Market last week retraced 121 points or 1.19% on weekly basis & formed what is known as a Bearish Engulfing candlestick pattern on weekly chart. The intermediate uptrend faced some serious resistance this week. We expect the short term weakness to continue for some more time although the primary uptrend is not threatened as yet. 10050-10080 is an important supply region in short term.

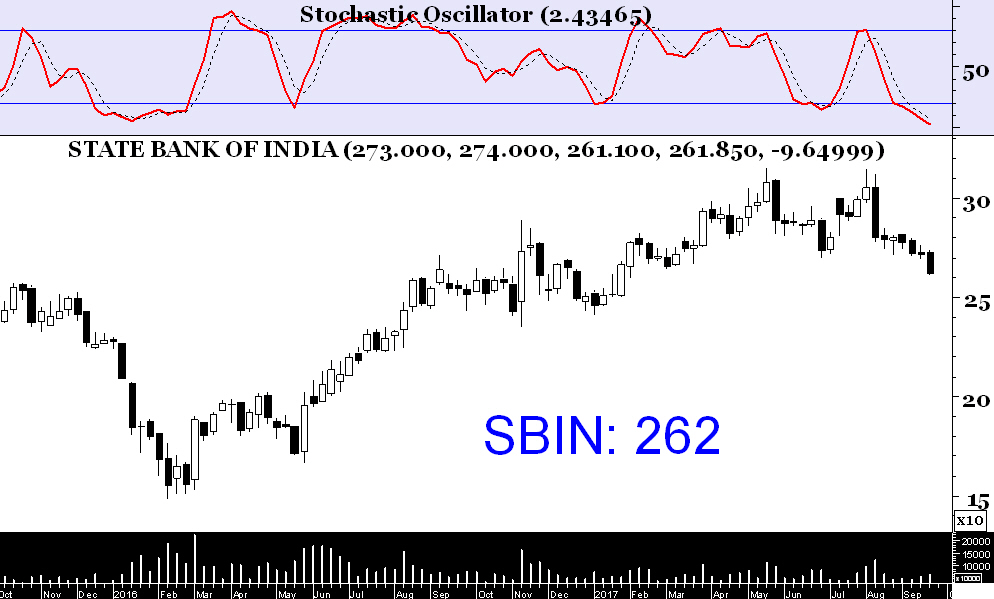

This bluechip banking stock has slipped into a primary downtrend & it has been underperforming the broader market since August. On Friday it closed at a new 6-month low & looking poised for continued weakness. Sell on rise to 270 regions, stop 276, and target 257.

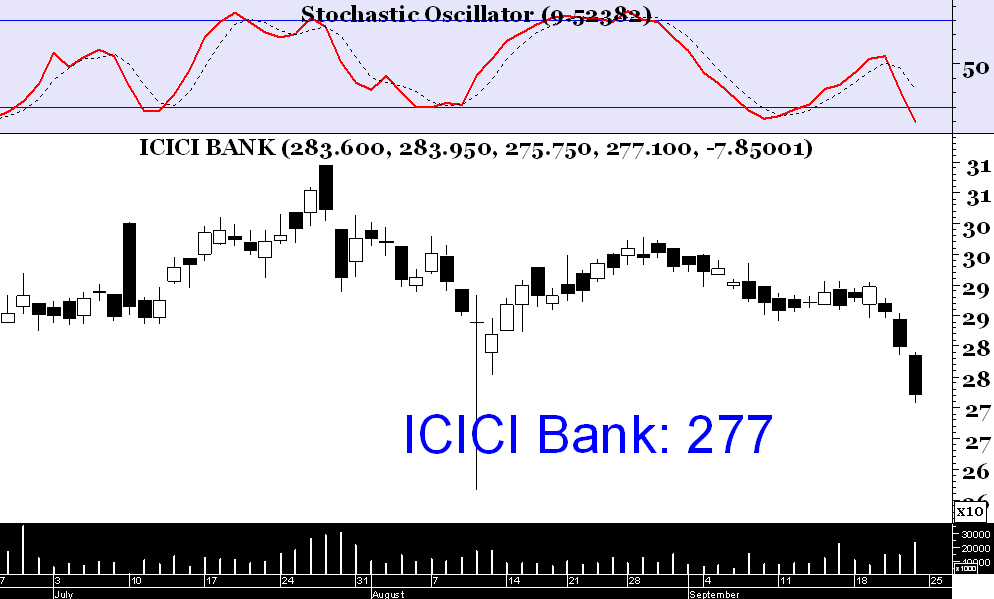

It is another underperformer in banking sector & more specifically in private banking sector. On Friday, it closed at a multi-month low & appears to continue its journey southward. Sell on rise to 280 with stop 290 & target 260.

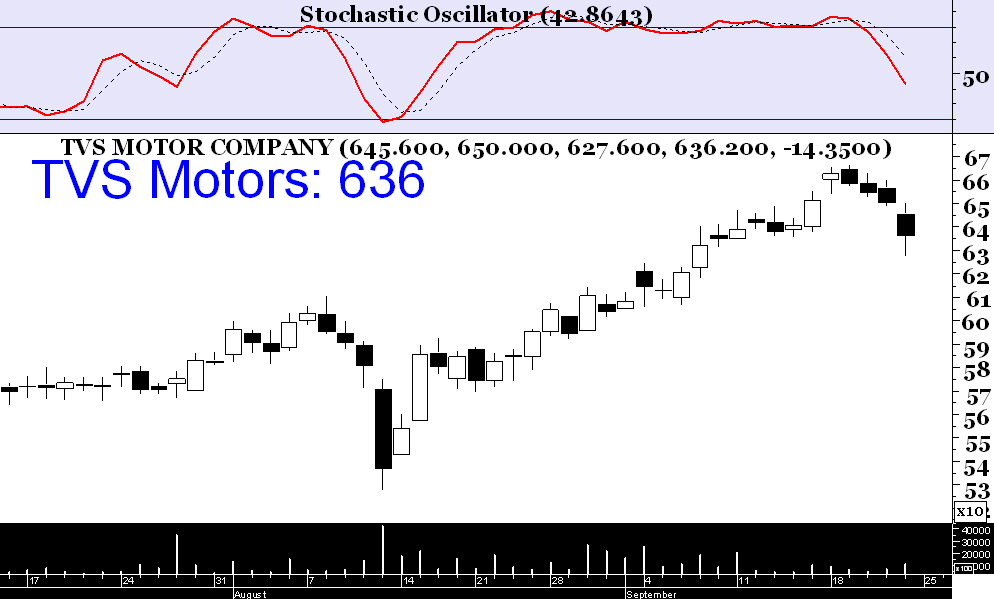

Like all other stocks, TVS Motors too, has slipped into a short term corrective phase but neither the intermediate, nor the primary uptrend has been reversed as yet & consequently we view the present weakness as a buying opportunity. Buy above 650, stop 627, target 684.

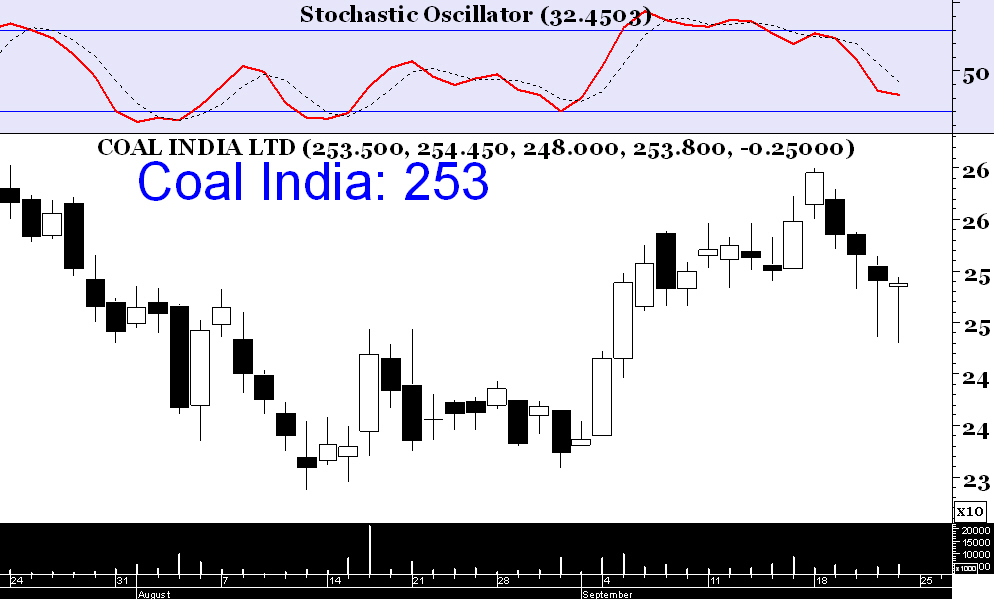

Coal India has shown some sort of resilience in the face of broad based sell off & looking poised for some relief rally this week. Buy above 255, with stop loss at 248 & target 265.