Nifty (CMP: 10244)

As on Tuesday evening, Indian Equity Market put up a strong resilience & closed some 32 points higher at 10244 regions in spite of the global rout where Dow plummeted a massive 500 points previous night & in fact closed below its 200 DMA for the first time since February of 2016. This does dot augment well for sure for the longer term trend in equities. Even after today’s relative strength in Nifty, we reiterate our grossly bearish opinion about the intermediate term outlook of the market. 10250 looms as an important resistance for Nifty, followed by 10400 regions. The primary downtrend is likely to reverse only upon closing above 10550.

Mindtree (CMP: 800)

The software & IT industry is relatively immune to the current weakness of the broader market & Mindtree ir a relative outperformer in this sector. We recommend buying this stock at CMP 800 regions with stop loss at 765 & target 850.

(Sell) SBIN (CMP: 250.50)

The PSU Banks have lately been grossly underperforming for various regulatory issues & prices of their stocks are also witnessing a steady deterioration. We pick SBI from this sector as a probable shorting candidate at CMP 251 regions with stop loss at 257 & targeting for 245 odd levels.

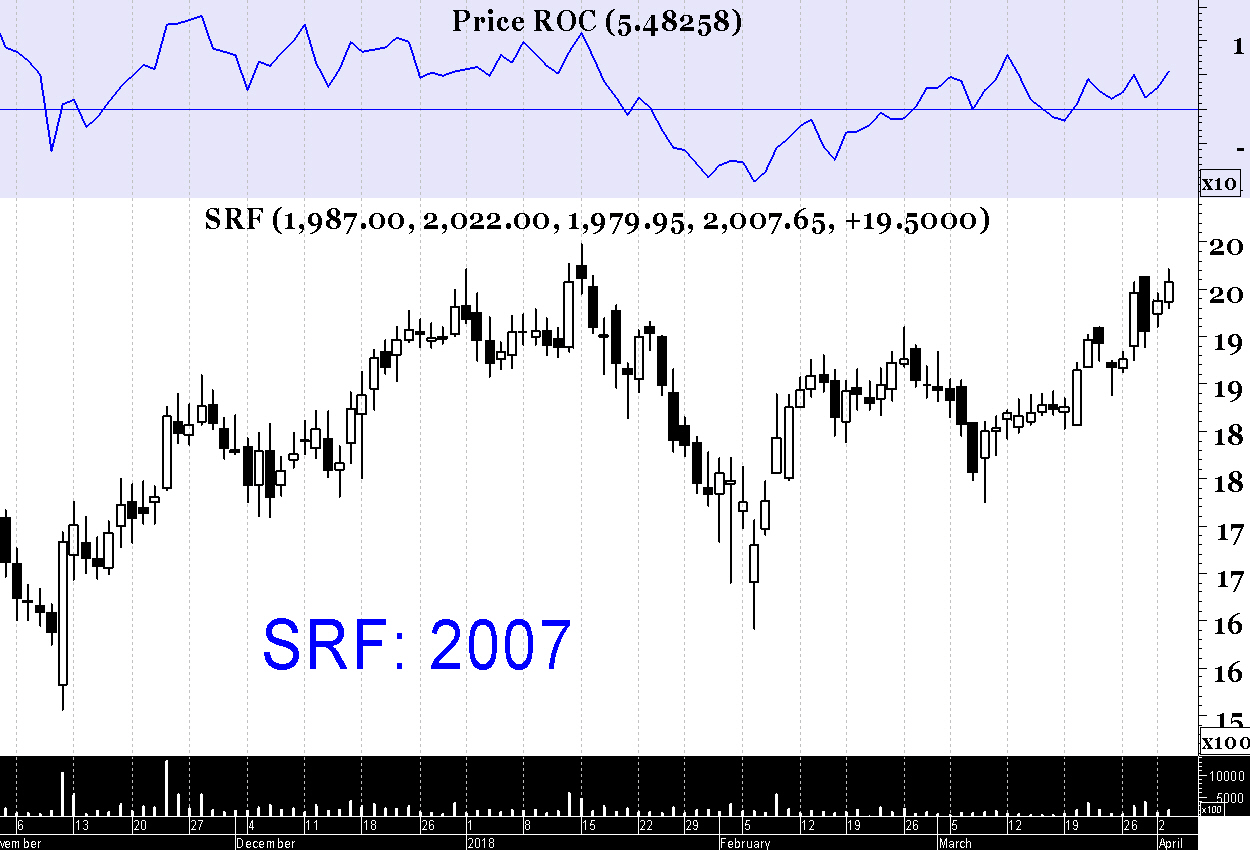

SRF (CMP: 2007)

This Chemical, packaging & plastics stock have been in a steady uptrend & on Tuesday it closed within a striking distance of its lifetime high. Chances are high that sooner than later, this stock will sojourn to new territory keeping the uptrend alive. One may therefore buy SRF at CMP 2007 regions with stop loss at 1950 & target 2100.

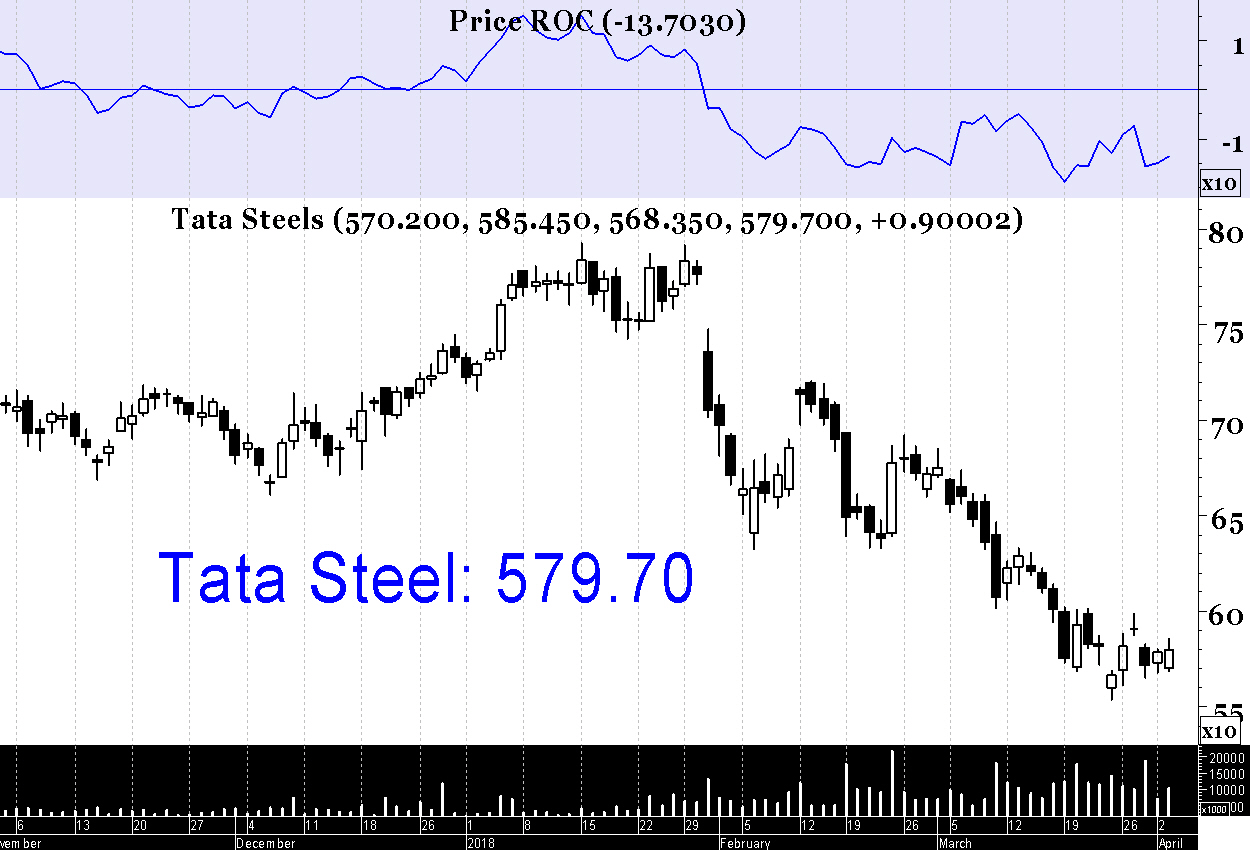

(Sell) Tata Steel (CMP: 580)

The intermediate downtrend is pretty strong in most metal stocks & Tata Steel presents itself as a good shorting candidate at CMP 580 with stop loss at 594 & target 560.