Within a general intermediate downtrend, Nifty pulled back on Monday. However, the market breadth remained poor & resistance looms at 10460 till 10480 regions. Primary uptrend will be resumed only above 10700.

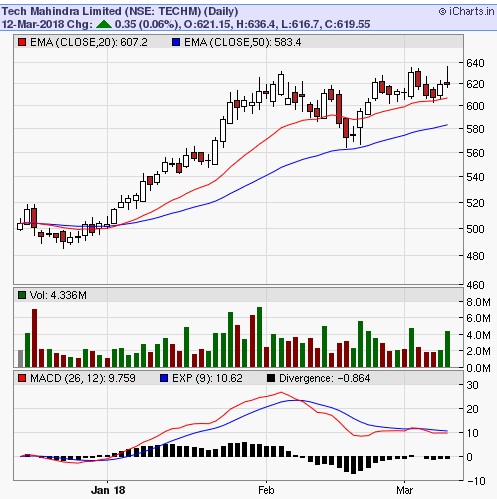

In a generally declining market, IT stocks are holding well & Tech Mahindra is one of the outperformers in this sector. Buy at CMP with stop loss 600. A closing above 640 will be very bullish for Tech Mahindra.

This is another IT stock on the verge of new breakout. Buy NIIT Tech above 915 with stop loss at 890 & target 950.

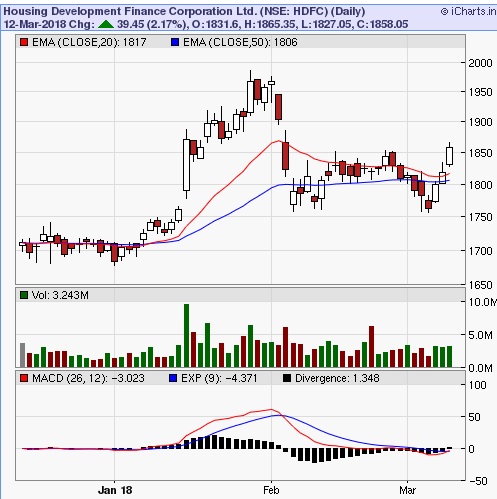

HDFC has given a significant breakout above a one-month consolidation zone & warrants to be traded from the long side. One could therefore buy HDFC at CMP and add more at 1800 regions with stop loss at 1750 7 target 1950.

After putting up a strong performance on 3rd week of February, V2Retail went into a phase of consolidation, but on Monday, it yet again showed signs of vigor. One may therefore buy this stock at CMP with stop loss at 400 & target 450.