer on weekly chart. The Hammer is a bullish reversal kind of pattern, provided, prices stay above Friday’s close. In any case, if Nifty continues above 10340 sometimes early next week, the odds of resumption of longer term uptrend will improve. The Gap at 10232-10268 is likely to provide support for the Index next week.

This FMCG stock is one of the star performers of the present bull run. The stock is in a primary uptrend & has a habit of making new high every now & then. Buy at CMP with stop loss at 4685 & target 5000.

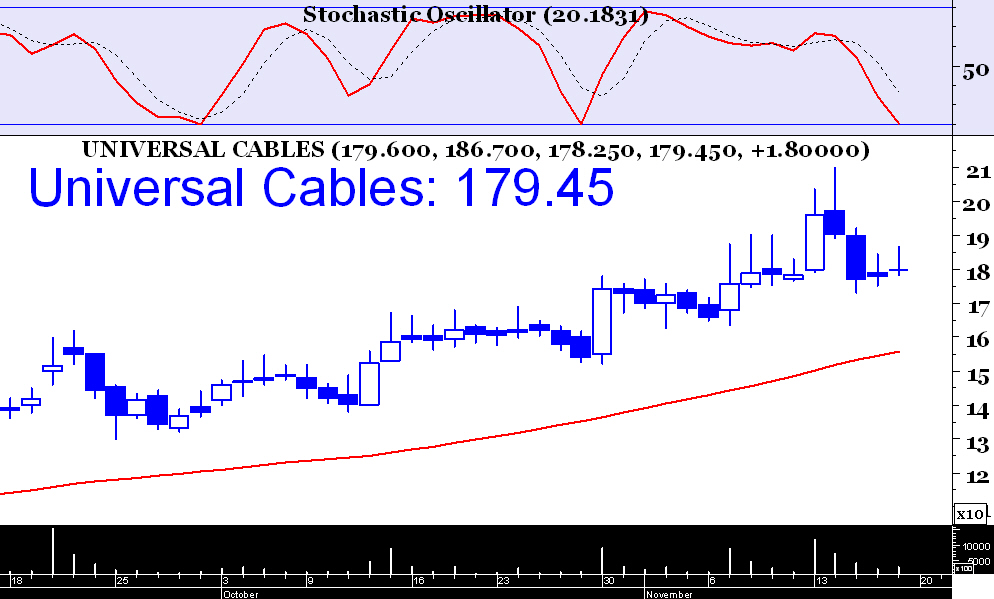

After breaking out off a multiple resistance area in the zone of 125-130 in September, Universal Cables have been rising almost in a steady linear fashion and currently quoting at 179 zones, that too after making a high of 209 earlier this week. We recommend buying with stop loss at 173 & target 210.

This evergreen banking stock is on the verge of lifetime breakout. For the next week, one may buy SBIN on pull back to 333 regions with stop loss at 324 & target 350.

The stock has been in a very strong primary uptrend & making new high almost in a regular fashion. Overall health of the Breweries sector is improving as well. We recommend a buy on Tata Global on pull back to 251 regions with stop loss at 241 & target 264.