Market broke away from its important resistance zone of 10120 earlier this week but in quite of an anticlimax, Nifty unexpectedly dropped 64 points on the specially convened Samvat trading session on Thursday evening to finally settle at 10146. However, this weakness, by no means reverses the intermediate & longer term trend of the broader index, which continues to remain up. Nifty is comfortably above its major moving averages and intermittent pullbacks continue to remain buying opportunities. We note 10120, 9984 & 9890 as important intermediate support in near future.

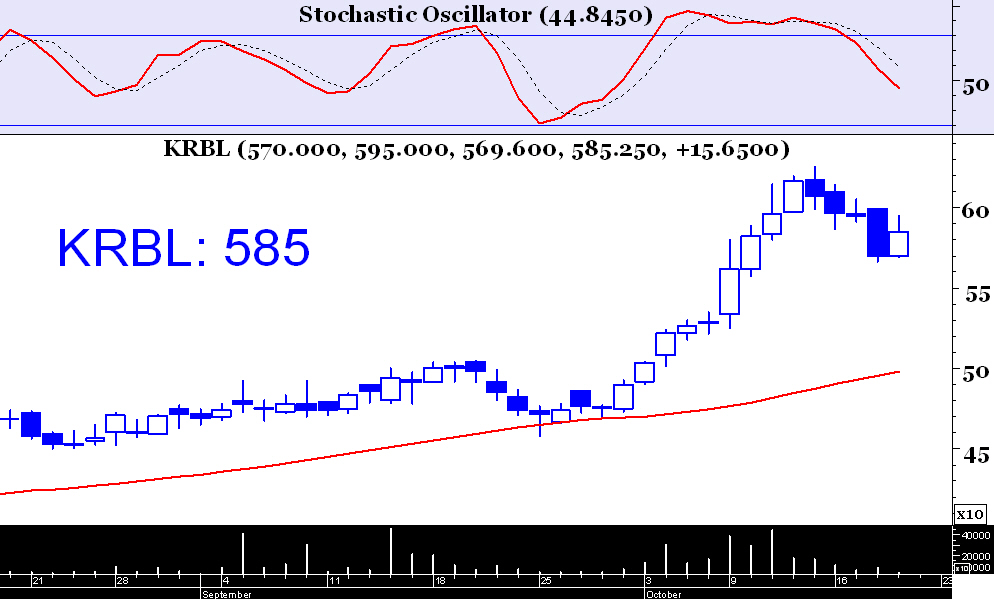

This rice producing company is witnessing a secular growth evident from its primary uptrend as seen in the adjoined diagram. One might buy on pull back to 570 regions with stop loss at 530 & target 625.

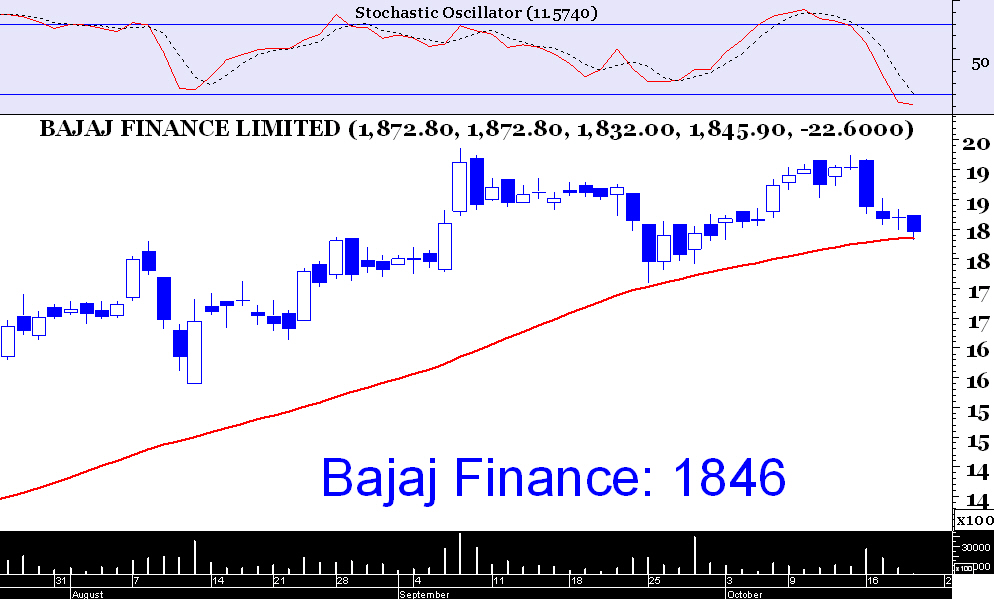

This NBFC stock is one of our all time favourites and we had also recommended it earlier in this series. Well, the stock seems to have taken a knock previous week, thus presenting yet another long entry opportunity on weakness. Buy above 1874, stop 1830, target 1930.

FMCG stocks, in general are in long term bullishness & Dabur is a leader in this sector. We notice the primary uptrend & subsequent pull back in this scrip for the past several trading sessions. One may buy Dabur above 321 with stop loss at 315 & target 329.

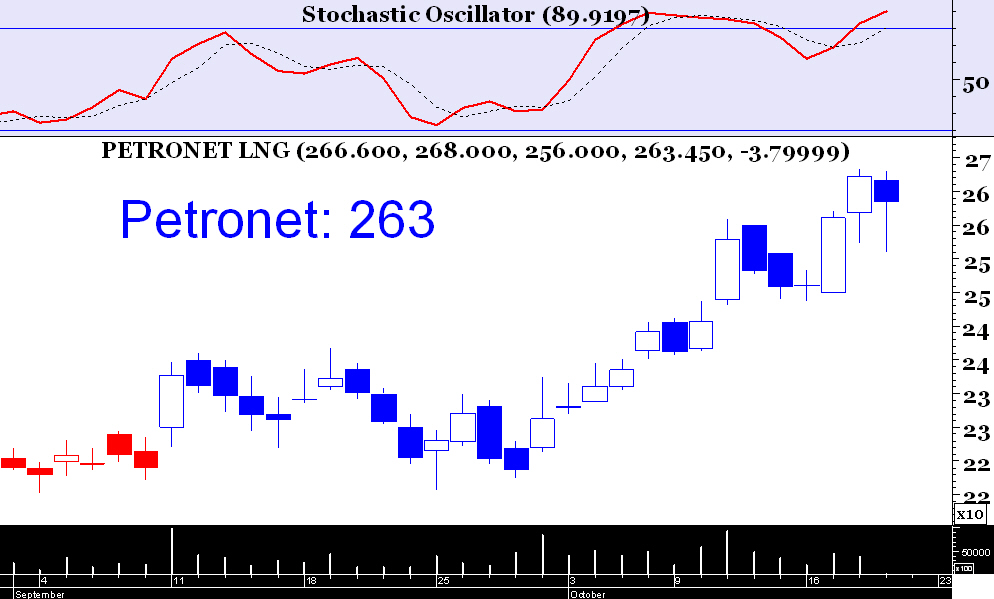

This energy scrip is putting up a spectacular show even in the face of general market weakness & hence deserves to be traded from the long side. Buy on decline to 260 regions with stop loss at 248 & target 275.