The index is continuing its dream run & closed higher for 8th week in a row. However, the market breadth has turned extremely bearish & the index is quite evidently being pushed by a handful of big names like Infy, ICICI Bank, VEDL or Tata Steel etc. As a result, even an overbought Nifty is not pulling back & we have to trade from the long side yet again. For the coming week, we see a support in the range of 10975-10995 region and one can buy Nifty on retracement with these levels as stop loss.

The entire IT index is on a raging bull phase & contributing lion’s share to the current bullishness of the market. Infy is outperforming in this sector. One could buy this stock on little decline to 1165 regions with stop loss at 1131 for a target 1210.

Among the midcap IT stocks, we prefer Hexaware for its long term primary uptrend which is very steady & reliable. This week, it has shown a good break out to a new life high followed by a normal correction. We recommend to buy Hexaware on little pull back to 370 regions with stop loss at 342 & target 410.

This FMCG giant has spent nearly 6 months in a hibernation phase & now it is waking up. A cognitive bottom is formed at 250 regions and the primary uptrend is likely to have resumed. We therefore recommend buying ITC on pull back to 273 regions with a longer term stop loss at 250 & potential target till 320.

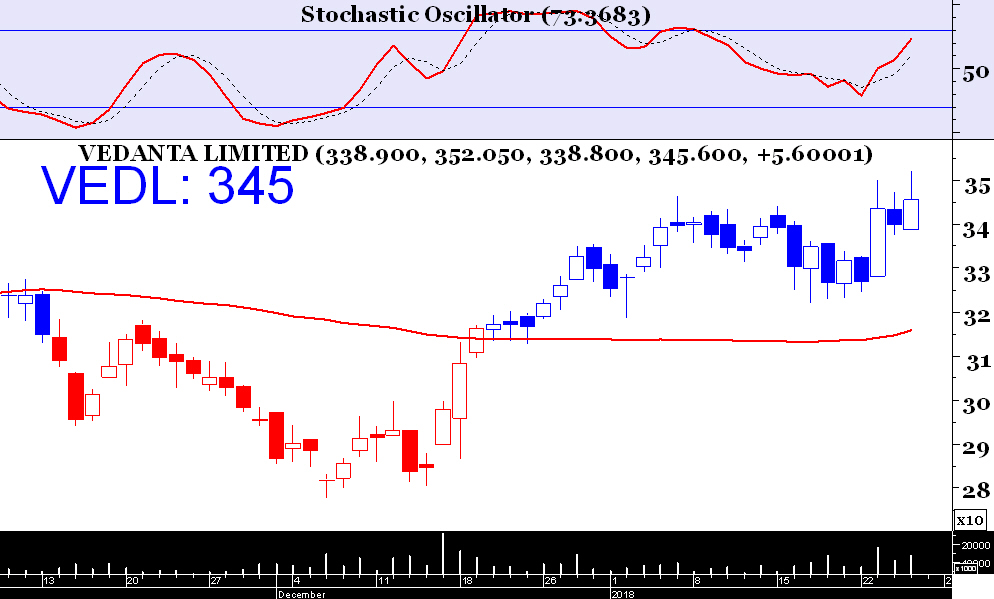

Metals are among the few outperformers in the present market & Vedanta is the front runner in this sector. Buy VEDL on decline to 340 with stop 324 & target 365.