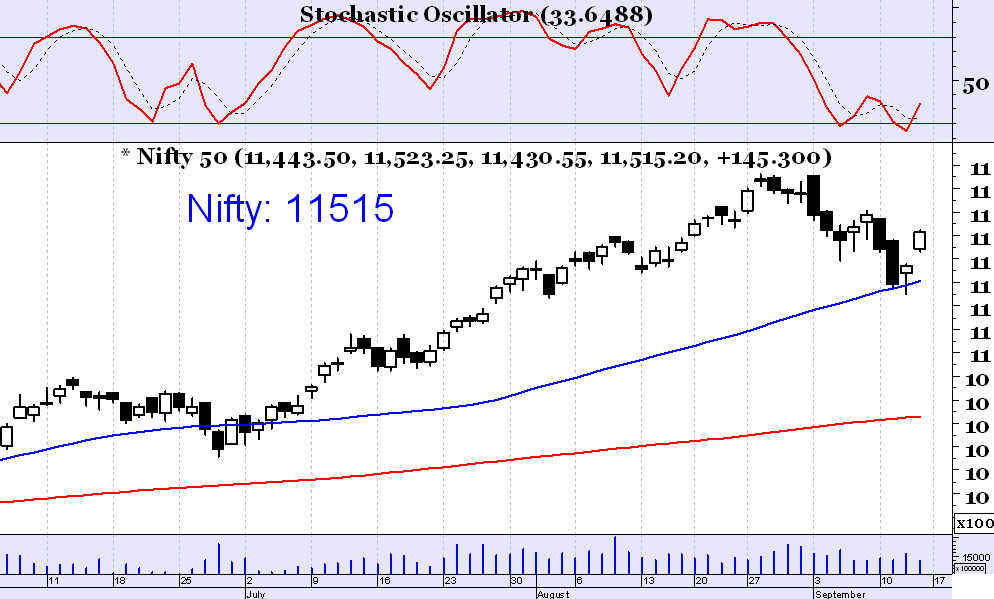

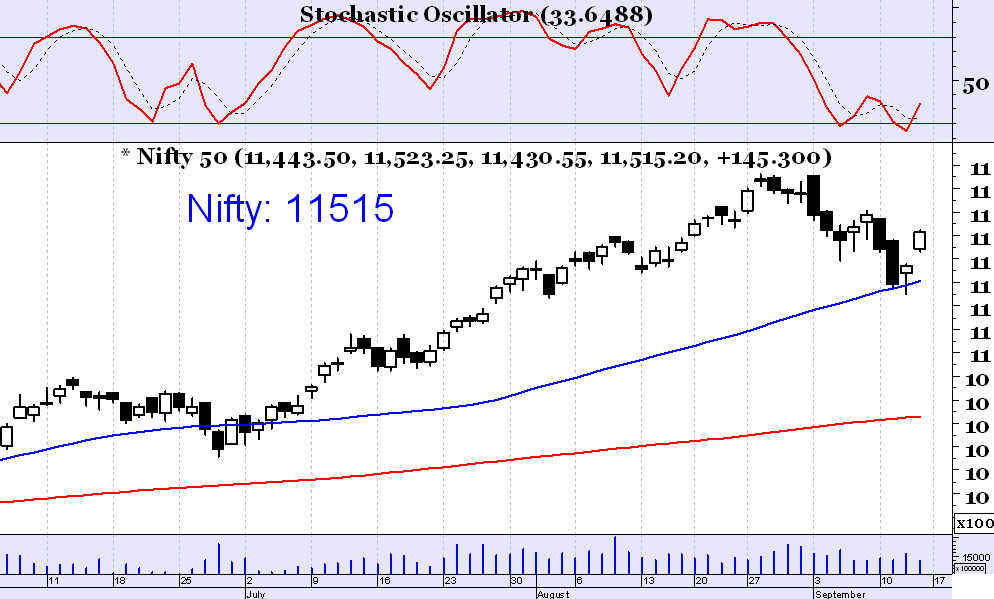

Nifty (CMP: 11515)

Last week saw a phase of increased volatility in Nifty where it briefly closed at a new 6-week low followed by some pull back towards the closing of the week. The index is still trading above major moving averages like 50, 100 & 200 day denominations & it puts the odd in favor of continuation of the bullish trend. The outlook for next week remains positive as long as it keeps above 11285 regions as the previous resistance is expected to serve as support.

Dabur (CMP: 468.25)

Riding on the strong fundamentals, Dabur is surging ahead. The nature of the long term trend is steady & hence reliable. The recent weakness represents a good opportunity to create a core position in this FMCG major. Short term support exists at 448 & 441 regions and any pullback might be a good opportunity to go long in Dabur.

Mahindra & Mahindra (CMP: 951.90)

Although there is a recent weakness, yet this major auto stock is an overwhelming out-performer in the longer term & the primary uptrend is significantly strong. Keep positional stoploss at 925 & buy M&M on pullback to 940 regions for target 975.

JSW Steel (CMP: 408.10)

We note this stock for its primary uptrend as well as the strong upward momentum. Past few sessions saw a routine pull back which was in fact a buying opportunity. Buy JSW Steel on pullback to 398 levels with stop loss at 388 (on closing basis) & target 418.

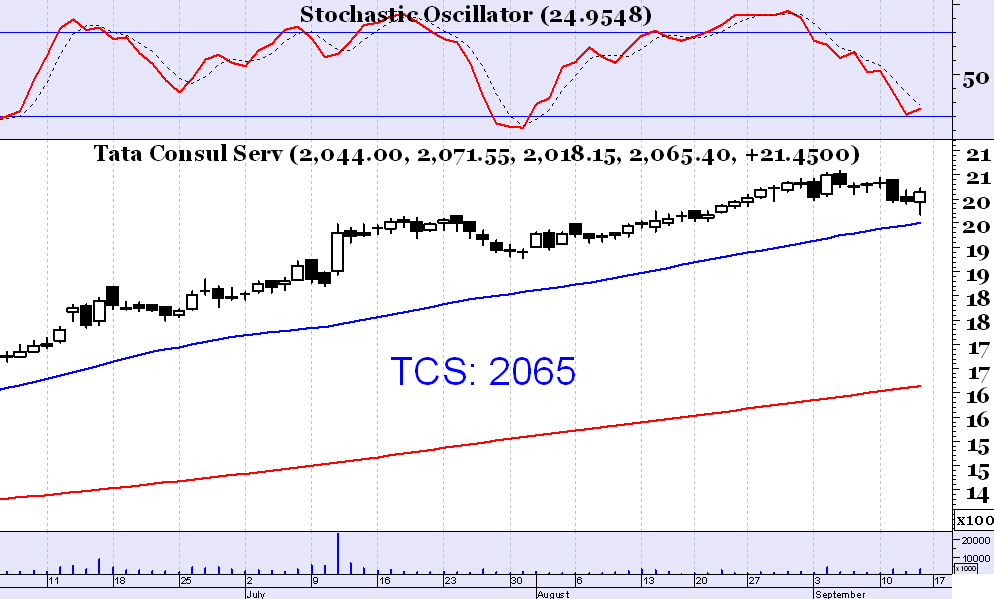

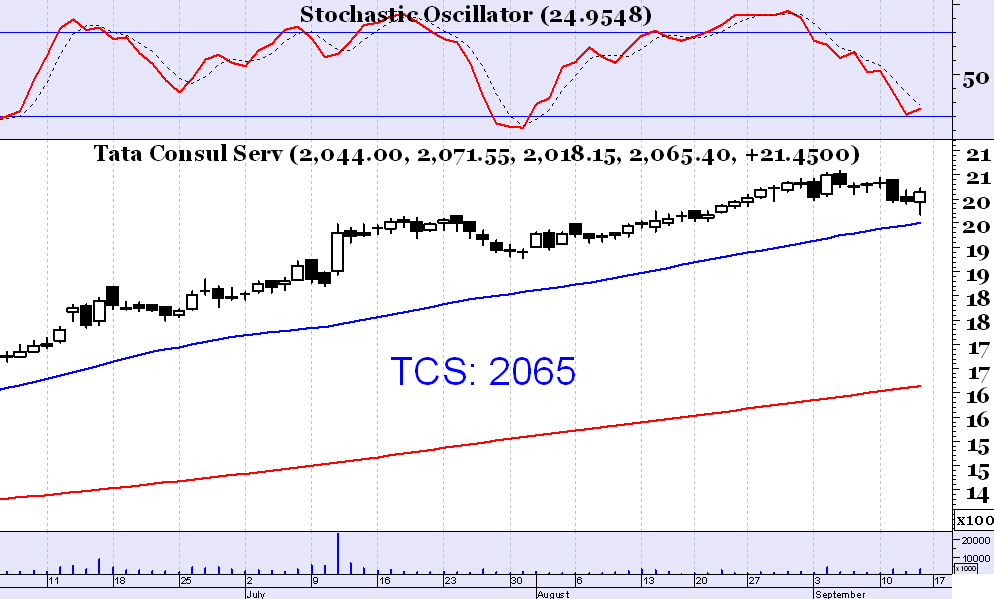

TCS (CMP: 2065)

Large-cap IT sector is seeing a strong demand & TCS is continuing in its primary uptrend. We recommend buying at CMP with stoploss at 2030 & target 2140.