Nifty (CMP: 10930)

Last week continued to witness extreme volatility where Nifty convincingly breached 11000 marks on Friday, but salvaged some of its lost ground towards closing and managed to close above 10900! An important observation lies in the fact that the index is now trading below 50 day average & odds of retest of 200 day average at 10750 zone looks imminent. The outlook for next week therefore remains negative as long as it stays below 11350 regions as the previous support is expected to serve as resistance.

(Sell) Ashok Leyland (CMP: 119.10)

Ashok Leyland has recently seen some serious sell off & it has damaged the intermediate uptrend. Last week saw some significant volatility in this scrip but it recovered smartly towards closing. Short term resistance exists at 123 & 128 regions and any pullback might be a good opportunity to go short in this Banking stock.

Infy (CMP: 730)

Although there is an minor consolidation phase in this stock, yet this IT major is showing promise in terms of resumption of the longer term uptrend. One may therefore initiate a long position in Tech Mahindra on pull back to 720 with stop loss at 703 & target 760.

Dabur (CMP: 426)

We identified this stock several times in the past in this column for its primary uptrend & it is currently pulling back. However, given the oversold nature at present, we recommend taking a long position in this major FMCG stock. One may therefore buy it at on pull back to 420 zones with stop loss at 405 on closing basis & target 443.

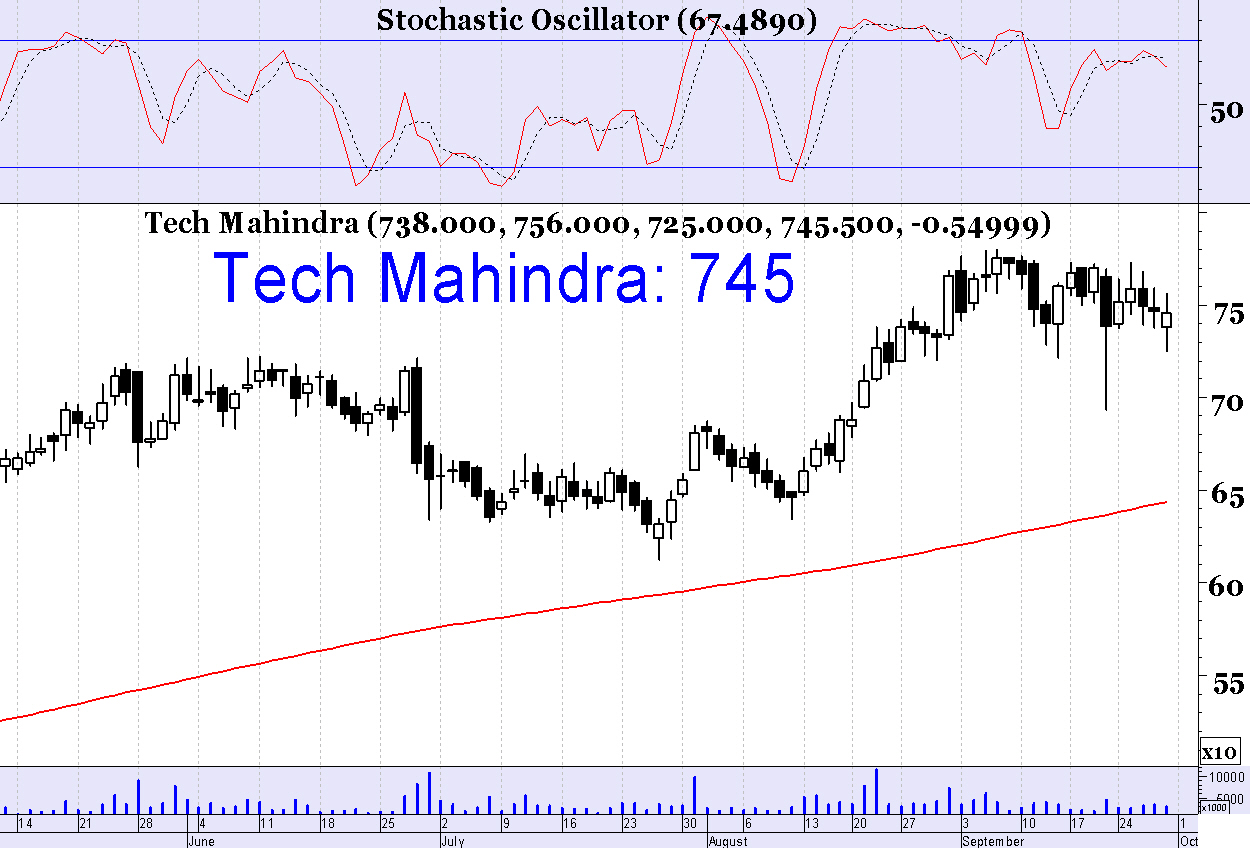

Tech Mah (CMP: 745)

Thanks to weakening Rupee, large-cap IT sector is still looking resilient as compared to the broader market & Tech Mahindra is one of the most outperforming scrip in this sector, which is still doing good. We recommend buying at CMP with stoploss at 720 on closing basis & target 780.