Business description from prospectus – MAS Financial Services is a Gujarat-headquartered NBFC with more than two decades of business operations. As of June 30, 2017, it operated across six States and the NCT of Delhi. The business and financing products are primarily focused on middle and low income customer segments, and include five principal categories: (i) micro-enterprise loans; (ii) SME loans; (iii) two-wheeler loans; (iv) Commercial Vehicle loans (which include new and used commercial vehicle loans, used car loans and tractor loans); and (v) housing loans. The company’s promoters have significant operational experience in the financial services sector in India, and its shareholders include development finance institutions including FMO and DEG and private equity investors including Sarva Capital.

Business description from prospectus – MAS Financial Services is a Gujarat-headquartered NBFC with more than two decades of business operations. As of June 30, 2017, it operated across six States and the NCT of Delhi. The business and financing products are primarily focused on middle and low income customer segments, and include five principal categories: (i) micro-enterprise loans; (ii) SME loans; (iii) two-wheeler loans; (iv) Commercial Vehicle loans (which include new and used commercial vehicle loans, used car loans and tractor loans); and (v) housing loans. The company’s promoters have significant operational experience in the financial services sector in India, and its shareholders include development finance institutions including FMO and DEG and private equity investors including Sarva Capital.

In addition to the sales team, it has entered into commercial arrangements with a large number of sourcing intermediaries, including commission based DSAs and revenue sharing arrangements with various dealers and distributors where part of loan default is guaranteed by such sourcing partners. As of June 30, 2017, it had 332 such sourcing intermediaries for our two-wheeler loan segment and 395 such sourcing intermediaries for the Commercial Vehicle loan segment. As of June 30, 2017, it had entered into arrangements with 55 sourcing intermediaries for the housing loan segment.

Promoters of MAS Financial Services – Kamlesh Chimanlal Gandhi, Mukesh Chimanlal Gandhi, Shweta Kamlesh Gandhi and Prarthna Marketing Private Limited

Tentative timetable in respect of the Offer:

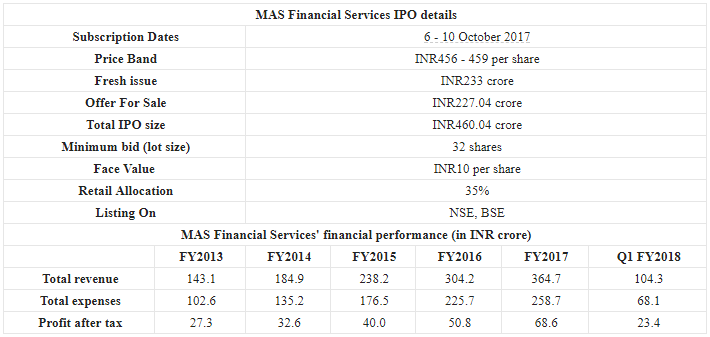

IPO Opening Date: 6 October 2017

IPO Closing Date: 10 October 2017

Finalisation of Basis of Allotment: 13 October 2017

Initiation of refunds: 16 October 2017

Please contact us today for application at 033 40266300