Business description from prospectus – Reliance Nippon Life Asset Management (RNAM) is one of the largest asset management companies in India, managing total AUM of INR3,625.50 billion as of June 30, 2017. The company is involved in managing (i) mutual funds (including ETFs); (ii) managed accounts, including portfolio management services, alternative investment funds (AIFs) and pension funds; and (iii) offshore funds and advisory mandates. It is ranked the third largest asset management company, in terms of mutual fund quarterly average AUM (QAAUM) with a market share of 11.4%, as of June 30, 2017, according to ICRA. For the financial year 2016, it was ranked the second most profitable asset management company in India, according to ICRA.

The company started its mutual fund operations in 1995 as the asset manager for Reliance Mutual Fund and manages 55 open-ended mutual fund schemes including 16 ETFs and 174 closed ended schemes for Reliance Mutual Fund as of June 30, 2017. It has a network of 171 branches and approximately 58,000 distributors including banks, financial institutions, national distributors and independent financial advisors (IFAs), as of June 30, 2017. Reliance Nippon Life Asset Management manages offshore funds through its subsidiaries in Singapore and Mauritius and has a representative office in Dubai.

As part of its managed accounts business, the company provides portfolio management services to high net worth individuals and institutional investors including the Employees’ Provident Fund Organisation (EPFO) and Coal Mines Provident Fund Organisation (CMPFO). Its Subsidiary, Reliance AIF Management Company Limited manages two alternative investment funds, which are privately pooled investment vehicles registered with SEBI. Further, it received a certificate of commencement of business as a pension fund manager from the Pension Fund Regulatory and Development Authority (PFRDA) in 2009 and manages pension assets under the National Pension System (NPS). As of June 30, 2017, it managed total AUM of INR1,503.93 billion as part of its managed accounts business.

Reliance Nippon Life is involved in managing:

1. Mutual funds (including ETFs);

2. Managed accounts, including portfolio management services, alternative investment funds (AIFs) and pension funds; and

3. Offshore funds and advisory mandates.

Company manages 55 open-ended mutual fund schemes including 16 ETFs and 174 closed ended schemes. Company has a network of 171 branches and over 58,000 distributors including banks, financial institutions, national distributors and independent financial advisors as of June 30, 2017.

Company Strengths:

1. Third largest asset management company in India backed by strong promoters.

2. Strong presence across India

3. Well-diversified product suite across mutual funds and ETFs, managed accounts and offshore funds and advisory mandates.

Company Promoters:

The Promoters of the Company are:

1. Reliance Capital Limited; and

2. Nippon Life Insurance Company

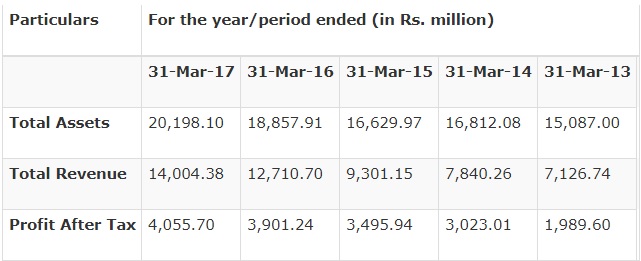

Company Financials:

Summary of financial Information (Consolidated)

Objects of the Issue:

The Offer consists of the Fresh Issue and the Offer for Sale. Company will not receive any proceeds from the Offer for Sale.

The objects for which the Company intends to use the Net Proceeds are as follows:

1. Setting up new branches and relocating certain existing branches;

2. Upgrading the IT system;

3. Advertising, marketing and brand building activities;

4. Lending to our Subsidiary (Reliance AIF) for investment as continuing interest in the new AIF schemes

managed by Reliance AIF;

5. Investing towards our continuing interest in new mutual fund schemes managed by us;

6. Funding inorganic growth and other strategic initiatives; and

7. Meeting expenses towards general corporate purposes.

Issue Detail:

»» Issue Open: Oct 25, 2017 – Oct 27, 2017

»» Issue Type: Book Built Issue IPO

»» Issue Size: 61,200,000 Equity Shares of Rs 10 aggregating up to Rs 1,542.24 Cr

› Fresh Issue of 24,480,000 Equity Shares of Rs 10 aggregating up to Rs [.] Cr

› Offer for Sale of 36,720,000 Equity Shares of Rs 10 aggregating up to Rs [.] Cr

»» Face Value: Rs 10 Per Equity Share

»» Issue Price: Rs 247 – Rs 252 Per Equity Share

»» Market Lot: 59 Shares

»» Minimum Order Quantity: 59 Shares

»» Listing At: BSE, NSE

Please contact us today for application at 033 40266300