Nifty (CMP: 10696)

Last week saw a consolidation phase in Nifty which remained in a quiet choppy period but gained 91 points on weekly basis. Nifty is still trading above all major moving averages like 50, 100 & 200 day denominations & it puts the odd in favor of the bulls.

With this, the weekly chart completes a morning star-like candle formation (in true sense, previous week’s Doji cannot be termed a ‘star’ though) which suggests that chances are high that an intermediate bottom has been made in Nifty and we are not expecting to violate 10400 in near future. This view will gain further confirmation if 10770 are subsequently conquered by the index next week.

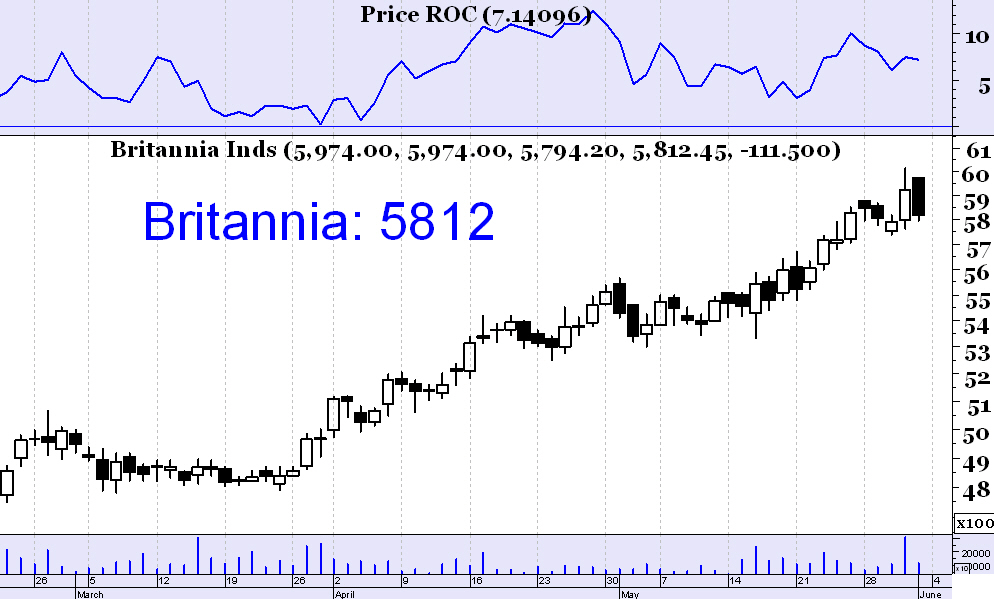

Britannia (CMP: 5812)

Riding on the strong fundamentals, Britannia is surging ahead & making a new life high almost on regular intervals. The nature of the trend is steady & hence reliable. Short term support exists at 5700 regions and any pullback might be a good opportunity to go long in this FMCG stock.

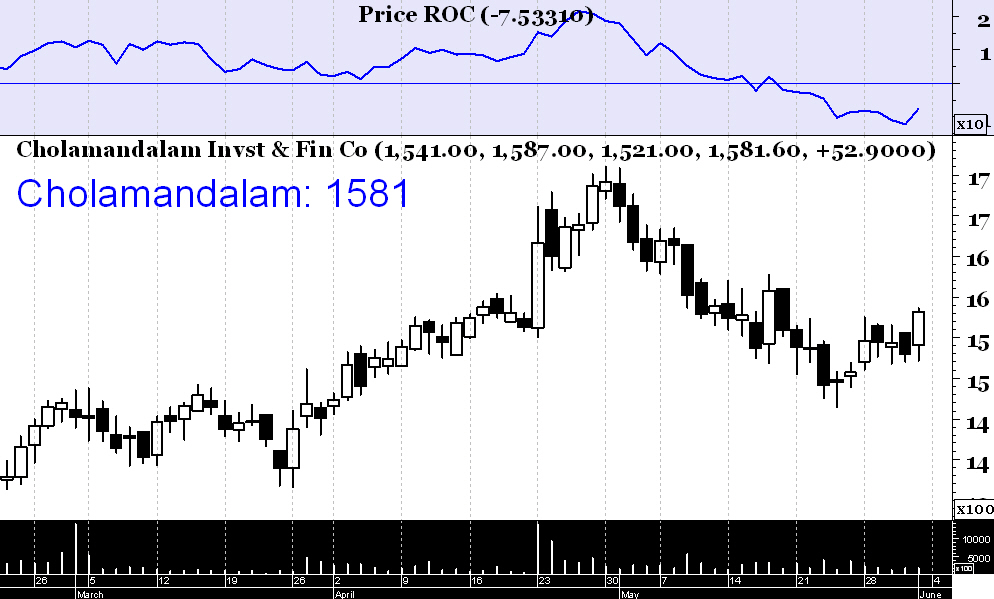

Cholamandalam Finance (CMP: 1581)

Although there is a recent weakness, yet this NBFC stock is a relative outperformer in the longer term & the primary uptrend is pretty strong. Keep short term stoploss at 1515 & buy Cholamandalam Investment on pull back till 1560 for target 1650.

Indusind Bank (CMP: 1915)

We like this stock for its tremendously strong long-term primary uptrend. Past week saw a routine pull back which is a buying opportunity. Buy at CMP with stop loss at 1857 & target 2010.

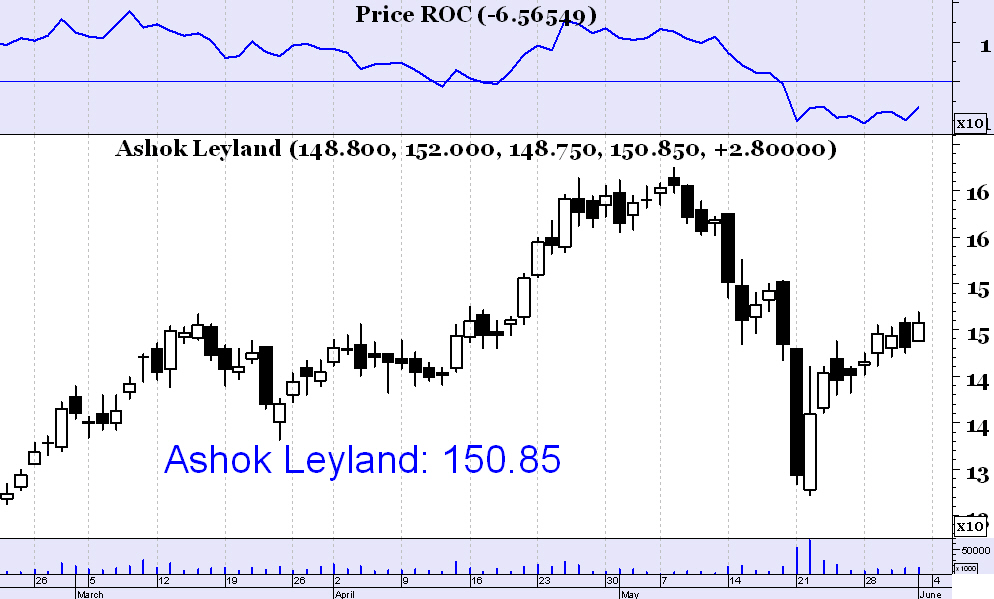

Ashok Leyland (CMP: 150.85)

Auto sector is seeing a strong demand & Ashok Leyland is continuing in its primary uptrend. We recommend buying at CMP with stoploss at 147 & target 157.