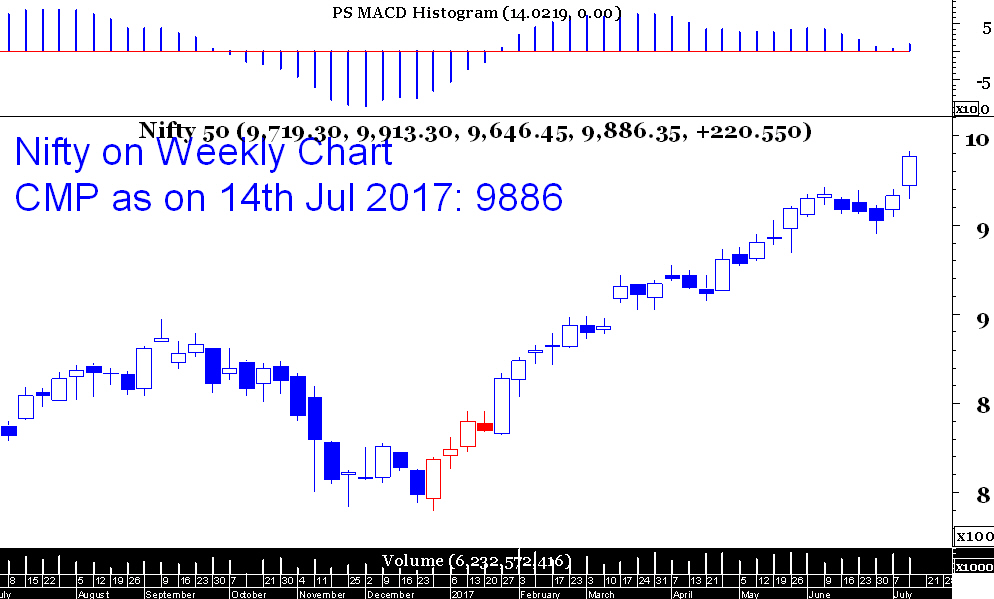

Nifty put up a commendable show this week as it closed at 9886, up a massive 220 points from last Friday. 9700 will act now as an intermediate support zone. On a shorter term, one could position trade Nifty from long side with stop loss at 9778, target 9990.

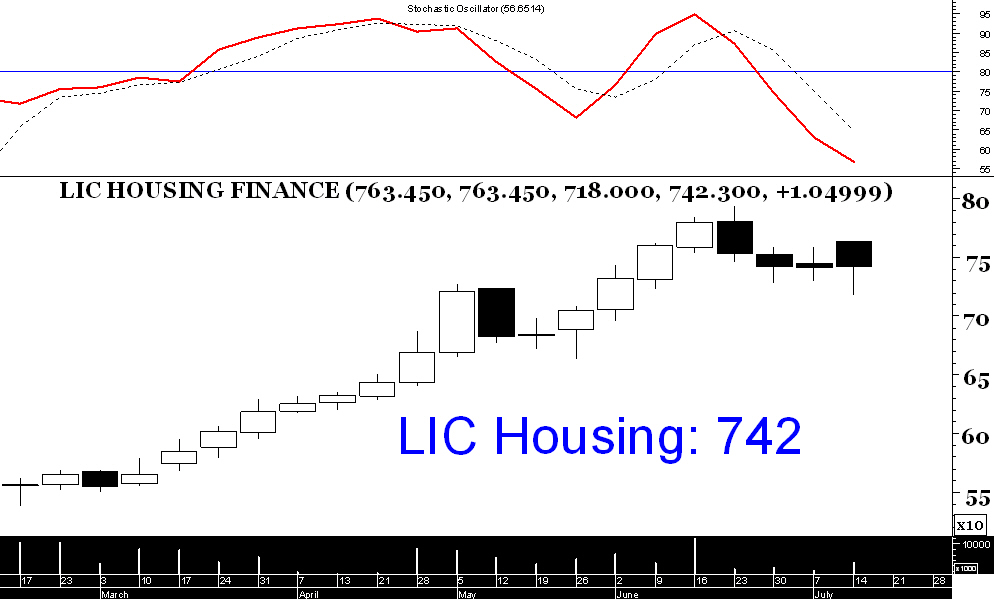

LIC Housing Finance has been a consistent outperformer for past several months. Currently, it has been going through a phase of consolidation which is also evident from Stochastic (7,3,3) on weekly chart. It closed at 742. One may buy at CMP with stop loss at 717 & target 795.

Aurobindo Pharma is one of the leading outperformers among its peers in pharma industry& it put up a strong breakout last week, putting the intermediate target at 800 odd levels. CMP 746, buy on 50% decline to 740 levels, add the remaining 50% at 720 regions, put final stop loss at 690.

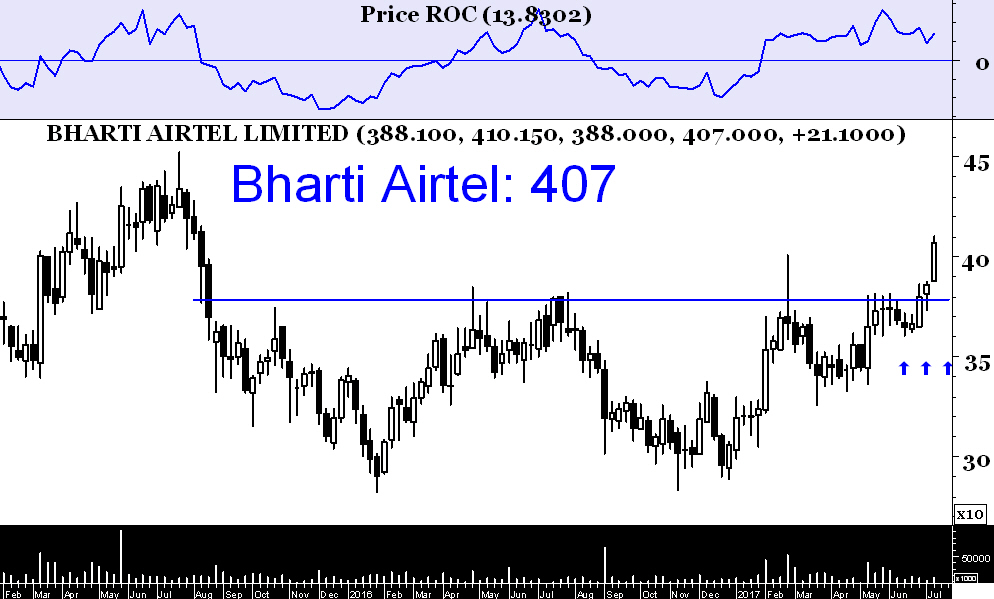

Bharti Airtel, as shown in the adjoined weekly chart, has broken out above a key resistance level this week, turning the intermediate trend up & putting the target at 450 regions. One could accumulate this stock on retracement to 400 & 390 regions with stop loss at 372.

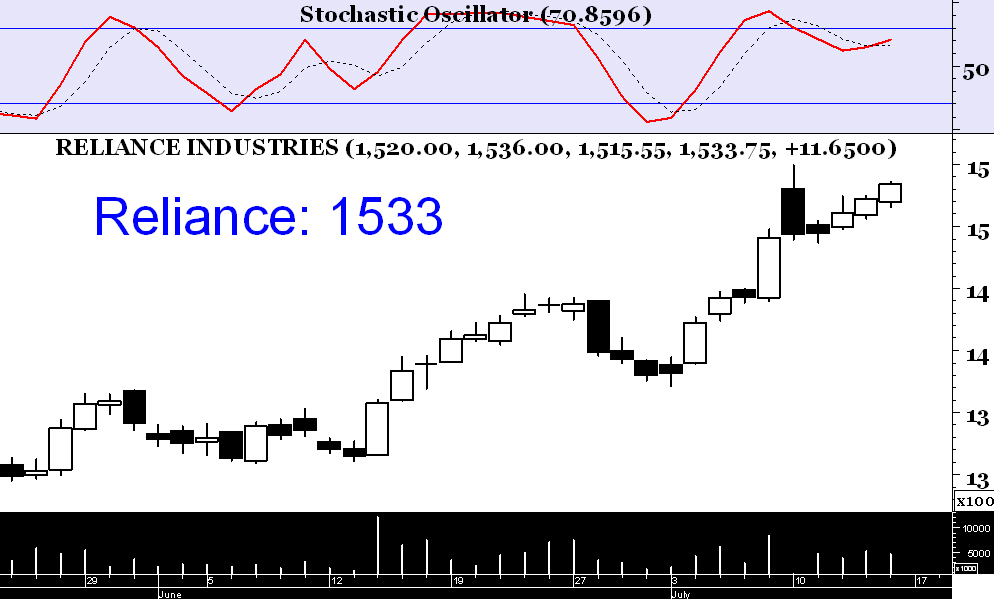

Reliance Inds has put up a very strong show since February 2017 & looks poised for even higher price. Last Friday, Reliance closed at its multi-month high price at 1533. One may buy this stock at CMP & accumulate more on pull back to 1490 43gions with the final stop loss at 1437.