Incorporated in 1992, Newgen Software Technologies is Delhi-based Software Product Company. Newgen offers product and platform that enables organizations to rapidly develop powerful software applications. Company mainly offers products in ECM and BPM space. Company sells its products through direct sales and through its 300 strong channel partners globally.

Newgen Software has four patents registered in India and 27 outstanding patent applications in India and one outstanding patent application in the USA. Newgen has over 450 active customers in over 60 countries. These customers are served by over 265 employees.

Newgen Software platform comprises of:

- OmniDocs Enterprise Content Management (ECM) Software (to digitization of enterprise content and information)

- OmniFlow Intelligent Business Process Suite (BPM) (to manage a complete range of business processes)

- OmniOMS Customer Communication Management suite (unified communication platform to improve communication with customers)

These enterprise-wide solutions are used by in various sectors including banking, government/PSUs, BPO/IT, insurance and healthcare.

Company Strengths

- Product based Software Company with strong industry recognition.

- Diversified business across several verticals (including banking, government/PSUs, BPO/IT, insurance and healthcare)

- Diversified revenue streams (license fees or subscription fees) from multiple geographies with low customer concentration

- Recurring and non-recurring, repeat revenues from long standing customer relationships

- Clients include 17 Global Fortune 500 companies

- Focused on driving innovation through in-house R&D.

Company Promoters:

The Promoters of the Company are Mr. Diwakar Nigam and Mr. T.S. Varadarajan.

Company Financials:

Summary of financial Information (Restated Consolidated)

| Particulars | For the year/period ended (in Rs. million) | ||||

| 31-Mar-17 | 31-Mar-16

|

31-Mar-15

|

31-Mar-14

|

31-Mar-13

|

|

| Total Assets | 4,467.11 | 3,892.55 | 3,243.41 | 2,650.47 | 1,578.12 |

| Total Revenue | 4,337.65 | 3,496.70 | 3,162.13 | 2,551.65 | 2,055.49 |

| Profit After Tax | 523.62 | 278.20 | 463.80 | 410.81 | 369.55 |

Objects of the Issue:

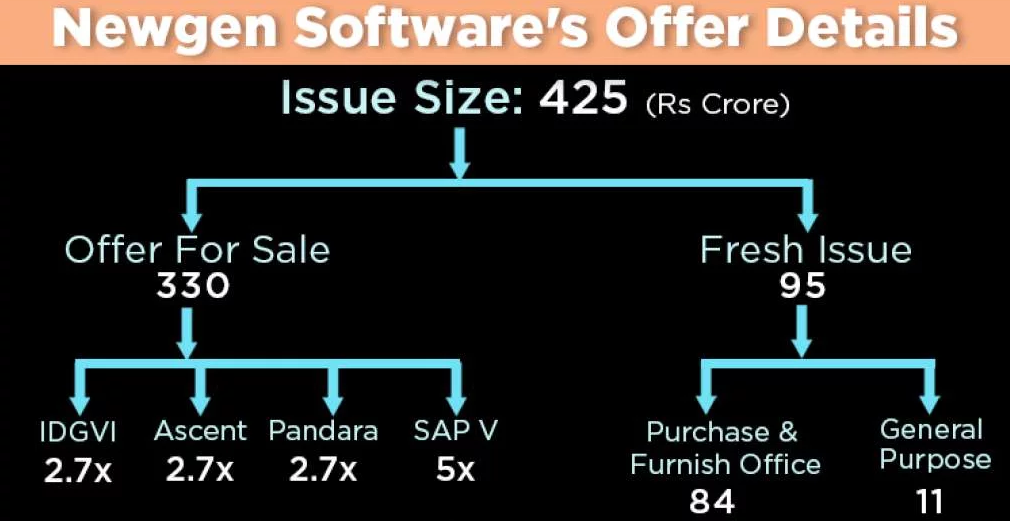

The Offer comprises a Fresh Issue by the Company and an Offer for Sale by the Selling Shareholders.

- Offer for Sale

The Offer includes an Offer for Sale of 13,453,932 Equity Shares by the Selling Shareholders. Company will not receive any proceeds from the Offer for Sale by the Selling Shareholders. - Fresh Issue

The objects for which the Net Proceeds of the Fresh Issue will be utilized are as:

a. Purchase and furnishing of office premises near Noida-Greater Noida Expressway, Uttar Pradesh; and

b. General corporate purposes

| Newgen Software IPO details | |

| Subscription Dates | 16 – 18 January 2018 |

| Price Band | INR240 – 245 per share |

| Fresh issue | INR95 crore |

| Offer For Sale | 13,453,932 shares (INR322.89 – 329.62 crore) |

| Total IPO size | INR417.89 – 424.62 crore |

| Minimum bid (lot size) | 61 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Listing performance of Newgen Software IPO

IPO Opening Date: 16 January 2018

IPO Closing Date: 18 January 2018

Finalisation of Basis of Allotment: 23 January 2018

Initiation of refunds: 24 January 2018

Transfer of shares to demat accounts: 25 January 2018

Listing Date: 29 January 2018

Please contact us today for application at 033 40266300