Business description from prospectus – Mahindra Logistics is one of India’s largest 3PL (third-party logistics) solutions providers in the Indian logistics industry which was estimated at INR6.40 trillion in Fiscal 2017, according to the CRISIL Report. The company follows “asset-light” business model which assets necessary for its operations such as vehicles and warehouses are owned or provided by a large network of business partners. The technology enabled asset-light business model allows for scalability of services as well as the flexibility to develop and offer customized logistics solutions across a diverse set of industries.

The company operates in two distinct business segments:

Supply Chain Management (SCM) – This segment offers customized and end-to-end logistics solutions and services including transportation and distribution, warehousing, in-factory logistics and value added services to clients. It operate the SCM business through a pan-India network comprising 24 city offices and over 350 client and operating locations as at May 31, 2017. It has a large network of over 1,000 business partners providing vehicles, warehouses and the other assets and services for the SCM business. Key clients in this business are Volkswagen India Private Limited, Vodafone India Limited, Thermax Limited, JSW Steel Limited, Ashok Leyland Limited, Siemens Limited, Bosch Limited, BMW India Private Limited, 3M India Limited, and Mercedes-Benz India Private Limited.

People Transport Solutions (PTS) – This segment provides technology-enabled people transportation solutions and services across India to over 100 domestic and multinational companies operating in the IT, ITeS, business process outsourcing, financial services, consulting and manufacturing industries. It offers services through a fleet of vehicles provided by a large network of over 500 business partners. As at May 31, 2017, the company operated PTS business in 12 cities and over 120 client operating locations across India. Key clients in India for the PTS business include Tech Mahindra Limited, AXISCADES Engineering Technologies Limited and ANZ Support Services India Private Limited.

Company Promoters:

The Promoter of the Company is Mahindra & Mahindra Limited.

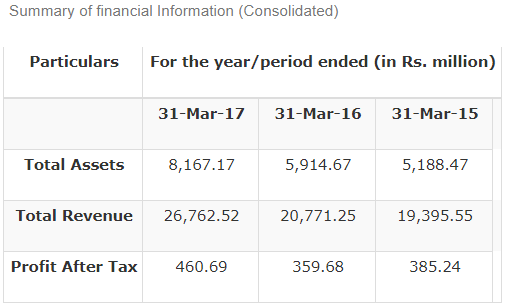

Company Financials:

Objects of the Issue:

The objects of the Offer are:

- To achieve the benefits of listing the Equity Shares on the Stock Exchanges and

- For the Offer for Sale.

Company will not receive any proceeds from the Offer as all the proceeds will be received by the Selling Shareholders.

Issue Detail:

»» Issue Open: Oct 31, 2017 – Nov 2, 2017

»» Issue Type: Book Built Issue IPO

»» Issue Size: 19,332,346 Equity Shares of Rs 10 aggregating up to Rs 829.36 Cr

› Offer for Sale of 19,332,346 Equity Shares of Rs 10 aggregating up to Rs [.] Cr

»» Face Value: Rs 10 Per Equity Share

»» Issue Price: Rs 425 – Rs 429 Per Equity Share

»» Market Lot: 34 Shares

»» Minimum Order Quantity: 34 Shares

»» Listing At: BSE, NSE

Please contact us today for application at 033 40266300