Nifty (CMP: 10737)

Last week continued to witness extreme volatility where Nifty kept on moving on both sides of 200 DMA & ended the week on a feeble note. This confirms short term trendlessness & we should now approach the market as one to buy on new breakout only. The outlook for next week therefore remains cautiously positive as long as it stays above 10550 regions.

(Sell) Maruti (CMP: 7408)

Maruti has recently seen some serious sell off followed by pull-back. Last week saw its foray above 100 DMA where it failed to put up any further strength. Short term resistance exists at 7550 & 7700 regions and this might be a good opportunity to go short in this auto stock.

ICICI Bank (CMP: 373)

Although there is a minor pullback in ICICI Bank, yet this Banking major is continuing showing promise in terms of resumption of the longer term uptrend. ICICI Bank is in fact outperforming all other stocks within Nifty in intermediate term. One may therefore initiate a long position in ICICI Bank on pull back to 368 regions with stop loss at 358 & target 384.

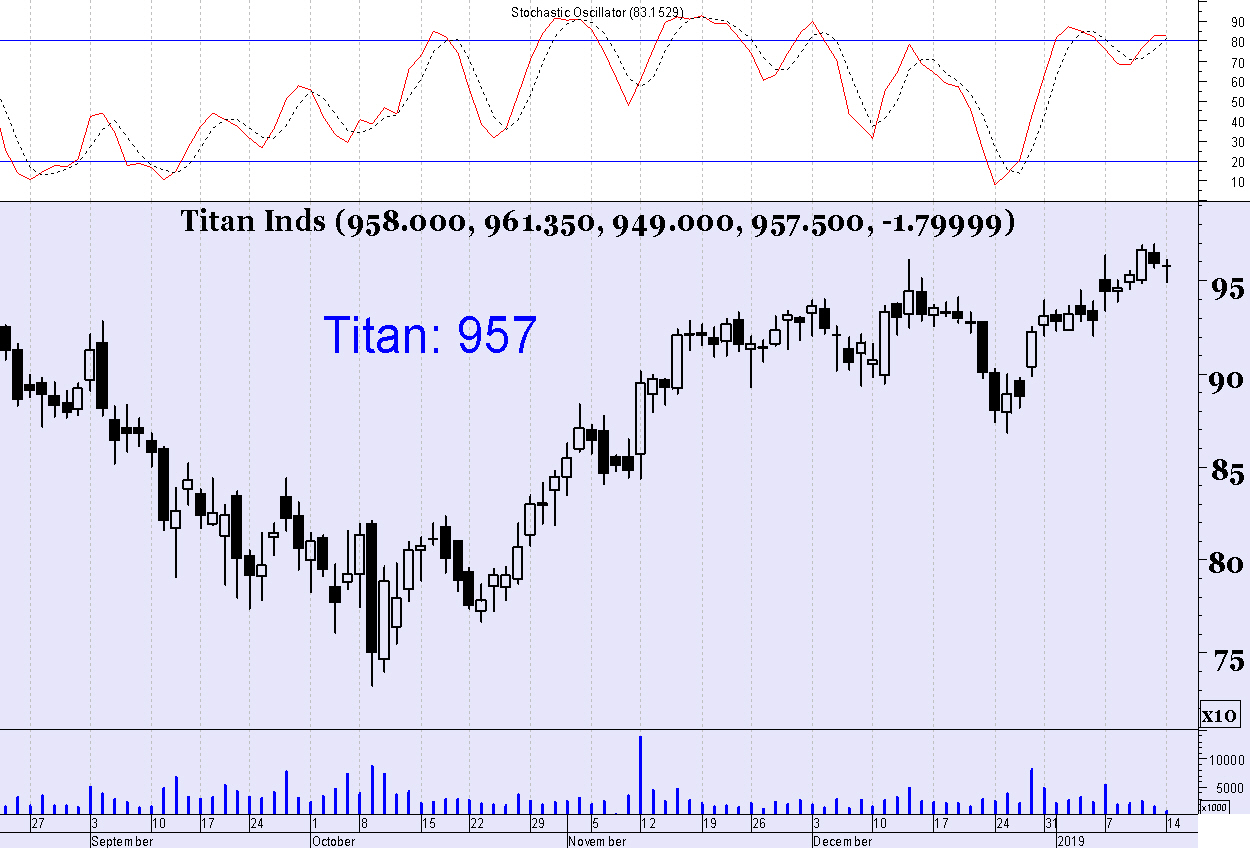

Titan (CMP: 957.50)

With a primary upward trend and reduced volatility Titan presents a good buying opportunity in near future. Titan is however trading near to The stock closed at 957 & one may buy it on pullback to 945 regions with stop at 920 & target 990.

SBI Life (CMP: 620)

Barring a few pullbacks, mid-cap insurance sector stock is still looking resilient as compared to the broader market & SBI Life is looking resilient in spite of its recent weakness and is one of the outperforming scrip in this sector. We recommend buying at CMP with stop loss at 600 on closing basis & target 650.