Nifty (CMP: 10480)

After 4 weeks of consecutive fall, Nifty rose for 3 weeks & maintained above all the major moving averages, which is a significant sign of strength.

However, for the new found strength to survive, Nifty now must not close below 10300 regions which happen to be the low of previous week. Another strong argument for the bulls’ camp is that the index for the first time in 2018, has registered a higher top formation on daily chart.

Going forward, we expect the volatility is likely to continue & the Midcap stocks are poised to outperform their large cap peers.

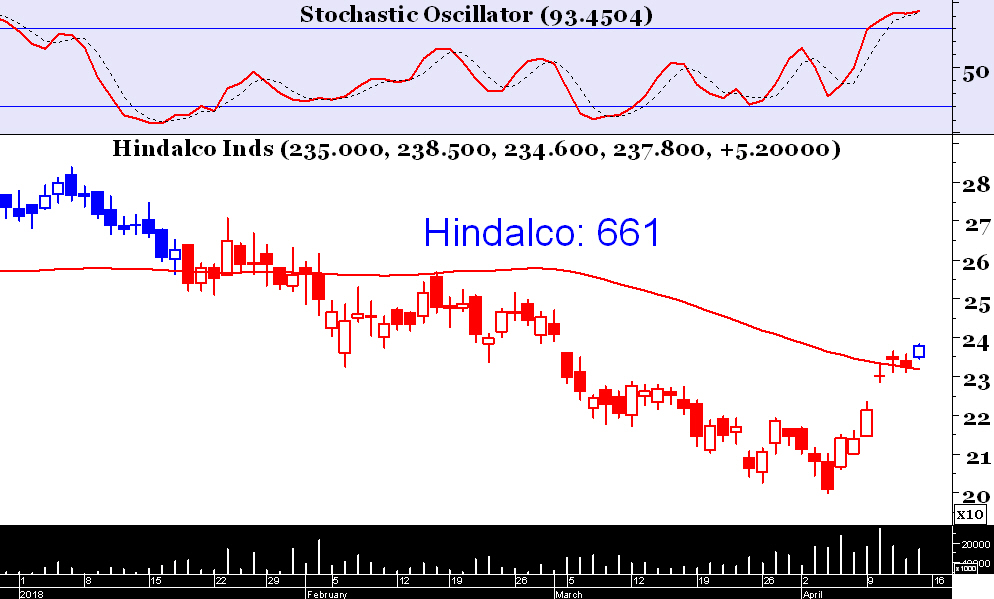

Hindalco (CMP: 237.80)

Riding on the strong demand for base metals globally, Hindalco surged ahead Friday. The nature of the trend is steady & hence reliable. Buy on decline with stoploss at 230.

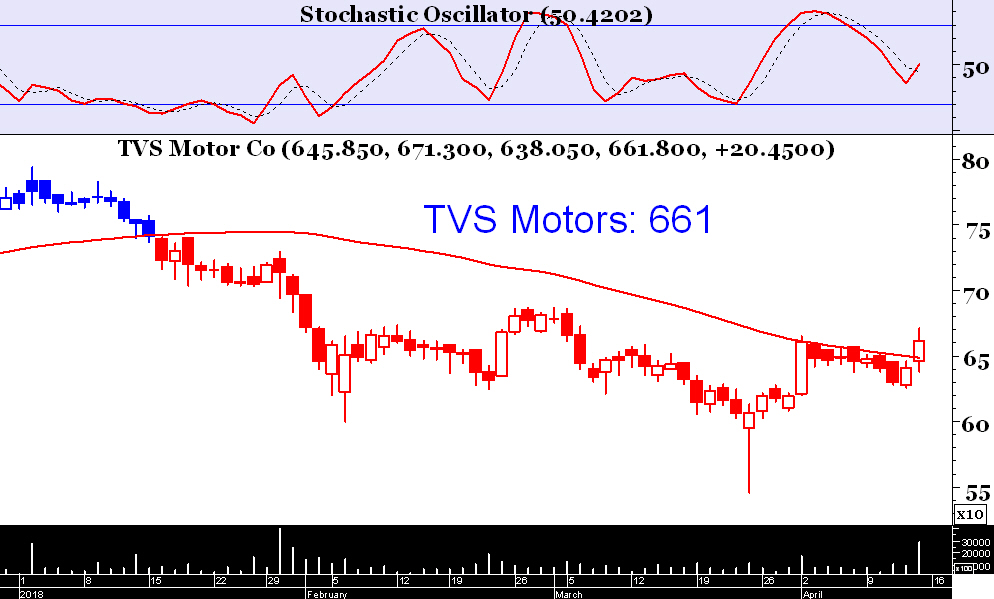

TVS Motors (CMP: 661.80)

The bears in TVS Motors are exhausting which is evident from its attempt of base formation on daily chart. The stock showed good demand previous week & closed above its 50 Day average for the first time since mid-January. We believe the strength is more likely to continue than reverse & one may therefore buy TVS Motors on decline with stop loss at 629.

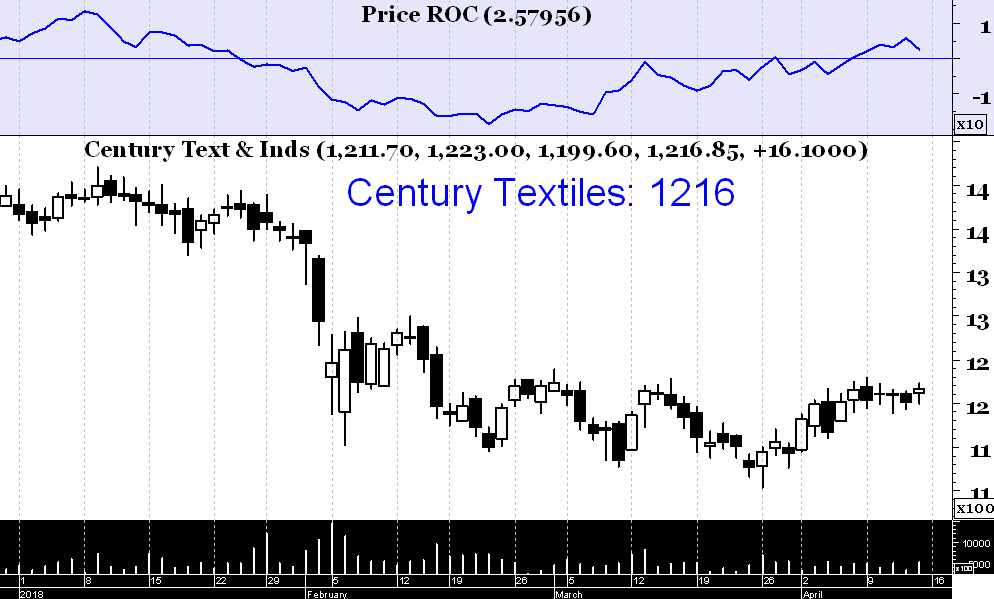

Century Textile (CMP: 1217)

The stock is trading at an important triple top resistance zone and a breakout above 1230 will drive up the demand. We recommend to buy Century Textile above 1230 with stoploss at 1188.

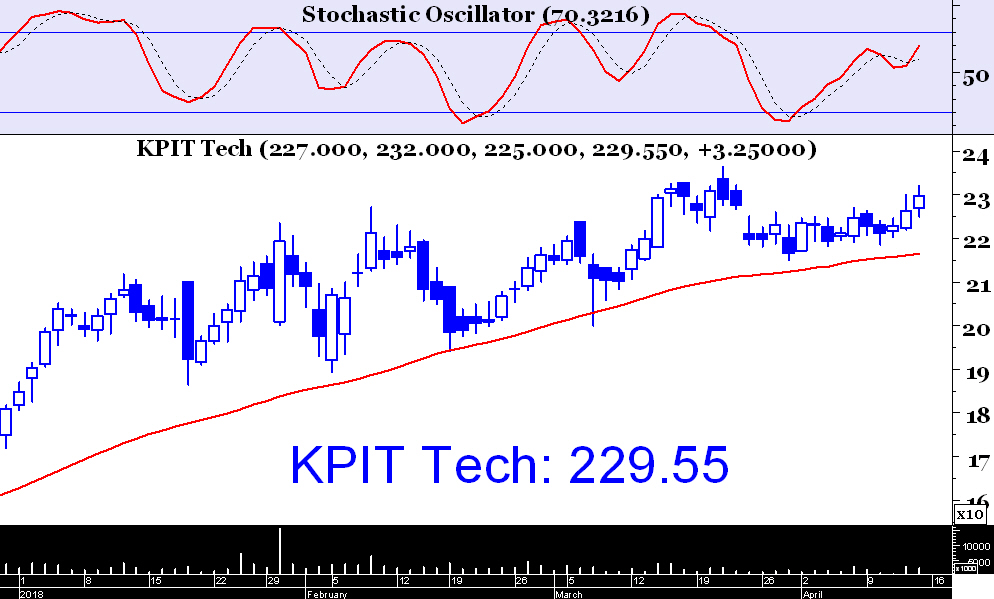

KPIT Technologies (CMP: 229.55)

IT sector is seeing a strong demand & KPIT Technologies is continuing in its primary uptrend. We recommend buy at CMP with stoploss at 219 & target 250.