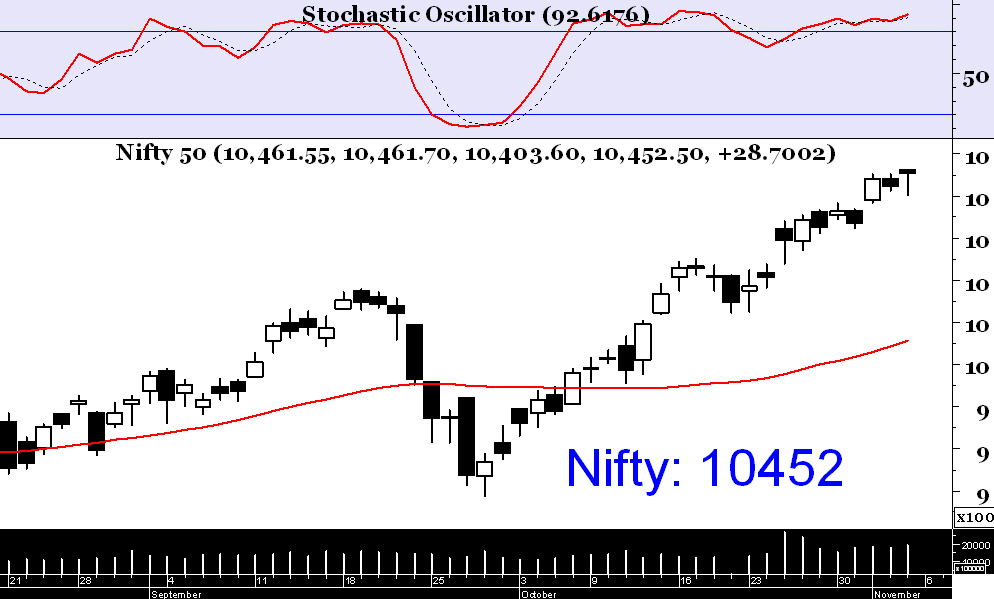

Its yet another life-high closing for Nifty last week. The liquidity driven rally is continuing unabated & the market breadth continues to remain very healthy. Trends in all timeframes are upward & immediate support on daily chart is seen only at 10335 levels. The short term uptrend shall reverse only upon violation of 10146.

This auto major have been one of the star performers of the present bull run, rising more than 50% in the past 6 month alone. However, we find the current status of this stock slightly weak which presents a beautiful buying opportunity. One could enter long in Ashok Leyland at or above 125.50 with stop loss at 123 & target 130.

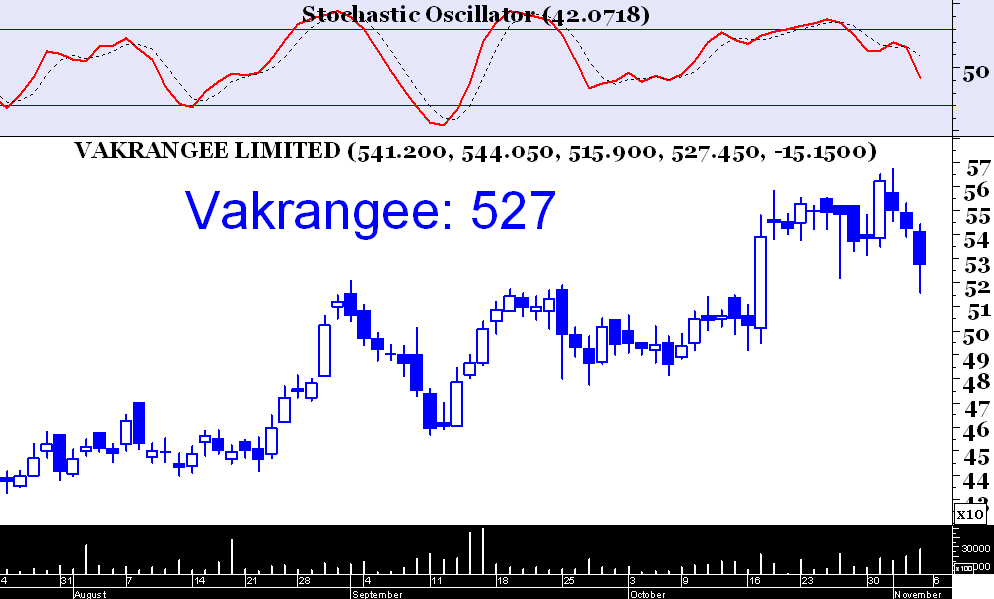

The consistent primary uptrend is intermittently paused several times in recent past presenting some good buying opportunities in Vakrangee. The current weakness also happens to be a low risk buying opportunity for this IT scrip. Buy above 544, stop 525, target 574.

The metal sector is currently going through a major bull phase & Tata Steel happens to be one of the leaders in this sector. One could enter long into this stock above 717 with stop loss at 696 & target 742.

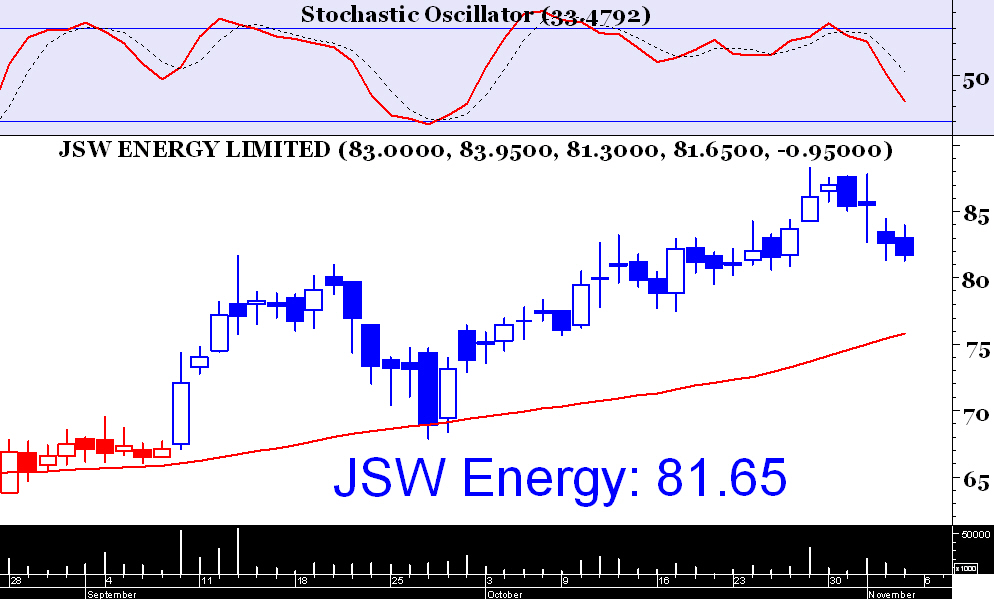

JSW Energy is on the verge of a major breakout on long term monthly chart while the weekly & daily charts also show significant demand. Buy JSW Energy above 84.50 with stop loss at 81 & target 89.