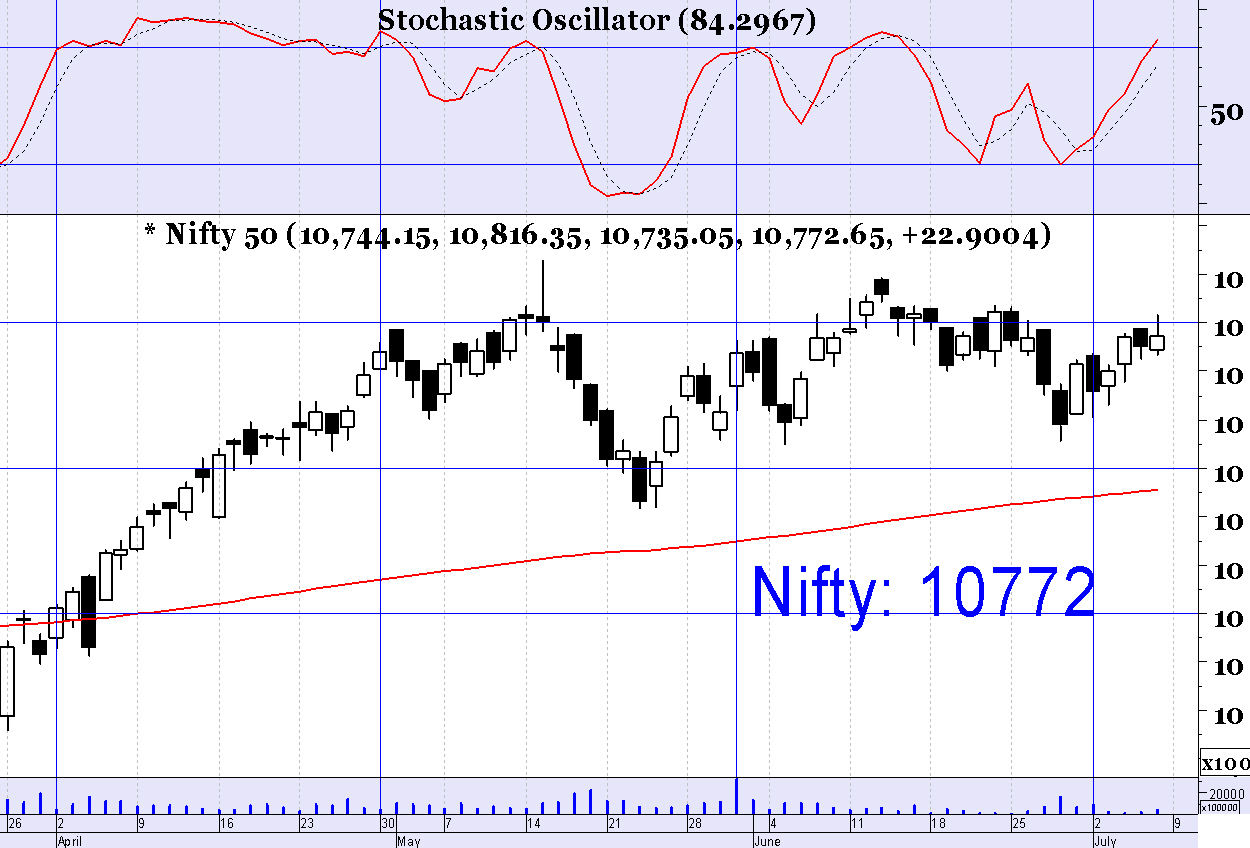

Nifty (CMP: 10772)

Last week saw a quiet choppiness in Nifty where it stayed within previous week’s range but it closed significantly away from its low. However, in spite of these, Nifty is still trading above major moving averages like 50, 100 & 200 day denominations & it puts the odd in favor of the bulls. This view will gain further confirmation if 10840 is conquered by the index sometimes next week.

GlaxoSmithkline Pharma (CMP: 2865)

In general, the pharma stocks have been weak for many years, but recently, it has come out off its 200 day average & have been creating higher bottom formation since early April. In fact, it since been an outperformer in this sector. We believe it is likely to continue iys outperformance in near future & hence one may keep a long position in Glaxo at CMP with stop loss at 2800 & target 3000.

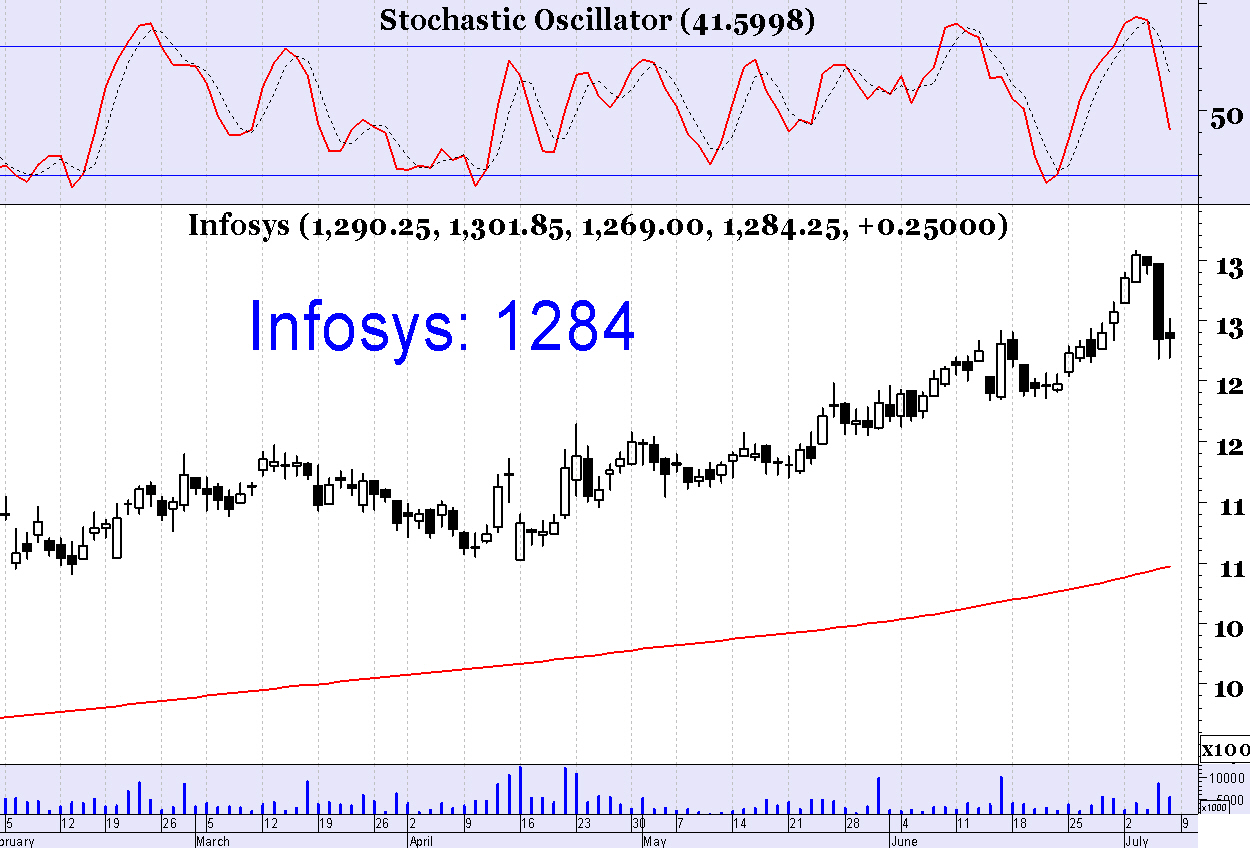

Infosys (CMP: 1284)

Although there is a recent weakness, yet this major IT stock is a relative outperformer in the longer term & the primary uptrend is significantly strong. Keep short term stoploss at 1255 & buy Infosys at CMP 1284 regions for target 1330.

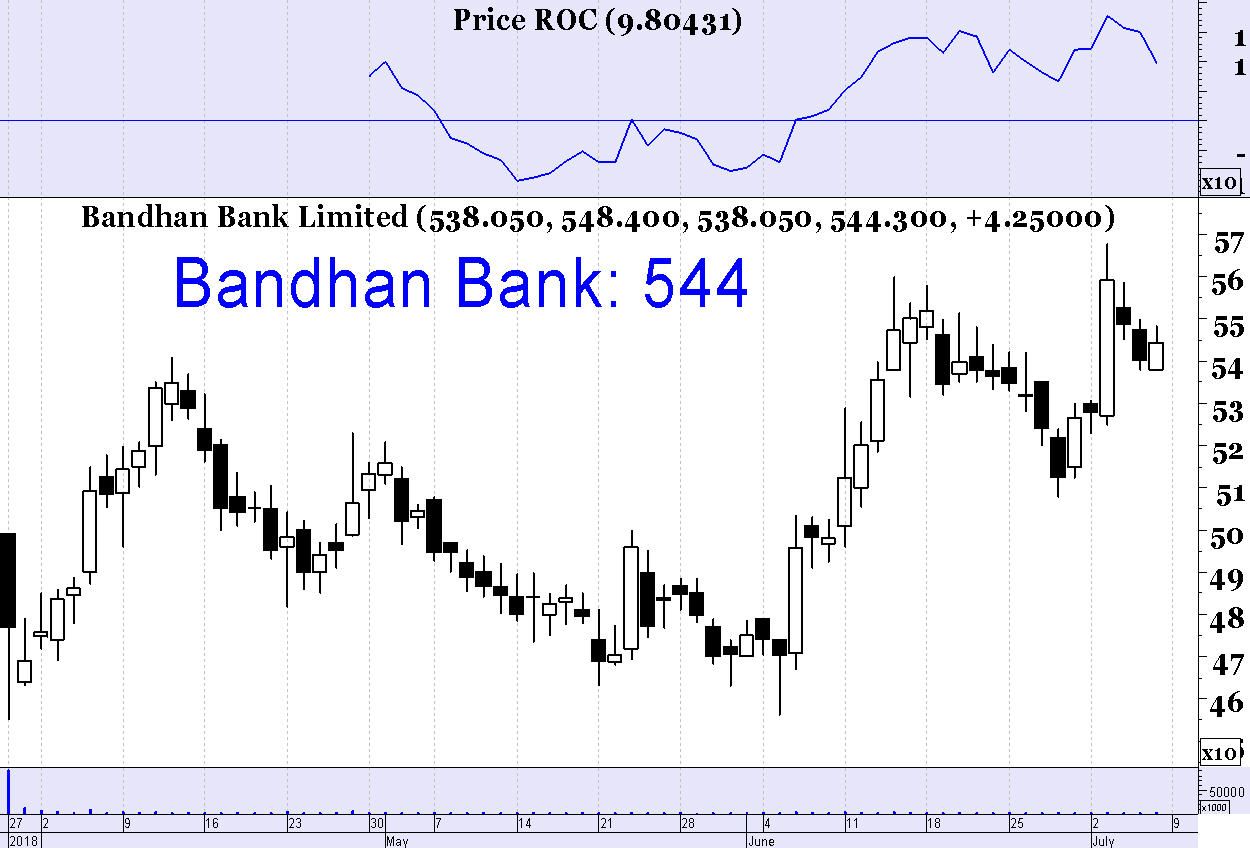

Bandhan Bank (CMP: 544)

We note this stock for its intermediate uptrend. Past few weeks saw a routine pull back which was in fact a buying opportunity. Buy on pullback to 540 levels with stop loss at 520 (on closing basis) & target 576.

Bajaj Finance (CMP: 2345)

Large-cap NBFC sector is seeing a strong demand & Bajaj Finance is continuing in its primary uptrend. We recommend buying at CMP with stop loss at 2270 (on closing basis) & target 2423.