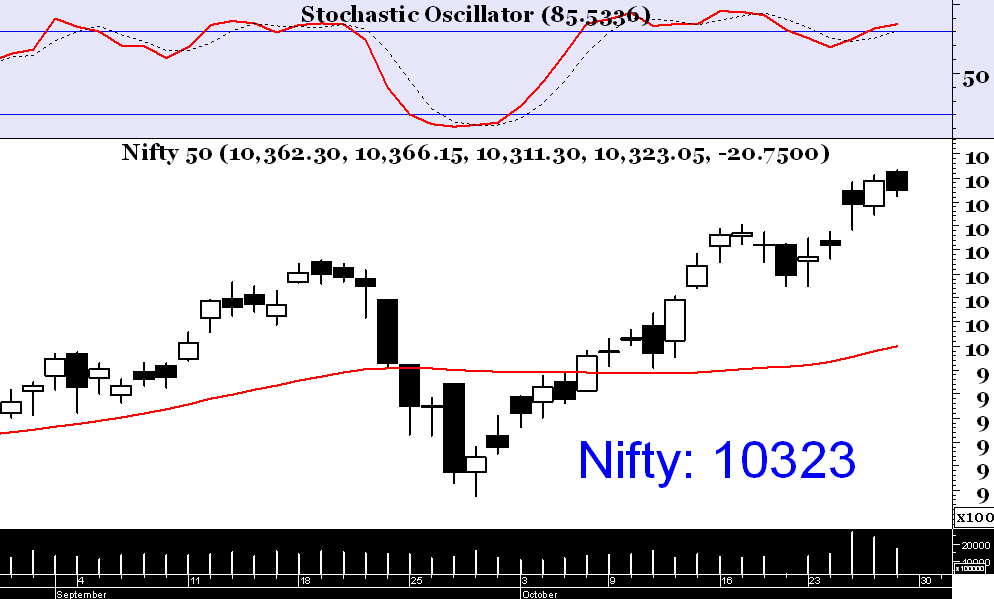

This week, the broader index surged to another life high on closing basis. The market at present is being driven by strong liquidity inflow & breadth is absolutely positive. The series of higher bottoms are visible on both weekly & daily timeframes & 19th Oct bottom at 10146 becomes important. As long as Nifty maintains above this mark, the short term uptrend remains intact.

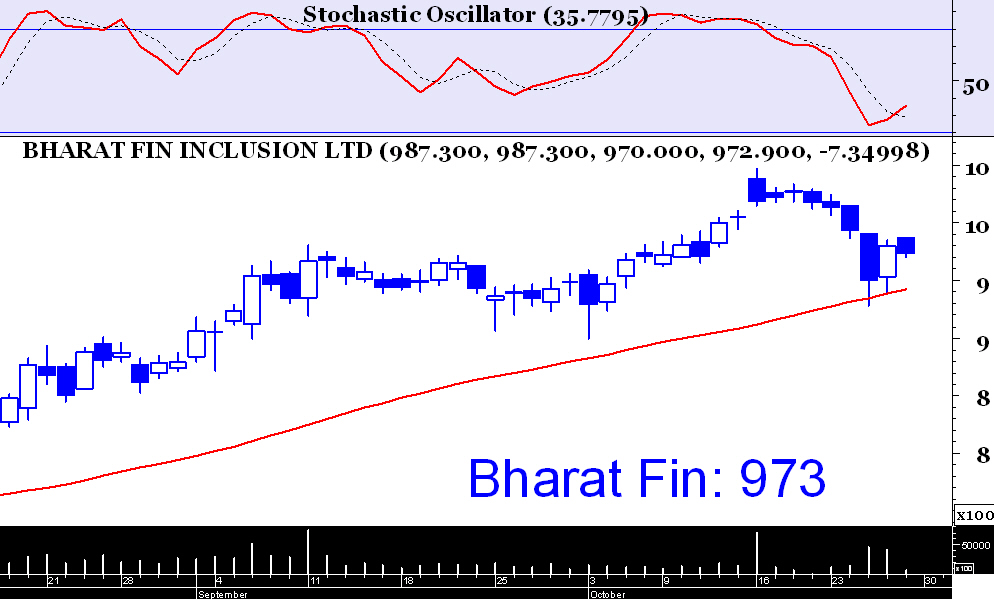

Stocks belonging to NBFC sector are extremely bullish & Bharat Finance is one of the leaders in this sector. The stock is showing strong bullish momentum within a primary uptrend & warrants a buy at CMP with stop loss at 950 on closing basis & target 1040.

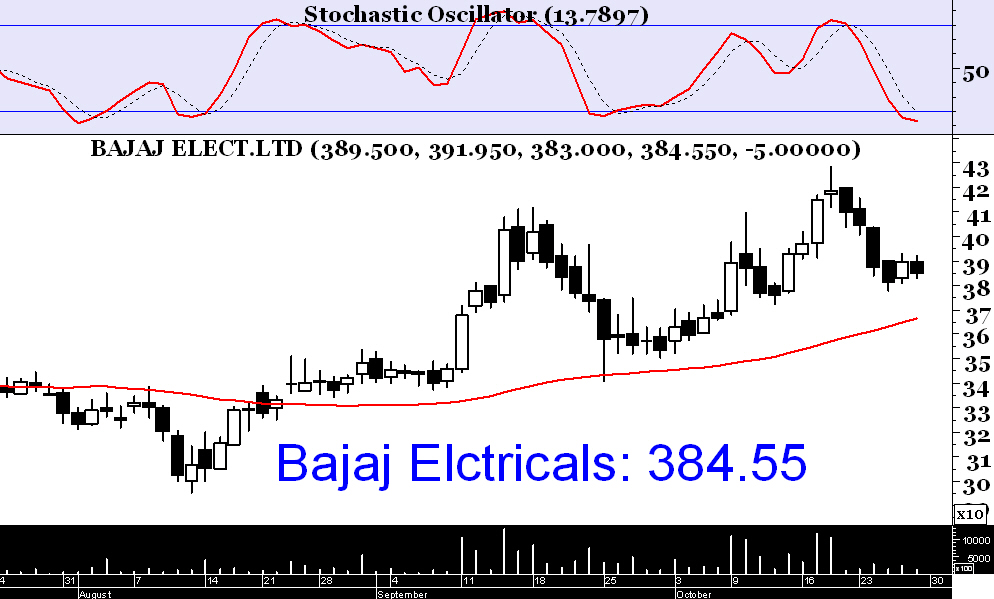

This consumer durable stock faced some resistance last week and retraced back, although the primary & intermediate uptrends are very much alive. One can buy this stock above 392 with stop loss at 381 & target 410.

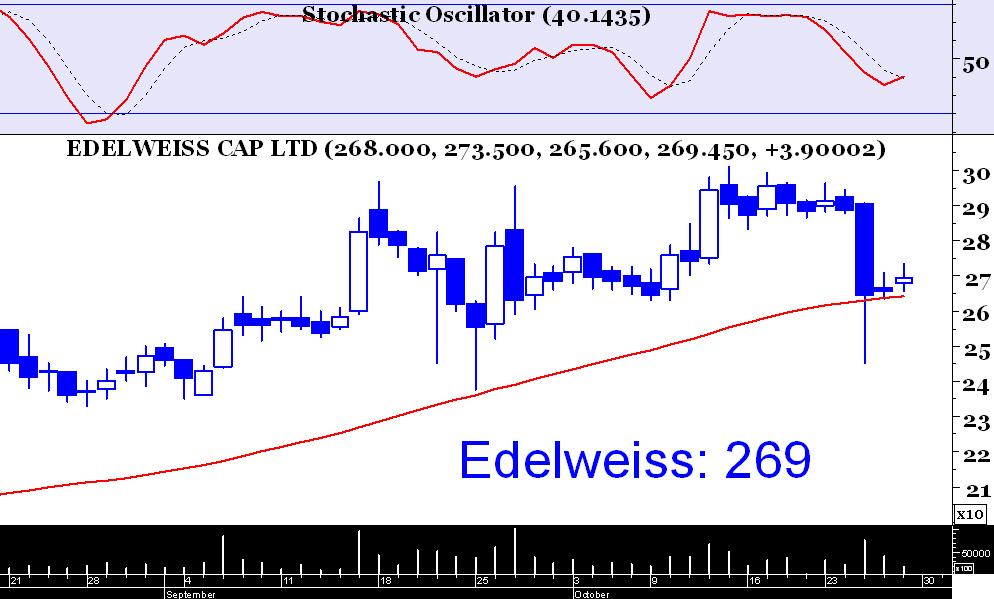

It is another primary uptrending stock currently subjected to a pull back & deserves a long position. Buy above 274 with stop loss at 263 & target 290.

After a significant sell-off, Havells right now is negotiating a multi-month support area at 480 regions & since the primary uptrend is still valid, we can take a buy position in this stock here. One could buy Havells at 489 with stop loss at 479 & target 514.