The broader index saw a miniscule loss of 32 points on weekly basis in a truncated trading week of 4 sessions. Quite visibly, Nifty is trapped within a choppy range between 10640 & 10270 for past several weeks and a decisive breakout in either direction will spell the fate of the next intermediate trend. Primary uptrend survives above the watermark of 10250.

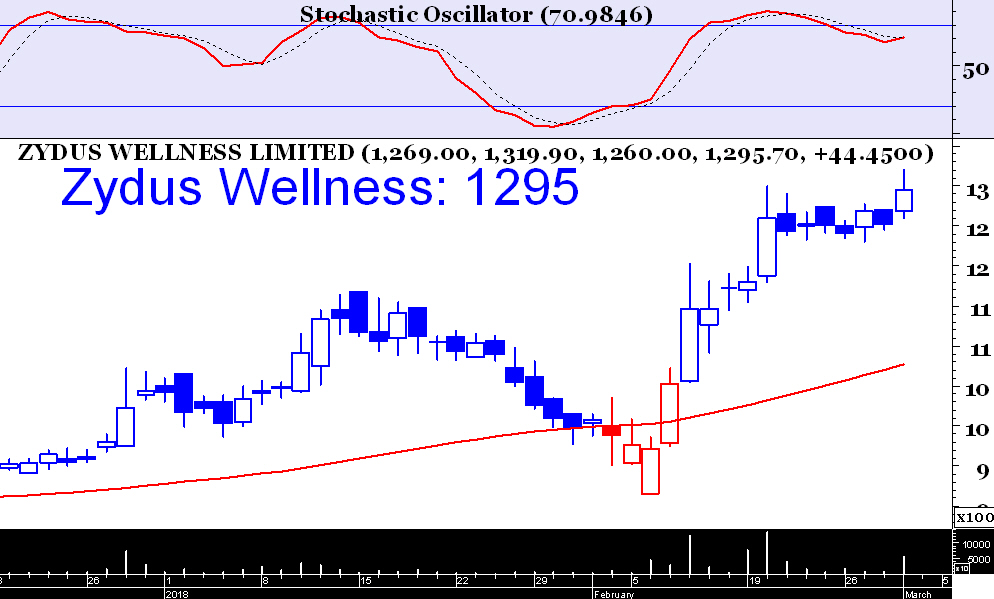

The stock is in primary uptrend & closed at new life high on Thursday. One could therefore take a buy call at CMP with stop loss at 1240 & target 1367.

This Auto component manufacturing scrip is showing a sustainable primary uptrend and warrants buying at CMP with stop loss at 883 regions on closing basis & target 1040.

This Electrical Infrastructure Company is undergoing a healthy transformation which is being shown in its primary uptrend, Buy at CMP with stop loss at 1680 & target 1770.

As the Banking index remains biggest underperformer in recent weeks, we identify State Bank which is a major contributor to Bank Nifty, as a potential shorting candidate. Sell below 261, stop loss 270, target 245 (all prices pertain to cash market).