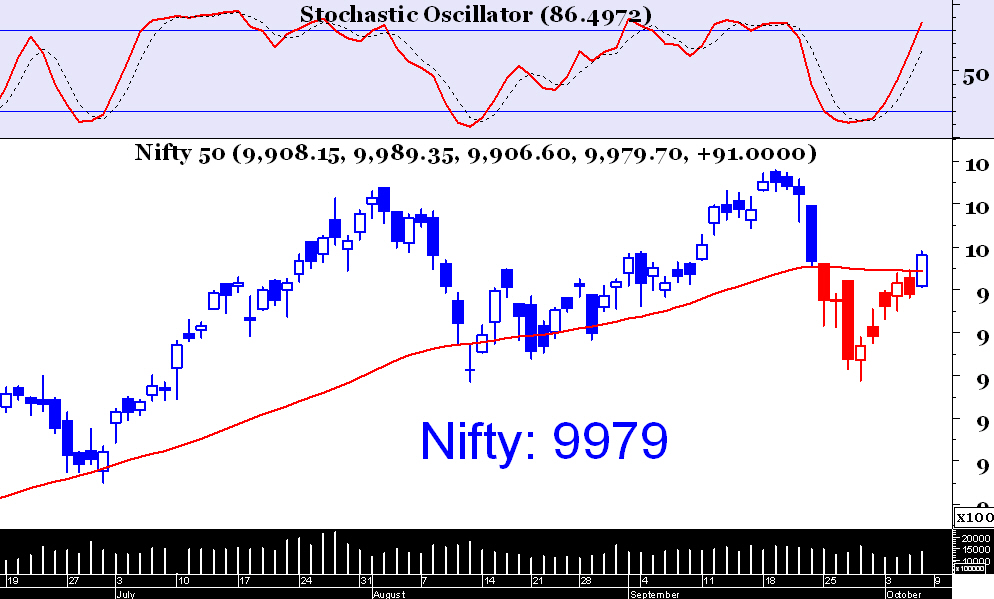

The market staged a spectacular recovery this week but is not out of the woods just as yet. Yes, it closed above previous week’s high of 9960 regions, in fact Nifty future closed past 10000 mark, but the 61.8% Fibonacci retracement levels (of the fall from 10180 to 9687) at 9995 regions is an important resistance as of now. If Nifty can convincingly close above this region sometimes early next week, the odds of resumption of the primary uptrend will increase. On the other hand, a daily close below 9880 regions will unleash further sell-off in the market.

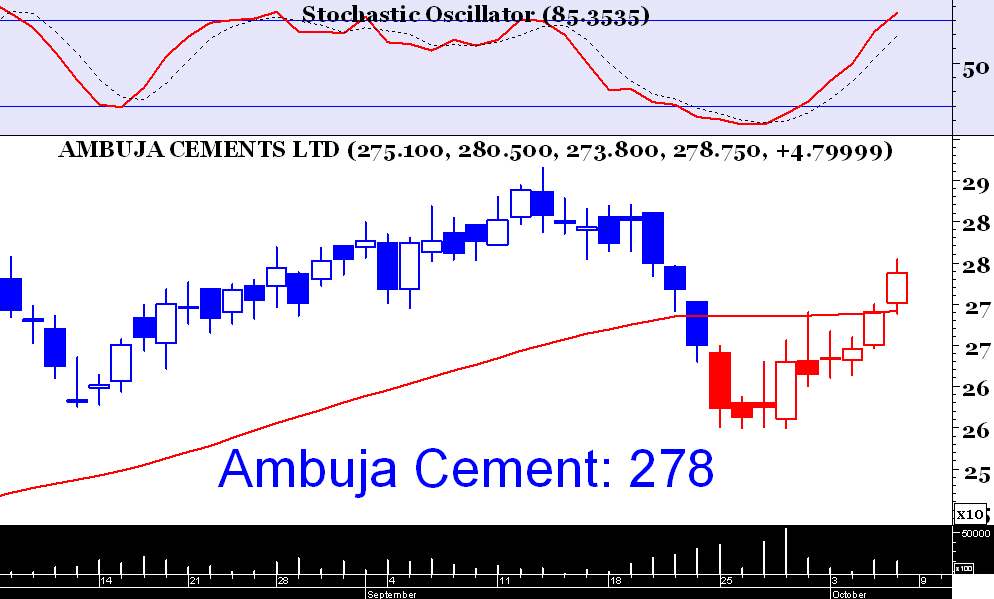

This is one of the most steadily uptrending stock of the present bull market. Ambuja cement made a double bottom at 258-261 regions & now resuming strength. Buy on little pull back to 274 regions & keep the stop loss at 265 for a target 290.

This power generation stock successfully negotiated an important resistance zone 1015 odd levels on Friday & gave a bullish closing at 1042 regions. A higher bottom has been formed at 960-970 regions to reinstate the primary uptrend of the stock. Buy on decline to 1020 regions with stop loss at 960 & target 1100.

In a week when Nifty rose nearly 2%, banking sector as a whole remained underperformer & ICICI Bank was one of the weakest in this sector (apart from SBI, too). The series of lower tops is clearly visible on the daily chart of this scrip & we recommend entering a short trade on pull back to 277 regions with stop loss at 284. The August spike low at 262 regions is a legitimate target.

The hold FMGC horse is raring to go again & its uptrend is very likely to resume sooner than later. Keep a long position in Hind Unilever with stop loss at 1169 regions & target 1300.