In this brief report we are going to take a look at how Indian Equity Markets are likely to behave in short to intermediate term, in the light of recent political & military conflict of India with Pakistan.

Past sheds light on to the future. We take this opportunity to recount how markets behaved in similar conditions in the past & from those experiences we will try to draw conclusion in the present context. To do so, we will refer to two well-documented atrocities between the neighboring nations within the past two decades, firstly the Kargil conflict of 1999 & the more recent surgical strike in Uri in September of 2016.

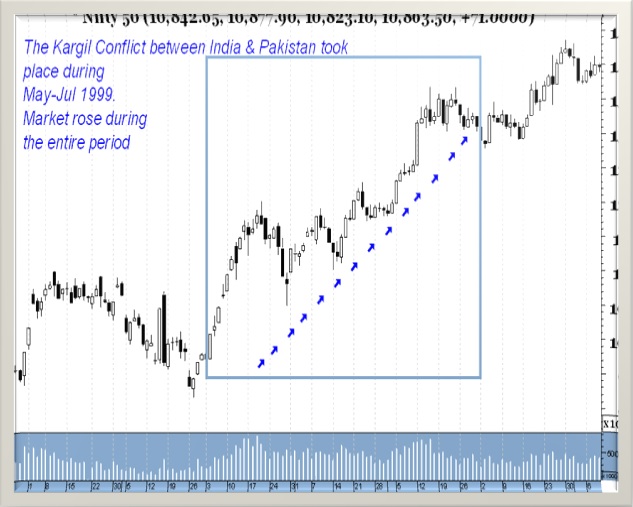

The infamous Kargil conflict between India & Pakistan took place nearly 20 years ago, in May to July of 1999. The Indian Equity Index Nifty rose nearly 190 points or 17% during this period. This was truly a rally of disbelief, as people used to wonder what was causing the market to defy gravity, especially during such tumultuous period in the northern front. Well, in retrospect, we can argue that the conflicts were more localized in nature & none of the nations were willing to enter into a full fledged war. The market anticipated this quite well & quickly discounted into the prices.

Indian Army in Uri sector, market was initially rattled to the core and a shock-wave was sent across the financial sectors, because this kind of response on part of India was unheard of in the past. The following three months saw prices to decline by nearly 10%. However, this entire fall might not be attributed to this incident alone. Because, on 9th of Nov, 2016, US presidential election result came out and that was another shocker for the financial world, only this time it shook the entire world & Indian equities responded at par with its global peers.

Nifty however, formed an important bottom in December of 2016, and that gave rise to a very strong bull market in 2017. Apart from the facts that conflicts like Kargil or Uri are more localized in nature, they also showed that there was a sense of urgency among Indian political leadership towards a more stable and decisive foreign policy, which was given a thumbs up by the market. After all, come what may, good or bad, what the market hates most is confusion.

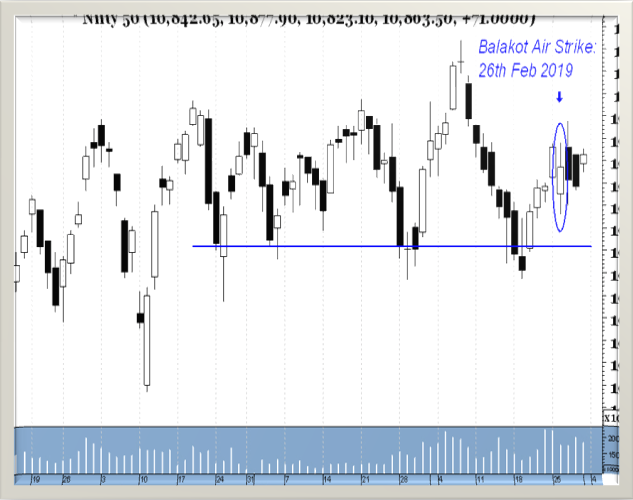

Now, let us take a quick look at the fallout of Balakot air strike carried out by the Indian Air Forces on the wee hours of 26th of Feb, 2019. Market opened 1% down on that day but recovered a lot of ground on that very trading session. In the three subsequent trading days as well, it held on to Tuesday’s low & showed resilience. There are other evidences to suggest that market has established a strong floor at around 10650 zone in Nifty (shown with a horizontal line in the above diagram) and as long as prices stay above this make-or-break level, the effects of the latest episode of skirmish between the two neighboring nations could be faded away into the future and the primary bull market is likely to assert itself sooner than later.