Business description from prospectus – New India Assurance is the largest general insurance company in India in terms of net worth, domestic gross direct premium, profit after tax and number of branches as of and for the fiscal year ended March 31, 2017. The company has been in operation for almost a century. In Fiscal 2017, it had the largest market share of gross direct premium among general insurers in India. As of March 31, 2017, it had issued 27.10 million policies across all product segments, the highest among all general insurance companies in India. As of June 30, 2017, its operations were spread across 29 States and seven Union Territories in India and across 28 other countries globally through a number of international branches, agency offices and subsidiaries including a desk at Lloyd’s, London.

Its insurance products can be broadly categorized into the following product verticals: fire insurance; marine insurance, motor insurance, crop insurance, health insurance and other insurance products. In Fiscal 2017, its gross direct premium from fire, engineering, aviation, liability, marine, motor and health insurance represented a market share of 19.1%, 21.9%, 29.6%, 18.2%, 21.0%, 15.1% and 18.4%, respectively, of total gross direct premium in these segments in India, and it was the market leader in each such product segment.

New India Assurance is rated A-(Excellent) by AM Best Company since 2007 and have been rated AAA/Stable by CRISIL since 2014.

Competitive Strengths

- Market leadership and established brand for around 100 years.

- International operations since 1920. Presence in UK with a desk at Lloyd‘s, London. Also have operations in Japan and Australia for over 50 years.

- Diversified product offering.

- Strong relationship with reputed reinsurers.

- Expansive multi-channel distribution network.

- Robust IT infrastructure

Company Promoters:

NIA promoter is the President of India, acting through the MoF.

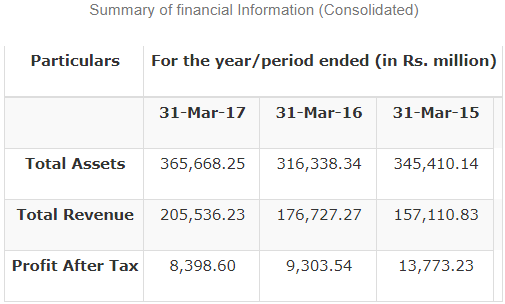

Company Financials:

Objects of the Issue:

The Offer comprises a Fresh Issue by the Company and an Offer for Sale by the Selling Shareholder.

Offer for Sale

The proceeds of the Offer for Sale shall be received by the Selling Shareholder. Company will not receive any proceeds from the Offer for Sale.

Fresh Issue

Company proposes to utilize the Net Proceeds towards meeting our future capital requirements which are expected to arise from the growth and expansion of our business, improving our solvency margin and consequently our solvency ratio.

Issue Detail:

»» Issue Open: Nov 1, 2017 – Nov 3, 2017

»» Issue Type: Book Built Issue IPO

»» Issue Size: 120,000,000 Equity Shares of Rs 5 aggregating up to Rs 9,600.00 Cr

› Fresh Issue of 24,000,000 Equity Shares of Rs 5 aggregating up to Rs [.] Cr

› Offer for Sale of 96,000,000 Equity Shares of Rs 5 aggregating up to Rs [.] Cr

»» Face Value: Rs 5 Per Equity Share

»» Issue Price: Rs 770 – Rs 800 Per Equity Share

»» Market Lot: 18 Shares

»» Minimum Order Quantity: 18 Shares

»» Listing At: BSE, NSE

Please contact us today for application at 033 40266300